URD 2022

-

1.Business overview and strategies

-

1.Sopra Steria Group at a glance

Until 2 September 2014, the name of the Company was “Sopra Group”. As a result of the successful public exchange offer made by Sopra Group for the shares of Groupe Steria SCA (see press release dated 6 August 2014), the Board of Directors met on 3 September 2014, with Pierre Pasquier presiding, and recorded the entry into effect of several resolutions conditionally adopted at the General Meeting of 27 June 2014.

Among the consequences of the implementation of these resolutions was the change in the corporate name from “Sopra Group” to “Sopra Steria Group”.

Registered office: PAE Les Glaisins, Annecy-le-Vieux, 74940 Annecy – France. Phone: +33(0)4 50 33 30 30.

Date of incorporation: 5 January 1968, with a term of fifty years as from 25 January 1968, renewed at the General Meeting of 19 June 2012 for a subsequent term of ninety-nine years.

To engage, in France and elsewhere, in consulting, expertise, research and training with regard to corporate organisation and information processing, in computer analysis and programming and in the performance of customised work.

The design and creation of automation and management systems, including the purchase and assembly of components and equipment, and appropriate software.

The creation or acquisition of and the operation of other businesses or establishments of a similar type.

And, generally, all commercial or financial transactions, movable or immovable, directly or indirectly related to said corporate purpose or in partnership or in association with other companies or persons” (Article 2 of the Articles of Association).

Explanation of the changes to the name of the entity presenting the financial statements after the end of the previous reporting period: N/A

“An amount of at least five per cent shall be deducted from the profit for the financial year, reduced by prior losses, if any, in order to constitute the statutory reserve fund. Such deduction shall cease to be mandatory when the amount in the statutory reserve fund is equal to one-tenth of the share capital.

Profit available for distribution comprises the profit for the year less any losses carried forward and amounts allocated to reserves, pursuant to the law and the Articles of Association, plus retained earnings.

The General Meeting may deduct from this profit all amounts that it deems appropriate for allocation to all optional, ordinary or extraordinary reserves, or to retained earnings.

The balance, if any, is apportioned at the General Meeting between all shareholders in proportion to the number of shares that they own.

-

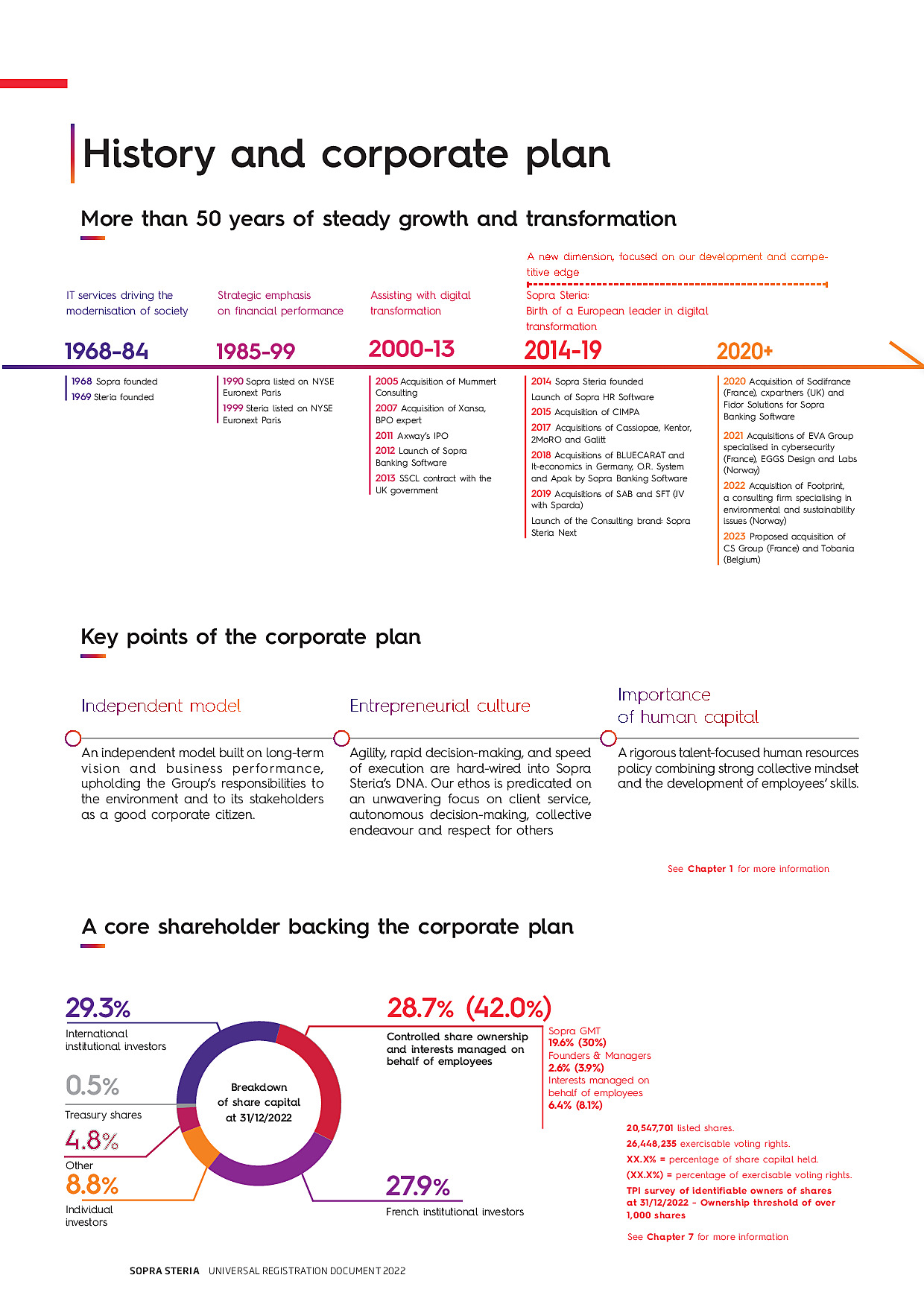

2.History of Sopra Steria Group

A long history of entrepreneurship

Backed by our strong entrepreneurial culture and our sense of collective purpose, we work every day to deliver a range of solutions, from consulting to systems integration, on behalf of our clients. We aim to be the benchmark partner for large public authorities, financial and industrial operators, and strategic companies in the main countries where we operate. We focus on being relevant at all times and ensuring that our impact is a positive one, both for society and from a business perspective.

-

3.Digital services market

3.1.Main markets – Competitive environment of the digital services sector

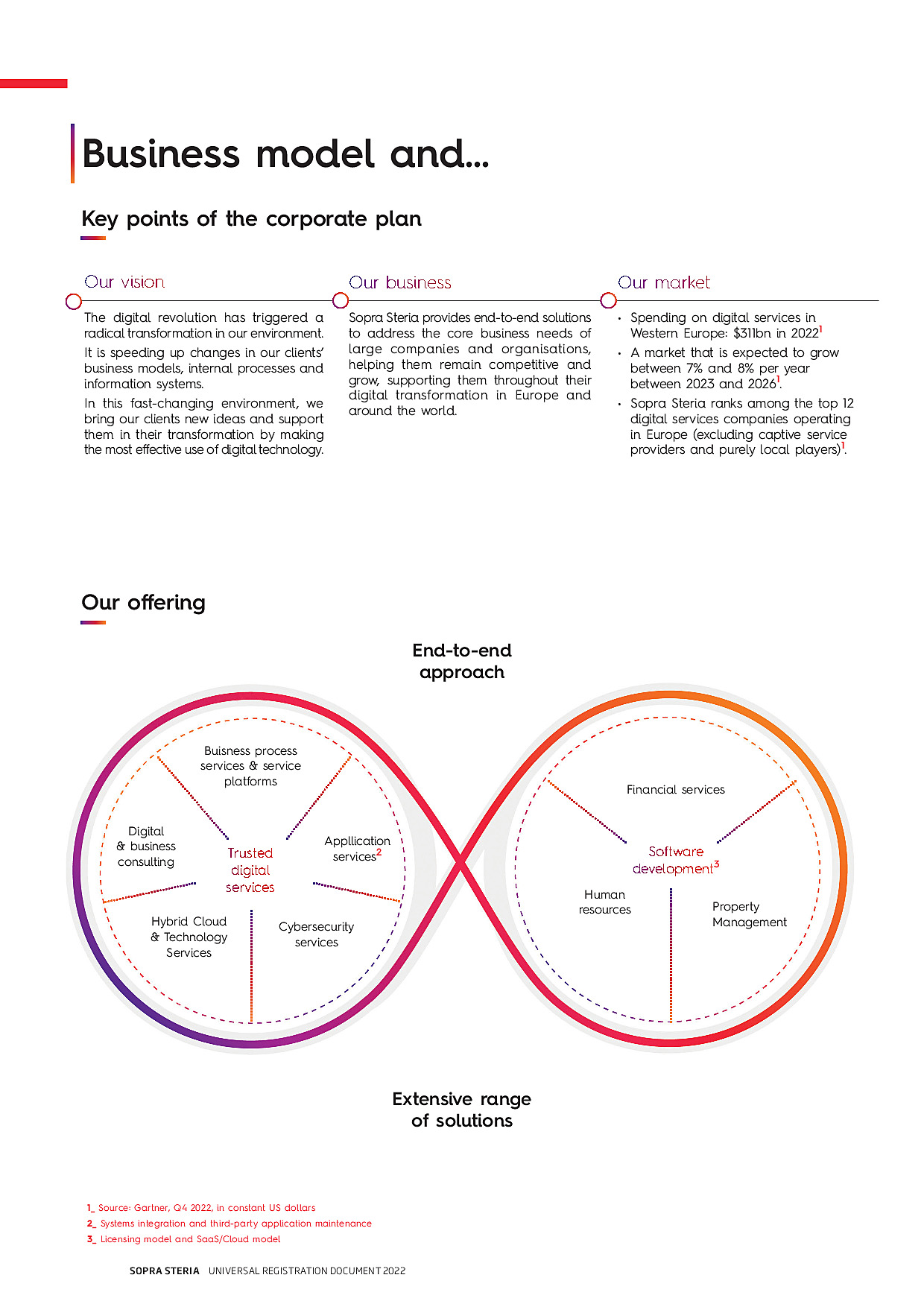

In 2022, the digital services market in Western Europe was worth an estimated $311 billion(1), up 9.5%(2). For 2023, Gartner predicts growth of 8.0% (at constant US dollars).

Digital services market in Western Europe (excluding hardware and software)

Three countries (the United Kingdom, Germany and France) account for 59% of IT services spending (1).

According to market research, in 2022 the market (1) grew by 9.3% (2) in France, 9.3% in Germany and 9.1% in the United Kingdom. For 2023, growth is expected to continue, amounting to 7.7% in France, 7.9% in Germany and 7.3% in the United Kingdom.

Gartner expects this trend to continue over the next few years, with market growth in Western Europe estimated at around 7% to 8% per year between 2023 and 2026.

Digital services market in Western Europe (excluding hardware and software)

In terms of business segments, according to Gartner, consulting was up 11.1% (2) in 2022 and implementation services grew by 11.8%. The Group’s other activities also experienced a year of growth: Outsourced infrastructure and cloud services were up 6.9%, with business process outsourcing up 9.7%.

For 2023, Gartner predicts growth of 9.2% in consulting, 6.9% in implementation services and 8.3% in outsourced infrastructure and cloud services. Business process outsourcing is expected to grow by 7.2%.

Furthermore, the IT services market remains fragmented despite some consolidation, with the leading player in the European market holding a 5% share. Against this backdrop, Sopra Steria is one of the 12 largest digital services companies operating in Europe (excluding software) with an average market share of just under 2%. In France (second in the market) and in Norway (fourth in the market), the Group’s market share is over 5%. In the other major European countries, its market share is around 1%.

Sopra Steria’s main competitors in Europe are: Accenture, Atos, Capgemini, CGI, DXC and IBM, all of which are present worldwide. It also faces competition from Indian groups, chiefly in the United Kingdom (such as TCS, Cognizant, Wipro and Infosys), and local companies with a strong regional presence (Indra in Spain, Fujitsu in the United Kingdom, Tietoevry in Scandinavia, etc.). Apart from its services business, listed rivals such as Temenos and Alfa Financials also command a significant presence in the software market, where Sopra Steria is also present, especially in banking.

-

4.Sopra Steria’s activities

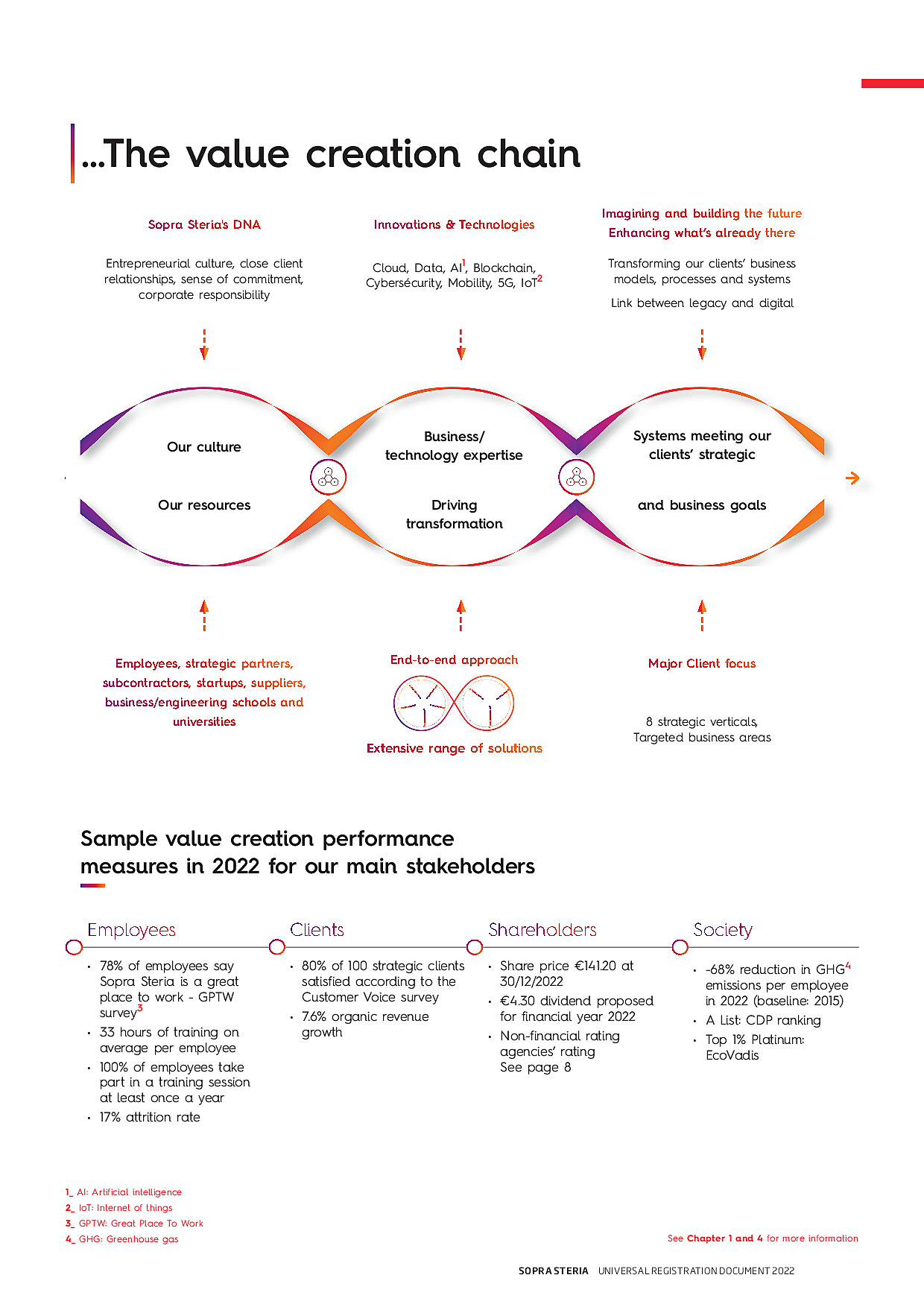

4.1.A major European player in digital transformation

Sopra Steria, a European leader in consulting, digital services and software development, helps its clients drive their digital transformation and obtain tangible and sustainable benefits, thanks to one of the most comprehensive portfolios of offerings on the market, encompassing consulting and systems integration, business and technology solutions, hybrid cloud and technology services, cybersecurity and business process services.

The Group provides end-to-end solutions to make large companies and organisations more competitive by combining in-depth knowledge of a wide range of business sectors and innovative technologies with a fully collaborative approach: from strategic analysis, programme definition and implementation, and IT infrastructure transformation and operation, to designing and implementing solutions and outsourcing business processes.

For Sopra Steria, helping clients succeed in their digital transformation means breaking down their strategic and business challenges into digital initiatives through an exclusive end-to-end offering. Thanks to very close relationships with its clients and its multi-disciplinary teams, the Group is able to continually innovate to guarantee that its offerings remain relevant to the strategic challenges of each of its vertical markets.

Sopra Steria’s teams are trained in the new microservices platforms, DevOps and cloud computing. They are also adopting new methods of designing, delivering and embedding teams. Sopra Steria is therefore able to offer the two key ingredients for successful digital transformation: speed of execution and openness to external ecosystems.

Sopra Steria Group is also the preferred partner of Axway Software, whose exchange and digital enablement platforms play an important role in modernising information systems and opening them up to digital technology.

Sopra Steria is an independent Group whose founders and managers control 22.3% of its share capital and 33.7% of its theoretical voting rights. With nearly 50,000 employees in nearly 30 countries, it pursues a strategy based on European key accounts.

4.1.1.Consulting and systems integration – 62% of 2022 revenue

a.Consulting

Sopra Steria Next, the Group’s consulting brand, is a leading consulting firm. Sopra Steria Next has over 40 years’ experience in business and technological consultancy for large companies and public bodies, with over 3,000 consultants in France and Europe. Its aim is to accelerate the development and competitiveness of its clients by supporting them in their digital transformation while addressing their sustainability challenges in keeping with our clients’ Corporate Responsibility policies. This support involves understanding clients’ business issues using substantial sector-specific expertise, and then working to design transformation roadmaps (business processes, data architecture, change management, etc.) to make the most of new digital technologies. It involves supporting the information systems departments of our clients, grasping their new challenges, assisting them with their overall transformation projects as well as the modernisation of their legacy systems.

b.Systems integration

Systems integration is Sopra Steria’s original core business, and covers all aspects of the information system life cycle and major transformation programmes. Sopra Steria is equipped to address the full range of its clients’ software asset needs:

Design and integration

Sopra Steria’s teams help their clients implement agile and industrial-scale projects. The Group undertakes to design and deliver systems in line with business requirements that are flexible and adapted to the new requirements of digital transformation as well as sector-specific regulatory constraints. This is made possible by working closely with the Sopra Steria Next teams.

Performance and transformation

In addition to standard information systems maintenance, Sopra Steria takes a continuous transformation approach to these systems to guarantee optimised operational efficiency for its clients, suited to changes in their business. The transformation approach includes a well-equipped and documented procedure making it possible to combine the issues involved in reducing the time to market with improved competitiveness and continuity of service.

Streamlining data flow

Once the systems and technologies are implemented, the information system gives access to reliable, relevant and critical data, offering better analysis of user satisfaction and optimisation of service performance.

With the increasing number of diverse data sources relating to fundamental changes in use, data is more valuable to the company than ever. To increase the value of this data, Sopra Steria has developed specific know-how and expertise to manage the exponential growth in data volumes and associated skills (data science, smart machines, automation, artificial intelligence) by integrating them in a global solution, securing the data regardless of its origin (mobile devices, smart objects, data privacy, the cloud, multimodal and multichannel systems, etc.) and using the data by means of contextualised algorithms.

The Group’s systems integration offering thus meets the challenges posed by both the obsolescence and modernisation of information systems, ensuring optimal flexibility and value creation.

Product lifecycle management (PLM)

CIMPA provides comprehensive expertise via its PLM offering, which covers all the various facets of PLM services:

- ■PLM strategy creation or optimisation;

- ■deployment of strategy-related tools, processes or methods;

- ■user training and support.

4.1.2.Hybrid cloud & technology services – 10% of 2022 revenue

With over 6,000 experts worldwide and more than 15 years’ experience in developing our outsourcing service centres in Europe and India, Sopra Steria – a leader in the hybridisation of information systems and a major player in digital transformation – provides support for all technological, organisational and security-focused information system transformation projects. Our main activities encompass consulting, transforming infrastructure and operating models, and managing hybrid cloud activities.

Our area of expertise covers two service categories that are essential to support information system transformation for our clients:

- ■Hybrid IT Services: A comprehensive range of shared transformation services and innovative, customisable operations to help IT departments adopt a hybrid model that combines cloud-based solutions with legacy systems and achieve their goals in relation to agility, availability and performance. Our catalogue of integrated services lets us provide end-to-end management of our clients’ applications in hybrid environments, as well as changes to these applications and interconnections with applications hosted in public and sovereign cloud environments.

- ■User Experience Services: A smart shared services platform providing users with office and application support built around knowledge of their business and drawing on AI-based digital solutions to offer a seamless experience.

Our consultants and experts are able to co-manage and run complex transformation projects and design and help roll out innovative technology solutions in response to clients’ business issues.

4.1.3.Cybersecurity services

With over 1,400 experts and several state-of-the-art cybersecurity centres in Europe and worldwide (France, United Kingdom, Singapore, Norway, Belgium, Poland, India), Sopra Steria has an international reach as a European leader in protecting critical systems and sensitive information assets for major institutional and private clients.

By absorbing EVA Group in 2022, Sopra Steria strengthened its capability in client-focused consulting and expertise and expanded its international presence (in the Asia-Pacific region, the US and Canada).

Through its comprehensive offering, the Group is able to address the entire cybersecurity value chain:

- ■Prevention: Drawing up a cybersecurity strategy that is adapted to the risks of the business and complies with the regulations in force, and spreading a culture of security within the organisation;

- ■Protection: Ensuring the continuous monitoring of assets by securing multi-cloud and hybrid environments, end-to-end encryption of applications and sensitive data;

- ■Detection and response: Adopting an overall defence strategy that mobilises all stakeholders to work together (detection, response, cyber threat intelligence, investigation, vulnerability management, etc.) towards a shared goal – recognising attackers and countering cyberattacks.

Drawing on this framework and our specific areas of expertise, we have developed offerings designed to address our clients’ priority concerns:

- ■Crisis management and cyber resilience, cloud security, industrial security, and IT and information systems security strategy

Sopra Steria’s business model based around value centres and products is designed to maximise the cyber value of the services delivered by the Group. It can be rolled out locally, through service centres (in France, nearshore in Poland and offshore in India) or in hybrid form, with “follow-the-sun” capability.

4.1.4.Development of business solutions – 15% of 2022 revenue

Sopra Steria offers its business expertise to clients via packaged solutions in three areas: banks and other financial institutions via Sopra Banking Software, human resources via Sopra HR Software, and real estate owners and agents with its property management solutions. The Group offers its clients the most powerful solutions, in line with their objectives and representing the state of the art in terms of technology, know-how and expertise in each of these three areas.

Sopra Banking Software: Solutions developer for the financial services industry

Drawing on its technologies and the strength of its commitment, Sopra Banking Software, a wholly-owned subsidiary of the Group, supports its clients – financial institutions – all over the world on a daily basis.

The customer experience, operational excellence, cost control, compliance and risk reduction are among the key transformation priorities for:

- ■banks in Europe and Africa: From direct- and branch-based retail banks and private banks to microfinance companies, Islamic financial institutions and centralised payment or credit factories;

- ■financing and lending institutions around the world: Serving individuals and companies, the automotive and capital goods sectors, as well as equipment and real estate leasing and even market financing.

With over 5,000 experts and more than 50 offices worldwide, Sopra Banking Software addresses its clients’ challenges across all geographies and in all business areas, covering issues such as communicating new offerings, the quality of customer relationships, production, accounting integration and regulatory reporting.

Solutions

Sopra Banking Software offers two kinds of services: Sopra Banking Platform, intended to respond to banks’ day-to-day needs, and Sopra Financing Platform, which specialises in managing financing:

- ■Sopra Banking Platform is a banking processing platform that relies on an architecture of independent and pre-integrated business components. It makes it possible to manage all banking operations (deposits and savings, management of the loan life cycle, payments, reporting) and offers innovative features in a digital and mobile environment;

- ■Sopra Financing Platform is a flexible and robust financing management platform able to deal with all types of financing tools within the framework of advanced process automation.

These solutions can be used either on-site at the client’s premises, on the cloud (public or private) or in SaaS mode.

Services

An end-to-end provider, Sopra Banking Software offers solutions as well as consulting, implementation, maintenance and training services. This means that financial institutions are able to maintain their day-to-day operations while shifting towards greater innovation and agility, with the aim of securing sustainable growth. Through its market-leading solutions backed by more than 50 years of experience in its field, Sopra Banking Software is committed to working with its clients and staff to build the financial world of the future.

Sopra HR Software: a market leader in human resource management

Sopra Steria Group also develops human resource management solutions via Sopra HR Software (a wholly-owned subsidiary of Sopra Steria). Sopra HR Software is present in 10 countries, providing comprehensive HR solutions perfectly suited to the needs of human resources departments. Sopra HR Software currently has a workforce of 1,800 people and manages the payrolls of 900 clients with over 12 million employees.

Sopra HR Software is a partner for successful digital transformation of companies and anticipates new generations of HR solutions.

Solutions

The Sopra HR Software offerings are based on the most innovative business practices and cover a wide range of functions, including core HR, payroll, time and activity tracking, talent management, staff experience, and HR analytics. The offering is based on two product lines, HR Access® and Pléiades®, aimed at large and medium-sized public or private organisations in any sector and of varying organisational complexity, irrespective of their location. In response to new hybrid working patterns, the new generation of Sopra HR 4YOU solutions offers a fully digital HR space that helps businesses stay closely connected with their employees and optimise HR performance and the quality of HR services.

Services

Sopra HR Software, a comprehensive service provider, offers a number of services linked to its solution offering and its HR ecosystem. Sopra HR Software supports its clients throughout their projects, from consulting through to implementation, including staff training, maintenance and business process services (BPS).

Sopra HR Software implements its own solutions either on-premise or in the cloud and also offers a wide range of managed services.

Sopra Real Estate: driving digital transformation in the real estate market

Sopra Real Estate Software is the leading developer, distributor, integrator, and service manager of property management software in France. Sopra Steria offers major public and private sector real estate players (institutional investors, social housing operators, property management firms, property managers and major users) comprehensive business software solutions providing a huge range of functionality.

Sopra Real Estate Software’s 700 real estate experts help our 400 clients realise their digital transformation so as to boost their return on assets, optimise practices and strengthen relationships with tenants and service providers.

Sopra Real Estate Software also offers a technical real estate asset management solution that is particularly well suited to helping our clients better understand their assets and manage their energy performance.

Solutions

From property management to building information management, we offer a range of solutions built around providing digital real estate services to tenants and partners.

Services

Sopra Real Estate Software supports its clients with an end-to-end service offering based on its solutions, from consulting to integration and managed services.

4.1.5.Business process services – 13% of 2022 revenue

Sopra Steria offers a full range of business process services (BPS) solutions: consulting for the identification of target operating models, development of transition and transformation plans, and managed services.

Sopra Steria manages two of Europe’s largest shared services organisations. Shared Services Connected Limited (SSCL) is a unique joint venture between Sopra Steria and the UK Cabinet Office. Sopra Steria provides a full range of business support services to major government departments, the police and UK government agencies. NHS Shared Business Services is a joint venture between Sopra Steria and the Department for Health and Social Care that provides support services to NHS trusts and UK health bodies.

Our BPS offering goes hand in hand with digital transformation. Digital technologies have opened up opportunities for improving key business processes in all organisations. Whether they involve robotics, chatbots, automatic natural language processing (NLP) or artificial intelligence (AI) more widely, digital technologies can streamline the execution of processes, cut their costs and lead to new approaches.

Furthermore, we enjoy a strong presence in the technology ecosystem, both in France and worldwide. We thus have access to a dynamic network of partners as well as a singular ability to identify innovative solutions owing to our connections with the world of technology startups. We combine our own platforms with those of our technology partners to provide the right level of innovation within our design/production/operation services. Our specialised design teams work to ensure the best possible client experience for end-users and we offer our clients ways to considerably improve process efficiency by leveraging intelligent automation and machine learning. Thanks to our technology assets, we are helping to develop tomorrow’s operating models.

Sopra Steria employs many consultants and practising professionals with expertise in BPS and the digital sector. They help organisations make the best use of new digital technologies to transform their activities, from their operating models to their processes and end-user services. Our ability to handle transformation in both its human and business dimensions allows us to support our clients wherever their digital journey takes them, helping them to move from a theoretical perspective on possible solutions to a focus on specific technologies. We eliminate inefficient practices, reorganise tasks and improve results for each activity entrusted to us, whether it involves individual business processes or highly complex shared services. Added to this is the experience of our employees in change management, which is essential to the success of any transformation. In the various BPS areas, we can provide the services ourselves or work in tandem with the client’s personnel to carry out the engagement. In these cases, we invest in these individuals to help them become more effective and productive, sharing our best practices with them.

-

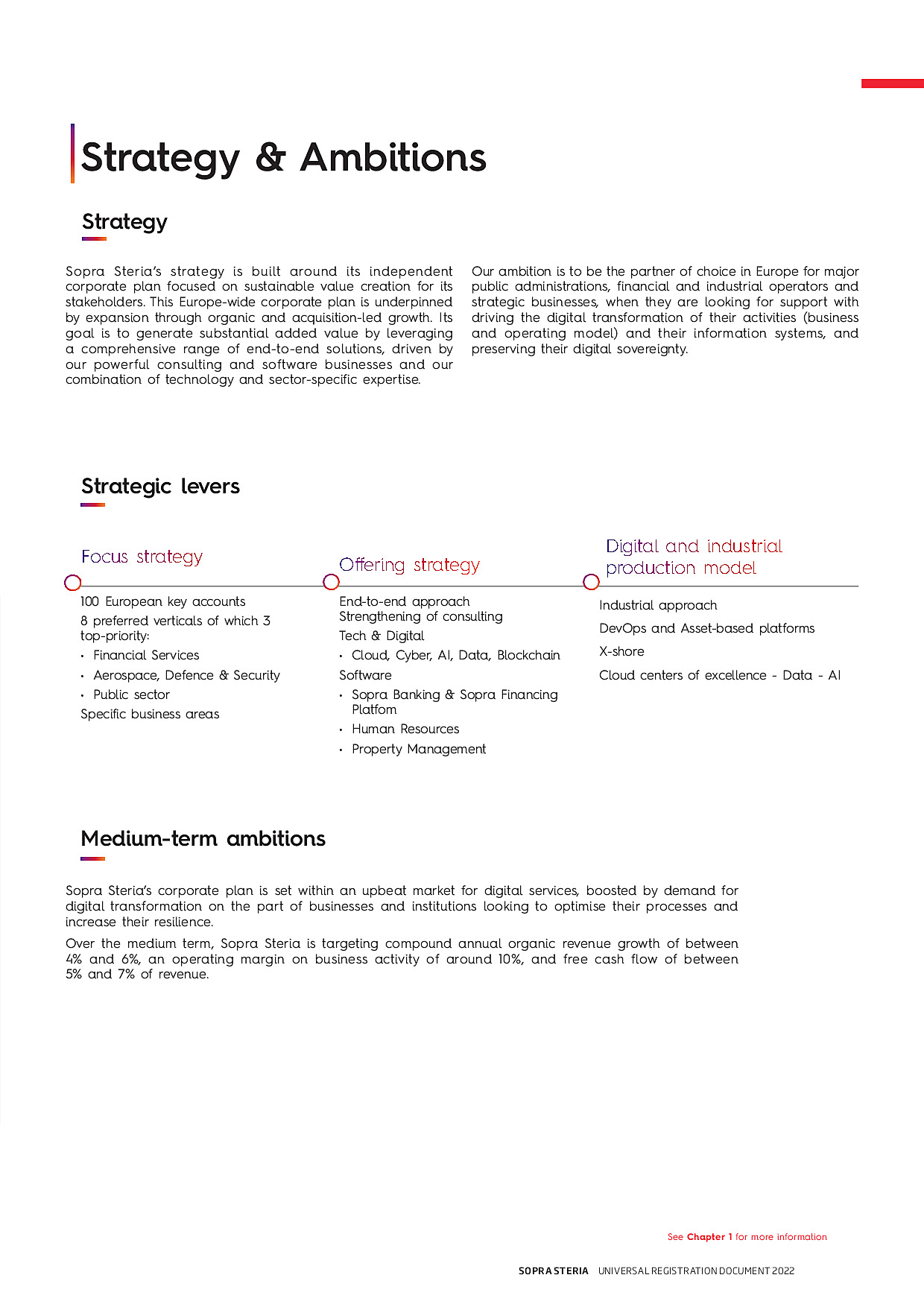

5.Strategy and objectives

5.1.Strong and original positioning in Europe

Sopra Steria’s ambition is to be a European leader in digital transformation. Its high value-added solutions, delivered by applying an end-to-end approach to transformation, enable its clients to make the best use of digital technology to innovate, transform their models (business as well as operating models), and optimise their performance.

The Group’s aim is to be the benchmark partner for large public authorities, financial and industrial operators and strategic companies in the main countries in which it operates.

- ■business software solutions which, when combined with the Group’s full range of services, make its offering unique;

- ■a position among the leaders in the financial services vertical (core banking and specialist lenders) bolstered by the success of the Sopra Banking Software solutions;

- ■very close relationships with its clients, thanks to its roots in the regions where it operates and its ability to meet core business requirements;

- ■a strong European footprint with numerous locations in many of the region’s countries which, when combined with these close relationships, raises its profile among large public authorities and strategic companies throughout Europe as a trusted and preferred partner for all projects involving digital sovereignty.

-

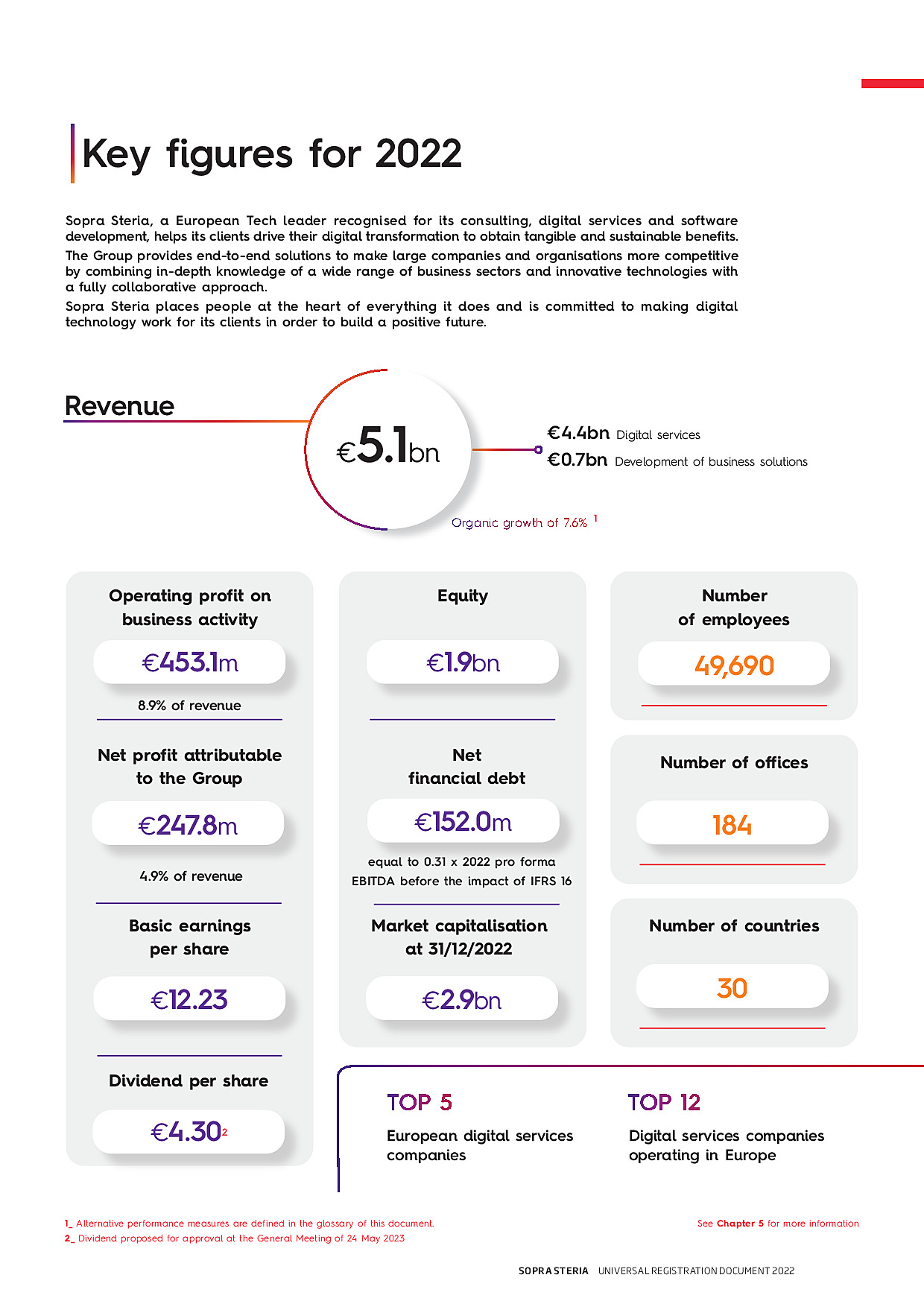

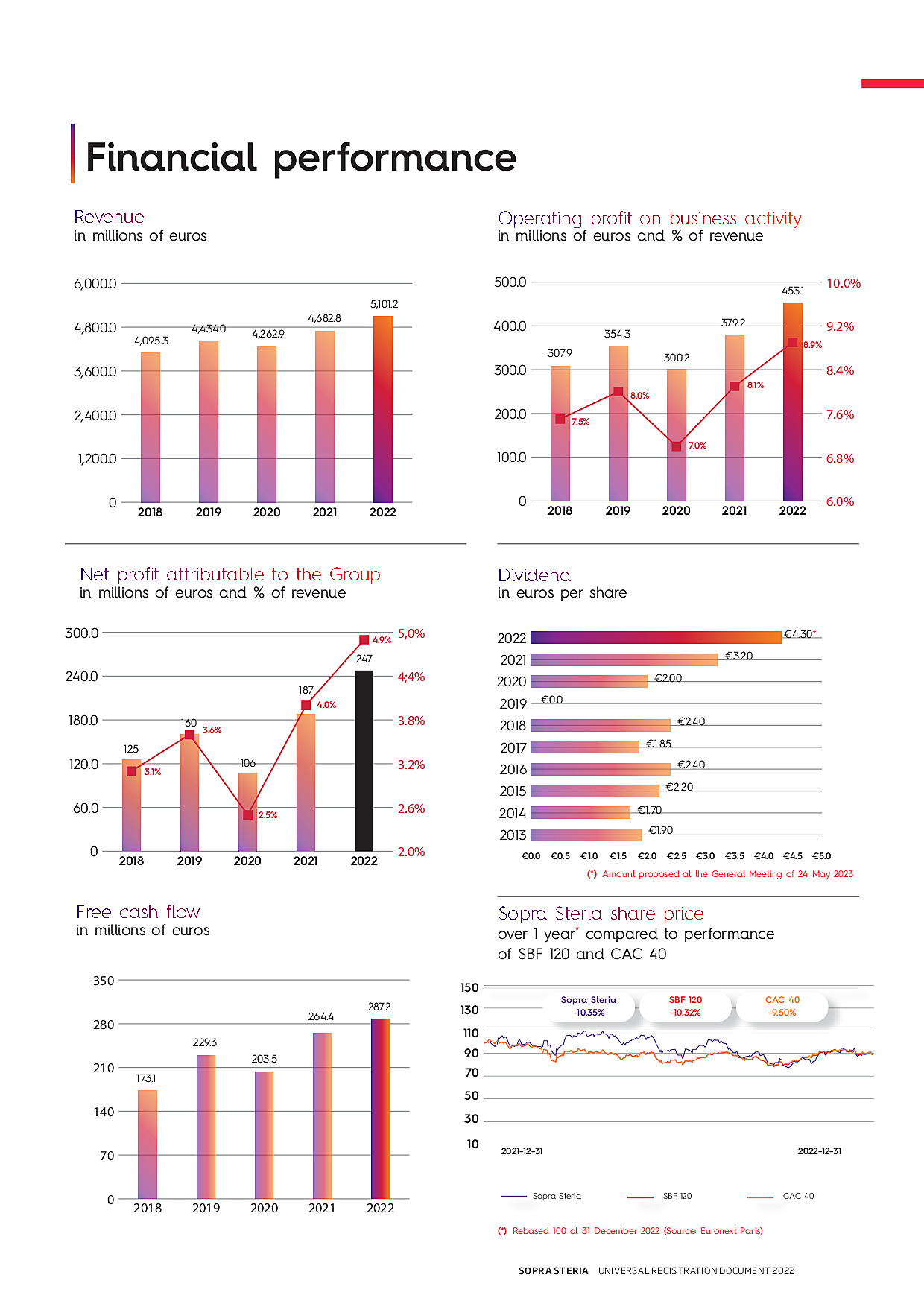

6.2022 Full-year results

6.1.Comments on 2022 performance

“Our strong performance in 2022 puts us on track to achieve our medium-term goal: delivering an operating margin on business activity of around 10% in 2024 and being among the top-performing players in our sector. As regards the financial targets set at the beginning of the year, we achieved our profitability target and exceeded our growth and cash flow targets. We also ramped up implementation of our strategy in 2022. We began to strengthen our business in areas where sovereignty issues are becoming increasingly important (defence, space, energy, cybersecurity, etc.), and at the same time, we worked to grow our market share in those European countries we consider strategic for our future development. We reviewed our operating model and reinforced leadership in our consulting business. We boosted our operational efficiency on multiple fronts: through the value we deliver to our clients, efficient management of our human resources, optimisation of our costs and an increased return on capital employed. Lastly, I’m proud to point out that, alongside this uplift in performance, we once again improved our score on our annual Great Place To Work® survey and were confirmed as being on CDP’s A List(6) for the 6th year running."

Financial year 2022 brought a further uplift in the Group’s profitability. Six entities accounting for 74% of total revenue have now achieved an operating margin on business activity of 10% or higher.

Consulting also delivered strong growth in 2022, with revenue up more than 18% at €435 million. Reflecting this strong trend, our average selling price increased by around 5% and the number of consultants rose by 400. The arrival of a Group Executive Director for consulting in October 2022 and a reorganisation to bring all our consultants in France together into a dedicated business unit will further boost our momentum and deliver higher added value.

The proposed acquisition of CS Group, announced in the middle of the year, is in line with our strategic goal of strengthening Sopra Steria’s positioning in digital sovereignty and trust for major European clients. The finalisation of this acquisition in 2023 will position the Group as a major player in defence and space (c. €700 million in revenue), aeronautics (c. €600 million), energy and utilities (c. €350 million) and cybersecurity (over €200 million).

The proposed acquisition of Tobania in Belgium will double the Group’s presence (over €200 million in revenue) in a country considered strategic in Europe in light of its market potential and the presence of European institutions.

We took a number of steps to boost our operational efficiency. We sought to move our offerings further up the value chain wherever possible and average selling prices rose across our business lines. We embarked on a programme to reduce our real estate footprint. We also ramped up the expansion of our offshore resources: the number of employees based in India rose by 14.2% in the year, compared with a 4.7% increase in the workforce as a whole. Consequently, resources at international service centres now account for 19% of the total workforce (up 0.6 points from 2021). These various factors contributed to the improvement in profitability and improved our return on capital employed, which rose 2.7 points to 14.1%(7).

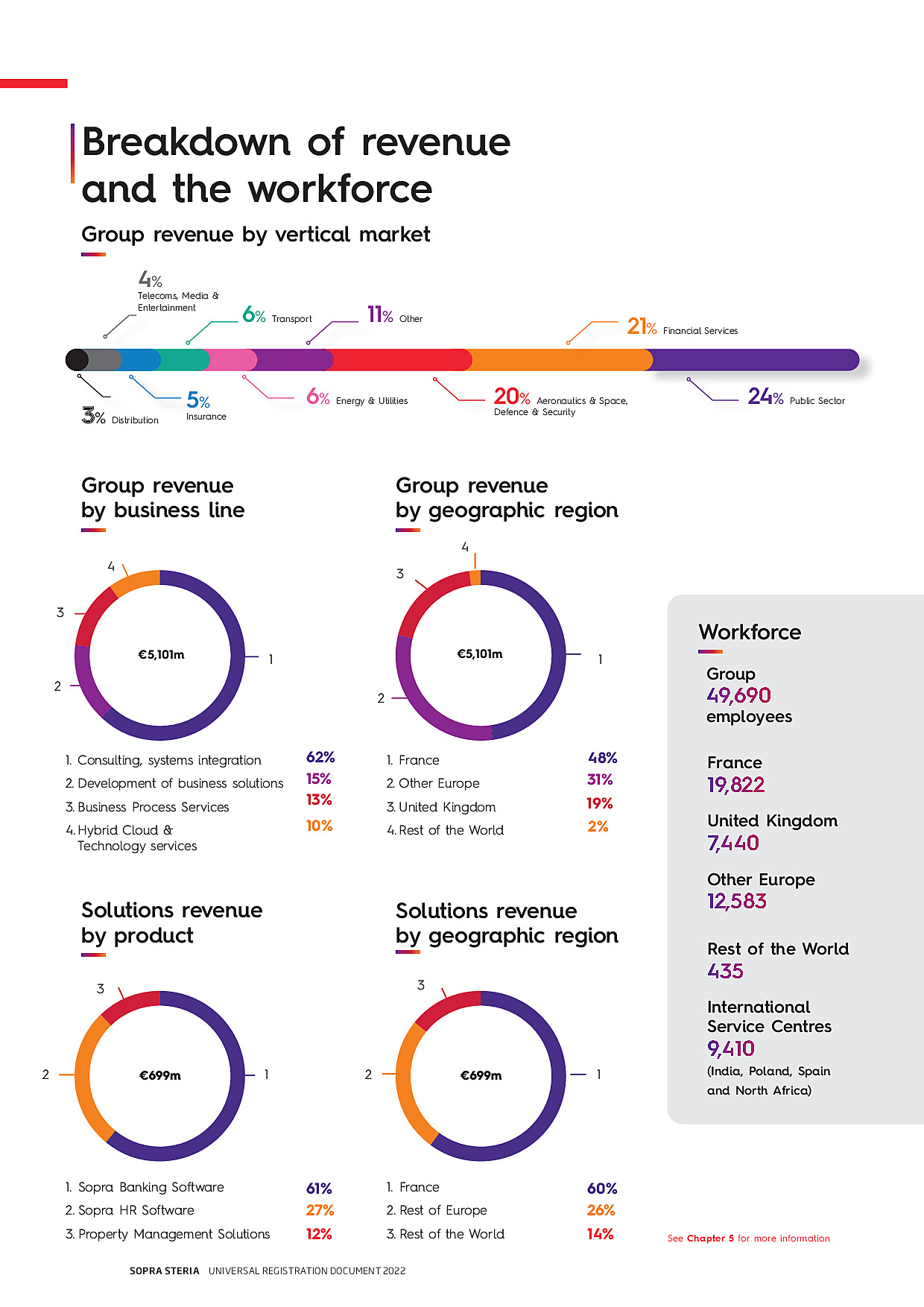

Details on 2022 operating performance

Consolidated revenue totalled €5,101.2 million, an increase of 8.9%. Changes in scope had a positive impact of €46.9 million, and currency fluctuations had a positive impact of €12.2 million. At constant scope and exchange rates, revenue growth was 7.6%. The fourth quarter was one of the most buoyant in the year, with revenue up 8.0%.

Operating profit on business activity came to €453.1 million, up 19.5% relative to 2021. Operating margin on business activity increased by 0.8 points to 8.9% (8.1% in 2021).

The France reporting unit (40% of the Group’s revenue) generated revenue of €2,039.0 million, representing organic growth of 9.7%. Business remained buoyant in the fourth quarter, with revenue up 9.5%. This performance was driven throughout the year by product life cycle management, cybersecurity and consulting, including in the fourth quarter, when consulting revenue was up 22%. The best-performing vertical markets were aeronautics, defence and transport. The reporting unit’s operating margin on business activity improved by 1.4 points to 10.0%.

Revenue for the United Kingdom (18% of the Group’s total) was €890.6 million, representing organic growth of 7.3%, while growth in 2021 had already been very high (13.9%). The two joint ventures specialising in business process services for the public sector (NHS SBS and SSCL) delivered average growth of 3.8%, with revenue coming in at €455.8 million. The defence and security sector was up 20.6% and the public sector 7.5%. The private sector posted full-year growth of 5.7%. The reporting unit’s operating margin on business activity improved by 1.4 points to 10.5%.

The Other Europe reporting unit (29% of Group revenue) posted organic revenue growth of 8.3% at constant scope and exchange rates to €1,473.0 million. The fastest growth was seen in Scandinavia and, to a lesser extent, Benelux, Spain and Italy. The situation in Germany normalised in the second half of the year. The reporting unit’s overall operating margin on business activity was 6.2% (7.8% in 2021). Countries in the reporting unit generated a full-year margin of almost 8% after the margin returned to nearly 10% in the second half. Sopra Financial Technology had a slightly more dilutive effect in 2021.

Revenue for Sopra Banking Software (8% of Group revenue) came to €426.5 million, an organic contraction of 2.3%. This was mainly the result of a decline in services revenue. Meanwhile, software revenue rose 1.3%, notably thanks to a 6.1% increase in subscriptions and resilient licence sales relative to 2021 levels. Revenue from the SBP Digital Banking Suite was up 13%. The R&D transformation programme generated an €10 million saving on development costs in the year, helping the continued turnaround in the reporting unit’s profitability: operating profit on business activity came in at €27.6 million, giving a margin of 6.5% (vs 4.0% in 2021).

The Other Solutions reporting unit (5% of Group revenue) posted revenue of €272.1 million, representing organic growth of 5.6%. Human resources solutions posted growth of 7.2%, while property management solutions grew by 2.2%. Both businesses had a strong fourth quarter, delivering organic growth of around 6%. The operating margin on business activity improved substantially, rising 2.9 points to 13.0% (10.1% in 2021).

-

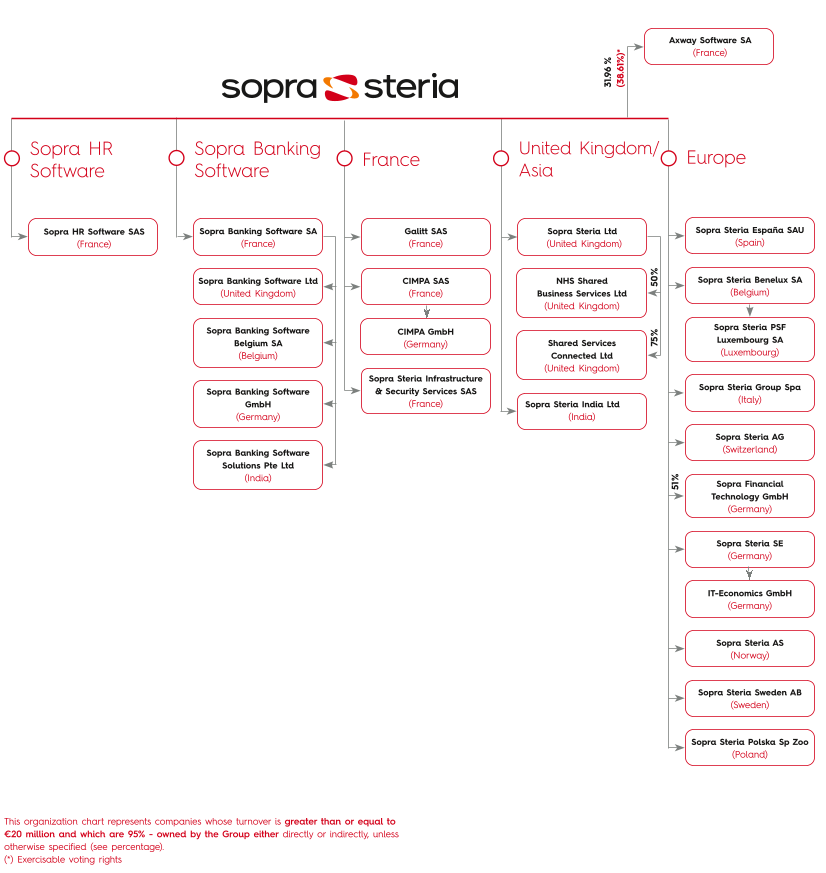

9.Group organisation

Sopra Steria Group’s governance consists of a Board of Directors, Chairman and Chief Executive Officer.

The organisation is supported by a permanent operational and functional structure as well as temporary structures for the management of particular deals and projects.

Sopra GMT, the holding company that takes an active role in managing the Group, takes part in conducting Group operations through:

- ■Its presence on the Board of Directors and the three Board committees.

- ■A tripartite assistance agreement entered into with Sopra Steria and Axway, concerning services relating to strategic decision-making, coordination of general policy between Sopra Steria and Axway, and the development of synergies between these two companies, as well as consulting and assistance services, particularly with respect to finance and control.

9.1.Permanent structure

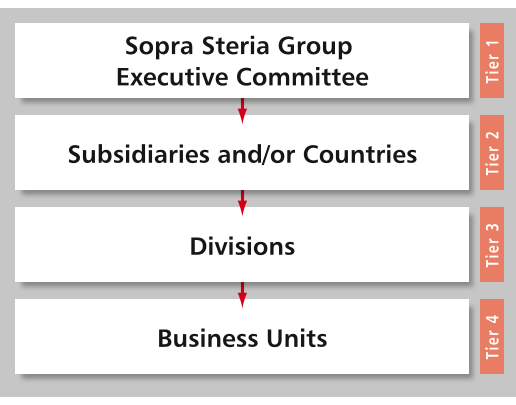

The Group’s permanent structure is composed of four operational tiers and their associated functional structures.

9.1.1.Tier 1: executive management and the executive committee

On Wednesday, 12 January 2022, Sopra Steria announced the appointment of Cyril Malargé to succeed Vincent Paris as Chief Executive Officer.

The Executive Committee (ExCom) is led by the Chief Executive Officer and consists of the heads of the main operating and functional entities.

The 15 members of Sopra Steria Group’s Executive Committee supervise the Group’s organisation, management system, major contracts and support functions and entities. The Executive Committee is involved in the Group’s strategic planning and implementation. Three of its members are women.

Members of the Sopra Steria Executive Committee:

- ■Cyril Malargé, Chief Executive Officer

- ■Laurent Giovachini, Deputy Chief Executive Officer, Business Strategy, Defence & Security

- ■Éric Pasquier, Software

- ■Fabrice Asvazadourian, Consulting – Sopra Steria Next

- ■Yvane Bernard-Hulin, Legal

- ■Éric Bierry, Sopra Banking Software

- ■Pierre-Yves Commanay, Continental Europe

- ■Perrine Dufros, Human Resources Development

- ■Dominique Lapère, Industrial Approach

- ■Fabienne Mathey-Girbig, Corporate Responsibility and Sustainable Development

- ■John Neilson, United Kingdom

- ■Xavier Pecquet, Key Accounts and Partnerships, Aeroline

- ■Mohammed Sijelmassi, Technology

- ■Étienne du Vignaux, Finance

- ■Grégory Wintrebert, France

The Group Management Committee consists of the members of the Group Executive Committee, together with 42 operational directors and functional directors. Eleven of the Group Management Committee’s members are women.

9.1.2.Tier 2: subsidiaries or countries

- ■a specific line of business (consulting and systems integration, development of business solutions, infrastructure management and cloud services, cybersecurity services and business process services);

- ■geographic area (country);

- ■these entities are managed by their own Management Committee, comprising in particular the Director and management of tier 3 entities.

9.1.3.Tier 3: divisions

9.1.4.Tier 4: business units

Each division is made up of business units, which are the organisation’s primary building blocks. They operate as profit centres and enjoy genuine autonomy. They have responsibility for their human resources, budget and profit and loss account. Management meetings focusing on sales and marketing strategy and human resources are held weekly, and the operating accounts and budget are reviewed on a monthly basis.

9.1.5.Operational support functions

The operational organisation is strengthened by operational support entities responsible for managing major transformations:

- ■the Key Accounts and Partnerships Department (DGCP), responsible for promoting the Key Accounts policy and developing relations with partners. The role of this department is to coordinate the commercial and production approaches for our major clients, particularly when different entities are involved;

- ■the Digital Transformation Office (DTO), responsible for designing and managing the Group’s digital transformation. It also manages the Group’s innovation approach;

- ■the Industrial Department, responsible for industrialising working methods and organising subcontracting on X-shore platforms. It also checks that projects are properly executed.

9.1.6.Functional structures

The functional departments are the Human Resources Department, the Marketing and Communications Department, the Corporate Responsibility and Sustainable Development Department, the Internal Control Department, the Finance Department, the Legal Department, the Real Estate Department, the Purchasing Department, and the Information Systems Department.

These centralised functions ensure Group-wide consistency. Functional managers transmit and ensure commitment to the Group’s core values, serve the operational entities and report directly to Executive Management.

The Group’s functional structures standardise management rules (information system resources, IT systems, financial reporting, etc.) and monitor the application of strategies and rules. In this manner, they contribute to overall supervision and enable the operational entities to focus on business operations.

9.1.7.A solid, efficient industrial organisation

Sopra Steria manages complex and large-scale programmes and projects in a market where delivery commitments are increasing and becoming globalised. The Group has an increasingly wide range of skills to support multi-site projects that generate strong gains in productivity with delivery models that guarantee clients an optimal cost structure.

- ■production culture: Transmission of know-how and expertise in the field;

- ■choice of personnel: Human resources are central to the approach, providing training, support and improved skills for each employee;

- ■organisation: The Industrial Department and its representatives in the business units control production quality and performance, identify and manage risks, support project managers and roll out industrialised production processes;

- ■state-of-the-art industrial-scale foundation: The Delivery Rule Book (DRB), the Digital Enablement Platform (DEP) and the Quality System across the Group’s various entities;

- ■global delivery model: Rationalising production by pooling resources and expertise within service centres, with services located based on the needs of each client (local services and skill centres in various entities, shared service centres nearshore in Spain and Poland, and offshore shared service centres in India).

-

2.Risk factors and internal control

-

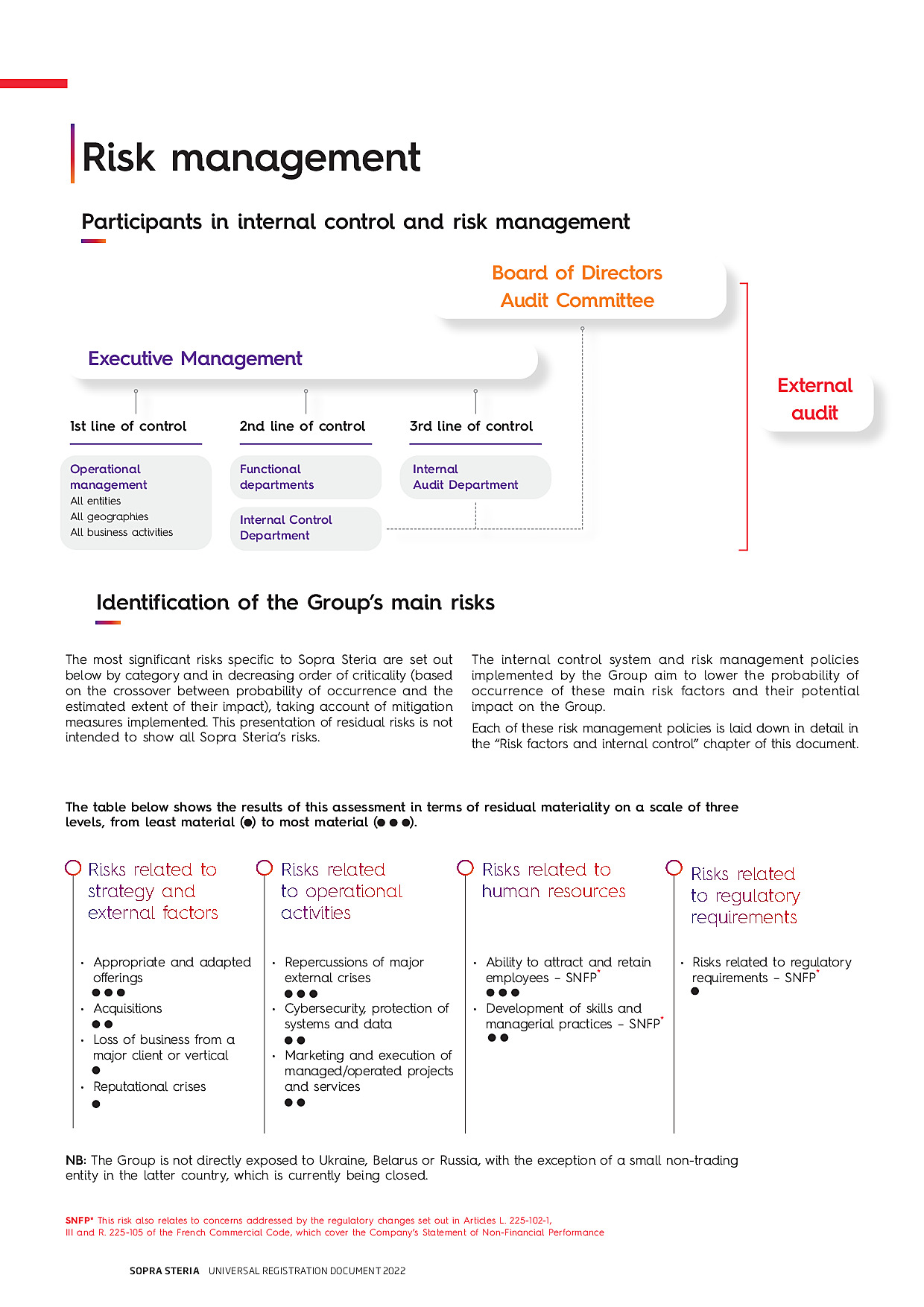

1.Risk factors

1.1.Risk identification and assessment

Risks are identified and the implementation of associated mitigation plans assessed and monitored on an ongoing basis by the various operational and functional units via the risk management system. This system, a pillar of the Group’s risk management system, is based on regular weekly, monthly and annual cycles that are followed at every level of the organisation, corresponding to monthly, annual and multi-year planning horizons (see description in Section 3.3.2 of this chapter, page 47). These cycles help the Group maintain an overall view that takes into account opportunities and risks at every level (strategy, market, operations, social, compliance, etc.). They are synchronised so as to facilitate higher-level consolidation. All engineering methodologies used by the Group’s business lines are predicated on the risk-based approach, helping disseminate this culture at every level of the organisation.

Every year, when the annual cycles take place, information gathered at Group level is used to update the general mapping of risks. This exercise, coordinated by the Internal Control Department, consists of identifying the risks that could limit Sopra Steria’s ability to achieve its objectives and complete its corporate plan, as well as assessing their likelihood of occurrence and their impact should they occur, on a financial, strategic, operating and reputational level.

This assessment is based on contributors’ perceptions, analysis of historical and forecast data and monitoring of changes in the external environment. The main operational and functional managers are involved through interviews and validation workshops. The risk mapping covers all internal and external risks and includes both financial and non-financial issues. Non-financial risks are handled in the same way as other risks.

Risks are assessed on a scale of four levels: very low, low, possible, almost certain in terms of likelihood; and low, moderate, significant, critical in terms of impact. The time frame used is five years.

Specific mapping for corruption and influence-peddling risks and risks relating to duty of vigilance are used in this general risk mapping.

The results of the mapping are reviewed and approved by Executive Management and presented to the Audit Committee of the Board of Directors.

The most significant risks specific to Sopra Steria are set out below by category and in decreasing order of criticality (based on the crossover between likelihood of occurrence and the estimated extent of their impact), taking account of mitigation measures implemented. As such, this presentation of residual risks is not intended to show all Sopra Steria’s risks. The assessment of this order of materiality may be changed at any time, in particular due to the appearance of new external factors, changes in operations or a change in the effects of risk management measures.

-

2.Insurance

The Group’s insurance policy is closely linked to its risk prevention and management practices, in order to ensure coverage for its major risks. The Group’s Legal Department is responsible for the centralised management of its insurance programme.

The aim of Sopra Steria Group’s international insurance programmes is to provide, in compliance with local regulations, uniform and adapted coverage of the risks facing the company and its employees for all Group entities at reasonable and optimised terms. With this in mind, the Company set up its own captive reinsurance company in late 2021.

The scope and coverage limits of these various insurance programmes are reassessed annually in light of changes in the size of the Group, developments in its business activities as well as changes in the insurance market and based on the results of the most recent risk mapping exercise. The insurance programmes provide sufficient coverage for risks with high financial stakes.

All Group companies are insured with leading insurance companies for all major risks that could have a material impact on its operations, business results or financial position.

- ■premises and operations liability and professional indemnity insurance

- ●This programme covers all of the Group’s companies for monetary consequences arising as a result of their civil and professional liability in connection with their activities, due to bodily injury, material or non-material damage caused to its clients and third parties.

- ■property damage and business interruption insurance

- ●This programme covers all of the Group’s sites for the direct material damage to property they may suffer as well as any consequential losses in the event of reduced business activity or business interruption occasioned by the occurrence of an insured event.

- ■premises and operations liability and professional indemnity insurance

-

3.Internal control and risk management

This section of the report outlines Sopra Steria’s internal control and risk management systems. These systems are based on the reference framework issued by the AMF. A specific subsection addresses the preparation of accounting and financial information.

The management control system is one of the fundamental components of internal control at Sopra Steria. It supports the internal dissemination of information as well as the various reporting and risk management procedures, and the implementation of controls.

3.1.Objectives and framework for the internal control and risk management system

3.1.1. Objectives of the internal control and risk management system

In order to address the identified risks presented in the preceding chapter, Sopra Steria has adopted a governance approach as well as a set of rules, policies and procedures together constituting its internal control and risk management system.

In accordance with the AMF reference framework, the internal control and risk management system, which is under the responsibility of the Group’s Chief Executive Officer, is designed to provide reasonable assurance regarding the achievement of objectives in the following categories:

- ■compliance with laws and regulations;

- ■implementation of instructions, guidelines and rules set forth by Executive Management;

- ■proper functioning of the Company’s internal processes, particularly those intended to safeguard its assets;

- ■quality and reliability of financial and accounting information.

More generally, the Group’s internal control and risk management system contributes to the control of its business activities, the effectiveness of its operations and the efficient use of its resources.

This system is updated on a regular basis, in application of a continuous improvement process, in order to best measure the level of risk to which the Group is exposed as well as the effectiveness of the action plans put in place to mitigate risks.

Nevertheless, the internal control and risk management system cannot provide an absolute guarantee that the Company’s objectives will be achieved and that all risks will be eliminated.

3.1.2.Reference framework and regulatory context

-

4.Procedures relating to the preparation and processing of accounting and financial information

4.1.Coordination of the accounting and financial function

4.1.1.Organisation of the accounting and financial function

Limited number of accounting entities

By keeping the number of legal entities, and therefore accounting entities, relatively low, the Group can drive reductions in operating costs and minimise risks.

Centralised coordination of the accounting and financial function

The activities of Sopra Steria’s accounting and finance function are overseen by the Group’s Finance Department, which reports directly to Executive Management.

The responsibilities of the Group Finance Department mainly include the production of the accounts, financial controlling, tax issues, financing and cash management, and participation in financial communications and legal matters.

Each subsidiary has its own finance team that reports functionally to the Group’s Finance Department.

Supervision of the accounting and finance function by Executive Management and the Board of Directors

The Finance Department reports to the Group’s Executive Management. As with all other Group entities, it follows the management reporting and controlling cycle described above: weekly meetings to address current business activities, monthly meetings devoted to a detailed examination of figures (actual and forecast), the organisation of the function and the monitoring of large-scale projects.

Executive Management is involved in the planning and supervision process as well as in preparing the period close.

The Board of Directors is responsible for the oversight of accounting and financial information. It approves the annual accounts and reviews the interim accounts. It is supported by the Audit Committee, as described in Section 1.3.3 of Chapter 3, “Corporate governance” of this Universal Registration Document, pages 78 to 80.

4.1.2.Organisation of the accounting information system

Accounting

The configuration and maintenance of the accounting and financial information system are centralised at Group level. Central teams manage access permissions, and update them at least once a year. The granting of these permissions is validated by Finance teams at the subsidiaries.

All Group companies prepare, at a minimum, complete quarterly financial statements on which the Group bases its published quarterly revenue figures and interim financial statements.

Monthly cash flow forecasts for the entire year are prepared for all companies and consolidated at Group level.

Accounting policies and presentation

-

3.Corporate governance

This chapter describes the organisation and operation of governance as well as the compensation policy for company officers and its application during financial year 2022. It lists and explains any points of divergence from or partial compliance with the recommendations of the AFEP-MEDEF Code.(1)

-

1.Organisation and operation of governance

1.1.Executive company officers

1.1.1.Separation of the roles of chairman of the board of directors and chief executive officer

On 19 June 2012, the Board of Directors decided to separate the roles of Chairman and Chief Executive Officer. It confirmed this decision in 2018 and 2021. It believes that this separation of roles remains the best way of addressing the Group’s strategic and operational priorities. Given the close relationship between the Chairman of the Board of Directors and the Chief Executive Officer, there is close collaboration and an ongoing dialogue between them. In summary, the current framework contributes to fluid and flexible governance arrangements. It means that the Group is able to act as quickly as needed and ensures decisions are taken with due care, while taking into account strategic priorities.

1.1.2.Role of the executive company officers

The Chairman is tasked with managing strategy, while the Chief Executive Officer is responsible for operations.

- ■guides the implementation of the Group’s strategy and all related matters, including mergers and acquisitions;

- ■assists Executive Management with the transformation of the Group;

- ■oversees investor relations and manages the Board’s relations with shareholders.

- ■works with the Chairman to formulate strategy;

- ■supervises the implementation of decisions adopted;

- ■ensures the operational management of all Group entities.

1.1.3.Succession plan for executive company officers

The Nomination, Governance, Ethics and Corporate Responsibility Committee conducts an annual review of the succession plan for the Chairman of the Board of Directors and the Chief Executive Officer so any unforeseen vacancies can be dealt with appropriately. As part of this process, it meets with the Chairman of the Board of Directors. It makes sure the plan covers existing requirements and the Group’s culture. It assesses the relevance of the proposed changes. It approves the actions laid down in the short- to medium-term plan.

In 2022, the Nomination, Governance, Ethics and Corporate Responsibility Committee conducted its annual review of the succession plan and adapted it to accommodate changes in Group governance.

1.1.4.Overview of the activities of the chairman of the board of directors in 2022

The Chairman of the Board of Directors carried out activities on a full-time basis throughout the year. This involved steering the work of the Board and other assignments entrusted to him.

The Chairman’s assignments include the governance of strategy, acquisitions and the Board of Director’s shareholder relations as well as the supervision of matters which were identified early in the year in coordination with the Chief Executive Officer. These matters all relate to long-term preparations required for the Group’s transformation (HR, digital and industrial transformation; key organisational and operating principles for the Group; employee share ownership; promotion of Group values and compliance).

The Chairman is responsible for maintaining balance between the Group’s various stakeholders: shareholders, employees and the community. He ensures that the social and environmental implications of the Group’s business activities are suitably taken into account.

In crisis situations, the ability to rank priorities, uphold the Group’s values, and consider its options from a longer-term perspective thanks to the commitment provided by the core shareholder is absolutely critical.

The various matters placed under the Chairman’s responsibility require a perfect knowledge of operational realities. Close relations with the Chief Executive Officer and the Executive Committee foster information flows between them. It facilitates effective coordination on:

- ■decisions required for the delivery of the medium-term strategic plan;

- ■monitoring of the implementation of such decisions over the long term.

- ■the roles defined in the internal rules and regulations of the Board of Directors;

- ■compliance with the respective prerogative powers of the Chairman and the Chief Executive Officer;

- ■a trust-based relationship established over the long term;

- ■a very good fit between the holders of these positions.

1.1.5.Agreement with sopra gmt, the holding company that manages and controls Sopra Steria Group

In carrying out all of his assignments, the Chairman may receive support from two advisors and draw on resources across the Group. He is supported by a permanent team of four individuals at the Sopra GMT holding company. Three of them have spent much of their careers with Sopra Steria Group. This team therefore has knowledge of the Group, its main managers and its organisational structure that an external service provider could not have. Its position within Sopra GMT means this team has an outside perspective and greater independence. These resources enhance the Board of Directors’ ability to oversee the smooth running of the Company.

The team was initially formed when Axway Software was spun off. It performs duties for Sopra Steria Group and Axway Software, in which Sopra Steria Group holds an ownership of approximately 32%. Sopra GMT provides both companies with its support and ensures synergies and best practices are implemented.

Sopra GMT’s employees carry out their own duties (oversight of acquisitions, corporate secretarial affairs for the Board of Directors and its Committees). They may also assist the Sopra Steria Group’s functional divisions. They are also active participants in various steering committees (acquisitions, corporate responsibility, internal control, internal audit, employee share ownership). They may join working groups tackling key issues for the Company. They provide the benefit of their technical expertise and an independent opinion.

The costs rebilled by Sopra GMT comprise the portion of payroll and related personnel costs allocated to the assignments performed for Sopra Steria Group. They also comprise, under the same conditions, any external expenses incurred by Sopra GMT (such as specialised advisors’ fees). As such, this organisational method does not increase the expenses borne by Sopra Steria Group. If the assignments handled by Sopra GMT’s employees were not entrusted to them, they would need to be reallocated within the Group.

Sopra Steria Group charges Sopra GMT fees for providing premises, IT resources, and assistance from the Group’s functional divisions as well as provision of appropriate expertise for Sopra GMT’s assignments.

The work performed by this team and the principle for the rebilling to the Company of the costs incurred are covered in a framework agreement for assistance. This agreement, approved as a related-party agreement by the General Meeting, is reviewed every year by the Board of Directors.

Pierre Pasquier’s compensation at Sopra GMT reflects his oversight of the assignments performed by the Sopra GMT team for Sopra Steria Group and Axway Software. It is not rebilled to these two companies.

Around 85% of Sopra GMT’s total operating expenses are rebilled. The remaining 15% comprises the expenses arising from Sopra GMT’s own internal operations. Expenses are rebilled on a cost-plus basis including a 7% margin. By definition, Sopra GMT generally records a small operating loss. The annual breakdown varies according to the respective needs of Sopra Steria Group and Axway Software. On average, since 2011, two thirds of the rebilling have concerned Sopra Steria Group.

The Board of Directors reviewed the implementation of this agreement at its meeting on 26 January 2023. It unanimously agreed to maintain the previously granted authorisation for the current financial year. The Directors directly or indirectly affected by this decision did not take part in either the discussion or the vote.

1.1.6.Executive management

Cyril Malargé has been with the Company for almost 20 years. He has served as Managing Director of the France reporting unit and, for the 18 months prior to his appointment as Chief Executive Officer, as the Group’s Chief Operating Officer. He has been a member of the Executive Committee since 2015.

The Chief Executive Officer has authority over the entire Group. He directs, administers and coordinates all of its activities. To this end, he is supported by Executive Management, the Executive Committee and the Management Committee. These Committees comprise the Chief Executive Officer, Deputy Chief Executive Officer and other key operational and functional managers from Sopra Steria Group and its subsidiaries.

The Chief Executive Officer has the broadest possible powers to act in all circumstances in the name of Sopra Steria Group SA, the parent company of Sopra Steria Group. He represents the Company in its dealings with third parties.

Certain decisions relating to strategy implementation and internal organisation require prior approval by the Board of Directors or its Chairman. Decisions “that are highly strategic in nature or that are likely to have a significant impact on the financial position or commitments of the Company or any of its subsidiaries” are defined in the internal rules and regulations of the Board of Directors. See Chapter 8, “Additional information” of this Universal Registration Document (page 290).

1.1.7. Agreement with éric hayat conseil

This agreement relates to the provision to Executive Management of consulting and assistance services. These services are provided in connection with strategic deals connected with business development among other areas. They are charged at a per diem rate of €2,500 (excluding taxes). The duties performed under this agreement are distinct from those performed by virtue of Éric Hayat’s directorship. For example, this may involve but is not limited to the following, in consultation with the Group’s operational managers:

- ■taking part in top-level market meetings;

- ■maintaining contacts with civil society;

- ■taking part in high-level meetings with certain key clients in France and abroad;

- ■preparing for and participating in delegations of corporate executives to priority countries for the Group.

This enables the Company to benefit from the experience and knowledge of the Group gained by Éric Hayat throughout his career. This knowledge extends to its environment and some of its major clients. Éric Hayat was a co-founder of Steria. He also previously chaired the digital sector employers’ organisation and subsequently the broader “Fédération Syntec”, and is a former member of MEDEF’s Executive Committee. His skills and experience are thus particularly well suited to the responsibilities entrusted to him, which mainly relate to major business opportunities.

This means that the number of Directors on the Board that are directly involved in addressing the Group’s priorities in terms of strategic and commercial positioning is increased, thus enriching the Board’s debates. Éric Hayat, in his capacity as a member of the Compensation Committee and the Nomination, Governance, Ethics and Corporate Responsibility Committee, provides these committees with the benefit of the knowledge of the Group’s operational managers accumulated and maintained in the course of these assignments. Lastly, he has access to information channels within the Company that are helpful for feeding information back to the Board of Directors and its Committees.

- ■expenses: €181 thousand;

- ■the Board of Directors reviewed the implementation of this agreement at its meeting on 26 January 2023. It unanimously agreed to maintain the previously granted authorisation for the current financial year. The Director affected by this decision did not take part in either the discussion or the vote.

-

2.Compensation of company officers

2.1.General principles

While paying particular attention to the stability of the principles used to determine and structure compensation for executive company officers, the Board of Directors re-examines their compensation packages on an annual basis to verify their fit with the Group’s requirements. In particular, the Board checks that compensation policy:

- ■continues to be in keeping with the Company’s best interests;

- ■contributes to the Company’s long-term success, takes into account its social and environmental priorities;

- ■is in keeping with the Company’s business strategy.

The Board also checks that compensation policy complies with the recommendations laid down in the AFEP-MEDEF Code. To this end, it is supported by the Compensation Committee, which helps it prepare its decisions in this area.

The Board of Directors considers that applying the compensation recommendations laid down in the AFEP-MEDEF Code of Corporate Governance protects the Company’s interests and encourages executives’ contribution to business strategy and the Company’s long-term success.

The Compensation Committee usually meets three to five times between October and February to help the Board prepare its decisions.

The Board of Directors generally discusses the strategic approach over the same period; this discussion has taken into account social and environmental issues associated with the Company’s business. For the past several years, the Group has been pursuing an independent, value-creating plan that combines growth and profitability. Priorities are adjusted each year based on the current state assessment undertaken at the end of the previous year.

The Committee reviews the current compensation policy applicable to company officers. It is then informed of estimates of how far the Chief Executive Officer has achieved their targets. These forecasts are refined in the course of the Committee’s various meetings. At the beginning of the year, the Compensation Committee determines the extent to which quantifiable targets set for the previous year have been achieved. It assesses the extent to which qualitative targets have been met. To this end, it meets with the Chairman of the Board of Directors and familiarises itself with any information that might be used in this assessment.

The Committee also takes into consideration the Group’s compensation policy and decisions on fixed and variable compensation payable to the members of the Group Executive Committee. It takes into account comparisons with other companies made available to it. However, sector consolidation has significantly reduced the number of companies allowing for a direct and relevant comparison.

The Committee also considers ways in which employees may be given a stake in the Company’s financial performance. It assesses the suitability of share ownership plans for all employees and long-term incentive plans for managers of the Company and its subsidiaries. The Board of Directors considers that employee and executive share ownership makes a lasting contribution to the Company’s priority focus on independence and value creation by ensuring that employees’ and executives’ interests are fully aligned with those of the company’s shareholders.

The Board of Directors has not, to date, fixed the number of shares that must be held and registered in the name of the Chairman of the Board of Directors who co-founded of the Company. Shares held directly or indirectly through Sopra GMT by the Chairman in a personal capacity or by the Chairman’s family group make up more than 10% of the Company’s share capital.

On the recommendation of the Compensation Committee, the Board of Directors set a requirement for the Chief Executive Officer to retain 50% of the performance shares actually awarded during his term of office. It also set a target for him to hold 50% of his compensation in the Company’s shares by the end of 2026.

When the Board of Directors reviews the budget for the current financial year, the company’s quantitative targets are a known quantity. The Compensation Committee takes them into account when determining the Chief Executive Officer’s quantitative targets for the financial year. It holds a further meeting with the Chairman of the Board of Directors to discuss potential qualitative targets.

The Compensation Committee then presents its recommendations to the Board of Directors, which deliberates without the interested parties in attendance. These recommendations relate to the Chief Executive Officer’s variable compensation for the previous financial year, fixed compensation payable to the Chairman of the Board of Directors, and the Chief Executive Officer’s fixed and variable compensation for the current financial year. The Committee also presents its observations on how compensation is apportioned among the Directors and any proposed adjustments. The total amount of the compensation referred to in Article L. 225-45 of the French Commercial Code subject to approval by the shareholders is agreed when the Board of Directors meets to prepare for the General Meeting of Shareholders.

As regards variable compensation, the Compensation Committee proposes the quantifiable criteria to be taken into account together with any qualitative criteria, as the case may be. It makes certain that the criteria adopted are mainly quantifiable and that criteria are precisely defined. As regards quantifiable criteria, it generally determines:

- ■a threshold below which variable remuneration is not paid;

- ■a target level at which 100% of compensation linked to the criterion in question becomes payable; and

- ■where applicable, an upper limit if there is the possibility that a target may be exceeded.

Performance is assessed by comparing actual performance with the target broken down into thresholds and targets, as the case may be. Where, by exception, compensation may exceed the target level, the extent to which it may do so is capped.

Based on the targets adopted, an amount equivalent to 60% of the annual fixed compensation cannot be exceeded. Even so, in the event of an outstanding performance relative to the quantitative targets, the Board of Directors may, after consulting the Compensation Committee, authorise the integration of targets being exceeding, subject to the cap on annual variable compensation set at 100% of annual fixed compensation. Effective payment of the Chief Executive Officer’s variable compensation will, in any event, be subject to shareholder approval at an Ordinary General Meeting.

Conversely, the Board of Directors may consider that the Group’s performance does not merit payment of variable compensation in respect of the financial year in question. That being the case, it does not take into account the extent to which qualitative targets have been met. It proposes to the shareholders that no variable compensation be paid in respect of that financial year.

Lastly, in the event of exceptional circumstances (such as an exogenous shock) leading to the suspension of the normal system of variable compensation for employees and Executive Committee members, the Compensation Committee would review the situation of the Chief Executive Officer. It could recommend to the Board of Directors that it ask the shareholders at the General Meeting to approve an improvement to the Chief Executive Officer’s variable compensation if that would serve the Company’s interests, subject to an upper limit of 60% of his annual fixed compensation.

Long-term incentive plans are based on awarding rights to shares. They are subject to the condition of being with the company over a period of time and performance conditions. The targets are set in the same way as for variable compensation.

Independently of the compensation policy, the company covers or reimburses company officers’ travel expenses (transportation and accommodation).

The Nomination, Governance, Ethics and Corporate Responsibility Committee and the Compensation Committee have four members in common. This overlap ensures that decisions are consistent between the two Committees.

The procedure for determining compensation policy applicable to executive company officers and the timing of that procedure are intended to ensure that all worthwhile information is taken into account when recommendations are drawn up and when the Board of Directors makes its final decision. This ensures that such decisions are consistent among themselves and aligned with the Company’s strategy.

The compensation policy applies to newly appointed company officers. However, in exceptional circumstances, such as to enable the replacement or appointment of a new executive company officer, the Board of Directors may waive application of the compensation policy. Such waivers must be temporary, aligned with the Company’s interests and necessary to secure the Company’s long-term success or viability. Furthermore, this option may only be adopted where there is consensus among the members of the Board of Directors as to the decision to be taken (i.e. no votes against). This may result in the awarding of components of compensation currently defined in the compensation policy as not applicable (severance pay, non-compete payment, supplementary pension plan), though any such items would be subject to approval at the following General Meeting.

-

3.Standardised presentation of compensation paid to company officers

3.1.AFEP-MEDEF Code tables

Overview of compensation, options and shares granted to Pierre Pasquier, Chairman of the Board of Directors (Table 1 – AFEP-MEDEF Code of Corporate Governance for Listed Companies, December 2022)

Statement summarising the compensation of Pierre Pasquier, Chairman of the Board of Directors (Table 2 – AFEP-MEDEF Code of Corporate Governance for Listed Companies, December 2022)

2021

2022

Amount awarded

Amount paid

Amount awarded

Amount paid

Fixed compensation

€500,000

€500,000

€500,000

€500,000

Annual variable compensation

-

-

-

-

Exceptional compensation

-

-

-

-

Compensation allotted in respect of directorship (L. 22-10-14)

€27,192

€27,944

€26,891

€27,192

Benefits in kind

€5,700

€5,700

€5,700

€5,700

Total

€532,892

€533,644

€532,591

€532,892

Pierre Pasquier is the Chairman and CEO of Sopra GMT, the holding company for Sopra Steria Group. In respect of these duties (leading the Sopra GMT team and chairing the Board of Directors), he received compensation of €130,000 in 2022. In addition, he received compensation under Article L. 225-45 of the French Commercial Code in the amount of €14,400 in respect of financial year 2022. This compensation was paid by Sopra GMT and was not rebilled to Sopra Steria Group (see Section 1.1.4, “Overview of the activities of the Chairman of the Board of Directors in 2022” of this chapter, page 54).

As Chairman of the Board of Directors of Axway Software, as indicated in its Universal Registration Document, Pierre Pasquier also received fixed compensation from that company in the amount of €138,000 and compensation in respect of Article L. 22-10-14 of the French Commercial Code of €19,518.

Overview of compensation, options and shares granted to Vincent Paris, Chief Executive Officer until 28 February 2022 (Table 1 – AFEP-MEDEF Code of Corporate Governance for Listed Companies, December 2022)

Statement summarising the compensation of Vincent Paris, Chief Executive Officer until 28 February 2022 (Table 2 – AFEP-MEDEF Code of Corporate Governance for Listed Companies, December 2022)

2021

2022

Amount awarded

Amount paid

Amount awarded

Amount paid

Fixed compensation

€500,000

€500,000

€82,988

€82,988

Annual variable compensation

€300,000

€97,500

€50,000

€300,000

Exceptional compensation

-

-

-

-

Compensation allotted in respect of directorship (L. 22-10-14)

-

-

-

-

Benefits in kind

€11,274

€11,274

€1,080

€1,080

Total

€811,274

€609,021

€134,068

€384,068

On the recommendation of the Compensation Committee, the Board of Directors proposed to the General Meeting of Shareholders of 1 June 2022 a temporary amendment to the compensation policy, specifically in connection with the end of Vincent Paris’ term of office, and not to set any conditions on the payment of his variable compensation in respect of 2022 (amount at issue: €50k). This proposal was based on the quality of the handover between Vincent Paris and Cyril Malargé and the impossibility of determining meaningful quantitative or qualitative targets over a period of a month and a half. Payment of Vincent Paris’ variable compensation for 2022 remains subject to approval at the General Meeting of Shareholders to be held in 2023.

Additional information concerning the situation following the end of Vincent Paris’ appointment as Chief Executive Officer

After his appointment ended, Vincent Paris’ employment contract came back into force. It had been suspended following his appointment as a company officer. During the following months, efforts to find him a permanent position within the organisation failed to reach an outcome satisfactory to both parties, and so they agreed on an amicable parting of ways through termination of his employment contract.

Vincent Paris left Sopra Steria Group effective 31 July 2022. A statutory payment of €621,864 was made upon termination of his employment contract, without any compensation being paid.

In addition, the Board of Directors decided, in a departure from normal practice and on an entirely exceptional basis, to remove the condition of continued employment applicable to the grant of 3,000 rights to free shares he was awarded on May 26, 2021. For information about the factors leading to this decision and an assessment of the benefit granted, please refer to Section see Section 5 "Additional information about resolutions passed with a majority of less than 80% at the General Meeting of 1 June 2022" of Chapter 8 "Additional information" of this Universal Registration Document, page 318 to 319.

Overview of compensation, options and shares granted to Cyril Malargé, Chief Executive Officer since 1 March 2022 (Table 1 – AFEP-MEDEF Code of Corporate Governance for Listed Companies, December 2022)

Statement summarising the compensation of Cyril Malargé, Chief Executive Officer since 1 March 2022 (Table 2 – AFEP-MEDEF Code of Corporate Governance for Listed Companies, December 2022)

(in millions of euros)

2021

2022

Amount awarded

Amount paid

Amount awarded

Amount paid

Fixed compensation

-

-

€450,000

€377,080

Annual variable compensation

-

-

€245,700

-

Exceptional compensation

-

-

-

-

Compensation allotted in respect of directorship (L. 22-10-14)

-

-

-

-

Benefits in kind

-

-

€9,300

€9,300

Total

-

-

€705,000

€386,380

The relative proportions of fixed and variable compensation in the annual compensation awarded to the Chief Executive Officer (excluding benefits in kind) were 65% and 35%, respectively.

Calculation of 2022 annual variable compensation

Criteria

Type

Potential amount as % of AVC(1)

Potential amount in €

Threshold

Target

Ceiling

Achieved

Amount awarded in €

Consolidated operating margin

Quantifiable

45.0%

€121,500

8.5%

9.0%

N/D (2)

8.9%

€97,200

Consolidated revenue growth

Quantifiable

30.0%

€81,000

4.0%

6.0%

N/D (2)

7.6%

€81,000

Qualitative targets related to the assumption of duties as Chief Executive Officer

Qualitative

15.0%

€40,500

N/A (3)

N/A (3)

N/D (2)

Target 100% achieved

€40,500

Progress towards meeting the 2025 target for the proportion of women in senior management positions

Qualitative

5%

€13,500

N/A (3)

N/A (3)

N/D (2)

Target 100% achieved

€13,500

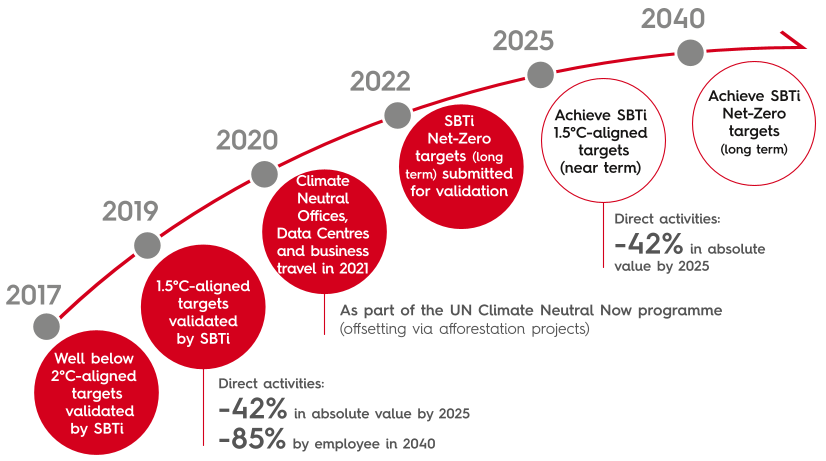

Progress towards meeting the target for reducing direct

GHG (4) emissions per employee (SBTi III) (5)Qualitative

5%

€13,500

N/A (3)

N/A (3)

N/D (2)

Target 100% achieved

€13,500

Total

100%

€270,000

€245,700

(1) AVC: Annual variable compensation.

(2) N/D: Not defined.

(3) N/A: Not applicable.

(4) Greenhouse gas.

(5) Science Based Targets initiative.

Performance criteria were applied as anticipated at the time they were determined on 23 February 2022. No compensation is due at the threshold; the amount due is calculated on a linear basis between the threshold and the target.