URD 2023

-

2023 Universal Registration Document

INCLUDING THE ANNUAL FINANCIAL REPORT AND MANAGEMENT REPORT INCLUDING COMPONENTS OF THE STATEMENT OF NON-FINANCIAL PERFORMANCE

The original French-language version of the Universal Registration Document was filed on 15 March 2024 with the Autorité des Marchés Financiers (AMF) in its capacity as competent authority in respect of Regulation (EU) 2017/1129, without prior approval in accordance with Article 9 of said regulation.

The original French-language version of the Universal Registration Document may be used for the purposes of an offer to the public of financial securities or the admission of financial securities to trading on a regulated market if it is supplemented by a securities note and, if applicable, a summary and any amendments made to the Universal Registration Document. The resulting combined document is approved by the AMF in accordance with Regulation (EU) 2017/1129.

The information included in both of those registration documents, other than the information mentioned above, has been replaced and/or updated, as applicable, by the information included in this Universal Registration Document.

This document is a free translation into English of the original French “Document d’enregistrement universel”, referred to as the “Universal Registration Document”. It is not a binding document. In the event of a conflict of interpretation, reference should be made to the French version, which is the authentic text.

Chairman’s message

Chairman’s message“Sopra Steria’s ambition is to become a compelling alternative to global providers for major European clients”

We are living at a time of considerable upheaval that is affecting all aspects of our lives: political, international, social, environmental, and societal. The development of digital technology is one of the key drivers of this change and heralds yet more major change to come.

As a major player in the European tech sector, Sopra Steria plays an important role in the development of digital technology. Our mission is to guide our clients, partners and employees towards bold choices, building a positive future by making digital work for people. Drawing on our founding values and corporate culture, we have adopted a responsible approach to digital technology that takes into account its impacts on all our stakeholders. That means digital ethics and sovereignty are priorities. We strive to continuously improve our environmental footprint by reducing our emissions. We are committed to work every day to uphold workplace gender equality, inclusion and diversity.

The strategic review we kicked off at the end of the public health crisis highlighted the need to speed up our internal transformation to adapt the Group to the environment in which it now operates. We are firmly committed to this process.

We have begun to streamline our range of services and solutions so that we can serve our clients even more effectively as they navigate the digital transition. In particular, we are expanding our consulting business and upgrading our operating model to better leverage our tech expertise.

Our external growth strategy is aimed at consolidating our position in markets we see as strategic for Sopra Steria in Europe. Through acquisitions over the past two years, we have significantly expanded our presence in Benelux and considerably strengthened our position in defence and security as well as securing a promising new foothold in the space segment.

-

Key figures for 2023

Key figures for 2023Sopra Steria, a major player in the European tech sector recognised for its consulting, digital services and software development, helps its clients drive their digital transformation and obtain tangible and sustainable benefits.

It provides end-to-end solutions to make large companies and organisations more competitive by combining in-depth knowledge of a wide range of business sectors and innovative technologies with a fully collaborative approach.

-

Our mission and values

Our mission and values Our mission

Our missionTechnology serves as a gateway to infinite possibilities. As fascinating as this never-ending stream of innovations is, it also raises questions as to what is actually behind the frantic race for novelty and change.

Solutions are never straightforward or obvious, and there is certainly never just one way of doing things.

At Sopra Steria, our mission is to guide our clients, partners and employees towards bold choices to build a positive future by putting digital technology to work in service of humanity.

Beyond technology, we set great store by collective intelligence, in the firm belief it can help make the world a better place.

-

Business model and…

Business model and…

Our vision

Our business

Our market The digital revolution has triggered a radical transformation in our environment.

It is speeding up changes in our clients’ business models, internal processes and information systems

In this fast-changing environment, we bring our clients new ideas and support them in their transformation by making the most effective use of digital technologySopra Steria provides end-to-end solutions to address the core business needs of large companies and organisations, helping them remain competitive and grow, supporting them throughout their digital transformation in Europe and around the world. Spending on digital services in Western Europe: $362bn in 20231

A market that is expected to grow between 8% and 10% per year between 2024 and 20271

Sopra Steria ranks among the top 13 digital services companies operating in Europe (excluding hyperscalers and software vendors)1 Our solutions

Our solutions -

…The value creation chain

…The value creation chain Sample value creation performance measures in 2023 for our main stakeholders

Sample value creation performance measures in 2023 for our main stakeholders

Employees

Clients

Shareholders

Society • 77% of employees say Sopra Steria is a great place to work – GPTW survey3

• 34 hours of training on average per employee

• 100% of employees take part in a training session at least once a year

• Attrition rate: 14%

• Over 80% of 100 strategic clients satisfied according to the Customer Voice survey

• 6.6% organic revenue growth

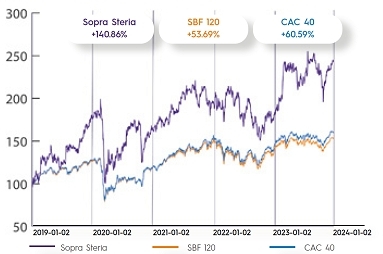

• Annual change in share price: Up 39.39% in 2023

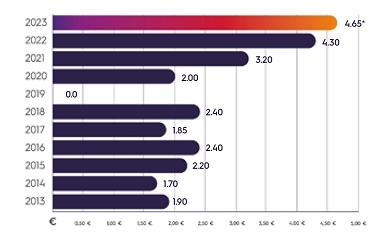

• €4.65 dividend proposed for financial year 2023

• Ranking by non-financial rating agencies (cf. page 11)

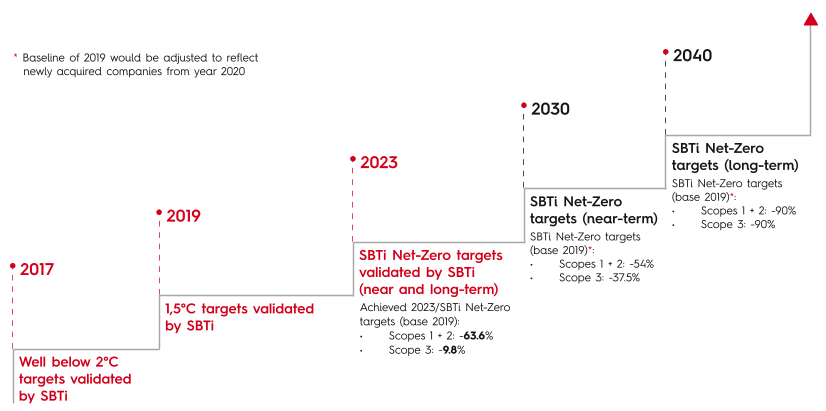

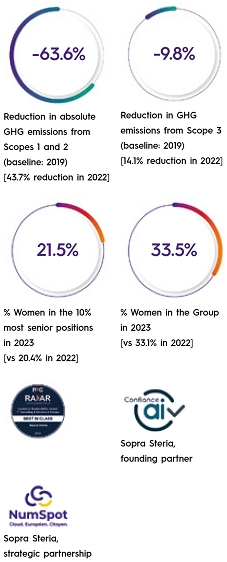

• 63.6% reduction in absolute GHG4 emissions from Scopes 1 and 2 in 2023 (baseline: 2019)

• 9.8% reduction in absolute GHG emissions from Scope 3 in 2023 (baseline: 2019)

• 20% reduction in office energy consumption at Group level relative to 2021

• A List: CDP ranking

• Top 1% Platinum: EcoVadis

-

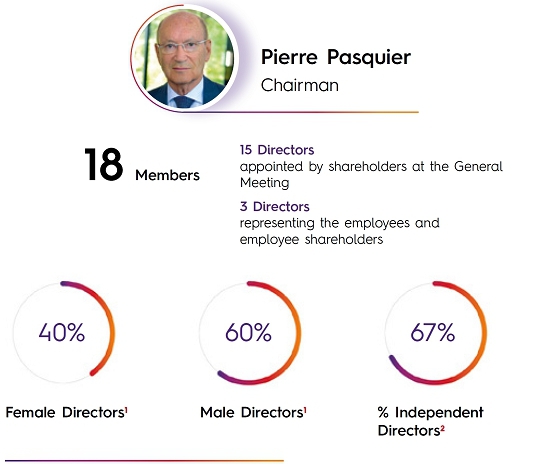

Governance

Governance Board of Directors

Board of Directors -

Governance

Governance Executive bodies

Executive bodies

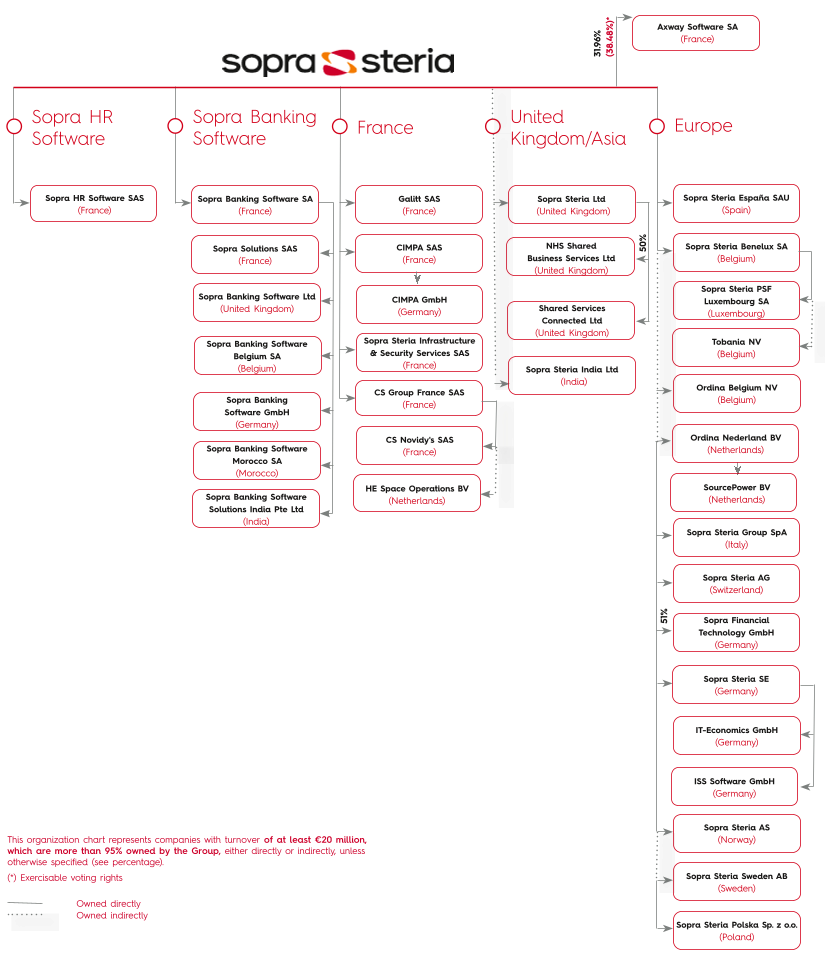

The Group is made up of a corporate function and a number of operational divisions.

The Executive Management team is supported by the Executive Committee (ExCom) and the Management Committee.

Executive Committee

The Executive Committee has 18 members. It supervises the Group’s organisation, management system, major contracts and support functions and entities. It is involved in the Group’s strategic planning and implementation. 3 of its members are women.

17 %

of Executive Committee members are women

• Cyril Malargé

Chief Executive Officer

• Fabrice Asvazadourian

Sopra Steria Next

• Pierre-Yves Commanay

Continental Europe

• Jo Maes

Benelux

• John Neilson

United Kingdom

• Mohammed Sijelmassi

Technology

• Laurent Giovachini

Deputy Chief Executive Officer, Defence & Security

• Yvane Bernard-Hulin

Legal

• Dominique Lapère

Industrial Approach

• Béatrice Mandine

Communications

• Xavier Pecquet

Key Accounts and Partnerships, Aeroline

• Étienne du Vignaux

Finance

• Éric Pasquier

Strategy, Software and Solutions

• Éric Bierry

Sopra Banking Software

• Axelle Lemaire

Corporate Responsibility

• Louis-Maxime Nègre

Human Resources

• Kjell Rusti

Scandinavia

• Grégory Wintrebert

France

-

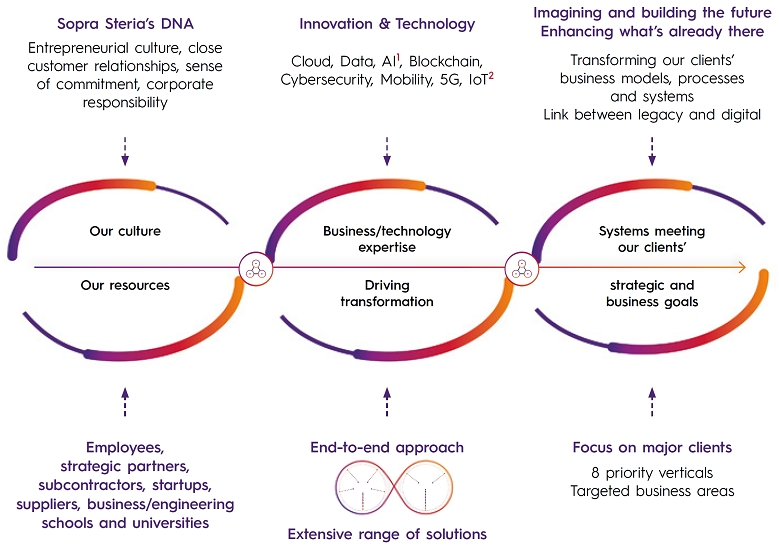

Strategy & Ambitions

Strategy & Ambitions Strategy

StrategySopra Steria’s strategy is built around its independent corporate plan focused on sustainable value creation for its stakeholders. This Europe-wide corporate plan is underpinned by expansion through organic and acquisition-led growth. Its goal is to generate substantial added value by leveraging a comprehensive range of end-to-end1 solutions. Our ambition is to be the partner of choice in Europe for major public administrations, financial and industrial operators and strategic businesses, when they are looking for support with driving the digital transformation of their activities (business and operating model) and their information systems, and preserving their digital sovereignty.

-

Corporate responsibility

Corporate responsibility“To rise to the immense challenges posed by the societal and environmental transformations currently underway, we are working and moving forward with all our stakeholders: our employees, who constitute our core strength and ability to take action; our clients, who are the reason why we seek to innovate and reinvent ourselves; our partners, with whom we develop technology solutions to help build a more sustainable world; our suppliers, who share our commitment; and our shareholders, whose support enables us to pursue our corporate plan.”

Three ESG priorities

Three ESG priorities Helping combat climate change

Helping combat climate changeReducing the carbon footprint of our business activities along our entire value chain

• Reduce absolute GHG1 emissions from Scopes 1 and 2 (baseline: 2019) by 54% by 2030 (near-term goal) and by 90% by 2040 (long-term goal)2

• Reduce absolute GHG emissions from Scope 3 (baseline: 2019) by 37.5% by 2030 (near-term goal) and by 90% by 2040 (long-term goal)2

• Integrate environmental sustainability into the services and solutions we offer

Increase the number of female Group

employees

Increase the number of female Group

employeesFirm commitment to promoting workplace gender equality and combating all forms of discrimination

• Continuous increase in the number of women in the Group’s workforce through recruitment and promotion

• Continue to increase the proportion of women in the 10% most senior positions

• Target for 2025: Women to make up 30% of the EXECUTIVE COMMITTEE

Embedding digital sustainability

into our value proposition

Embedding digital sustainability

into our value propositionPromoting digital ethics, environmental sustainability and digital sovereignty

• Through its subsidiary CS Group, Sopra Steria is involved in a number of projects run by Copernicus, the EU’s Earth observation programme, using geospatial data to promote environmental conservation efforts. CS Group’s contributions include the processing of data from very high-resolution images and calibration work for Earth observation equipment.

• Developed by Sopra Steria, Green For IT (G4IT), is a tool used to measure the environmental impact of digital services, operating across three levels of assessment: physical equipment, virtual equipment and applications. The tool is ISO 14040- and ISO 14044-compliant and available via a SaaS platform.

• As part of its strategic partnership with NumSpot, a sovereign cloud provider based in France, Sopra Steria offers its clients a secure, agile solution that complies with the highest standards required by public-sector organisations and operators of vital importance (OIV in French).

-

Corporate responsibility

Corporate responsibilityOur direct and indirect contribution to the 17 Sustainable Development Goals (SDGs) of the United Nations

Six major commitments aligned with the business model drive the Group’s strategy with respect to Corporate Responsibility:

Commitments to employees

l Being a leading employer that attracts the best talent and promotes positive labour relations, equal opportunity and diversity

• 9,629 new hires within the Group

• 34 hours of training on average per employee

• 77% of our employees say Sopra Steria is a great place to work – GPTW

Environmental commitments

l Mitigating the impact of the Group’s activities on the environment and helping combat climate change, drawing on all the links in our value chain

• Developing an SBTi Net-Zero strategy based first and foremost on achieving a 90% reduction in greenhouse gas emissions by 2040

• Group-wide office energy consumption reduced by 20% in 2023 relative to 2021, exceeding our original target of a 10% reduction

• Maintaining the responsible purchasing programme, selecting suppliers committed to environmental sustainability

Commitments to society

l Acting ethically in the Group’s day-to-day operations and across all its business activities

l Being a long-lasting partner for clients, meeting their needs as effectively as possible by providing them with the best technology as part of a responsible and sustainable value-creating approach

l Promoting digital trust by developing digital sovereignty in Europe, cybersecurity and AI through an ethical, safe approach to technology

l Supporting local communities by stepping up community initiatives, particularly in the field of digital inclusion

• 93% of the Group’s employees trained in preventing corruption and influence peddling

• Over 80% of 100 strategic clients satisfied according to the Customer Voice survey

• 205 community outreach projects

• 886 non-profits and schools supported, of which 148 for high-impact projects

• Over 1,960 volunteers on community outreach programmes

-

Aligning with the CSRD

Aligning with the CSRDThe materiality analysis, which helps identify and prioritise the most relevant material and non-financial issues for the Company, was updated in 2023. With the entry into force of the Corporate Sustainability Reporting Directive (CSRD) with effect from 1 January 2024 (Order 2023-1142 of 6 December 2023 on the disclosure and certification of sustainability information), in-depth analysis is underway to define a new double materiality matrix encompassing both financial materiality and impact materiality. This entails a change of approach, with the new matrix determining both external (environmental and social) impacts on the Group’s performance and the business’s impact on its economic, social and natural environment.

Alignment of information related to the Group’s non-financial performance with the Principal Adverse Impact (PAI) indicators set out in the EU’s Sustainable Finance Disclosure Regulation (SFDR)

Alignment of information related to the Group’s non-financial performance with the Principal Adverse Impact (PAI) indicators set out in the EU’s Sustainable Finance Disclosure Regulation (SFDR)Topic PAI indicators Information

for Sopra SteriaGreenhouse gases (GHG) Greenhouse gas emissions See Chapter 4, Section 3.2.2, “Summary of greenhouse gas emissions by scope”, 3.4.1, “Direct activities” and 3.4.2, “Indirect activities” Carbon footprint Greenhouse gas emissions intensity Exposure to the fossil fuel sector No exposure Share of non-renewable energy consumption and production See Chapter 4, Section 3.4, “Optimising resource consumption and reducing greenhouse gas emissions”, 3.4.1, “Direct activities” and 3.4.2, “Indirect activities” Energy consumption intensity Biodiversity Activities negatively affecting biodiversity-sensitive areas See Chapter 4, Section 3.4.1, “Working to promote biodiversity” Water Water usage 172,169 m3 – See Chapter 4, Section 3.4.1, “Direct activities” Waste Hazardous waste ratio Sopra Steria does not produce any hazardous waste according to the RoHS and REACH definitions. In 2023, the portion of hazardous WEEE not given a second life stood at 0.16% of the total amount of WEEE and paper, cardboard, plastic and metal waste.

See Chapter 4, Section 3.4.2, “Indirect activities”.Social and employee matters Violations of the UN Global Compact Principles or the Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Enterprises No violations Absence of a monitoring system or processes to ensure compliance with the UN Global Compact Principles and the OECD Guidelines for Multinational Enterprises See Chapter 4, Section 4.1.1, “Governance and organisation” Unadjusted gender pay gap Score of 39/40 for the “Pay gap” criterion of the French professional gender equality index, equating to a difference of less than 1% in favour of men. Board gender diversity 40% of members of the Board of Directors were women at 31/12/2023 Exposure to controversial weapons (anti-personnel mines, cluster munitions, chemical weapons and biological weapons) No exposure -

Dialogue with investors

Dialogue with investors Factsheet

Factsheet

Listing

Market

ISIN

Ticker symbol

Main indices Euronext Paris

Eligible for Share Savings Plan (PEA)

Eligible for Deferred Settlement Service

Compartment A FR0000050809 SOP SBF 120, CAC ALL-TRADABLE, CAC ALL SHARES, CAC MID & SMALL, CAC MID 60, CAC TECHNOLOGY, EURONEXT DEVELOPED MARKET, NEXT 150, EURONEXT FAS IAS, CAC SBT 1.5°, EURONEXT EUROZONE ESG LARGE 80 EURONEXT EUROZONE 300, EURONEXT VIGEO EUROPE 120, EN CDP ENVIRONMENT ESG FRANCE EW -

Financial performance

Financial performance -

1.Business and

strategy overview1.Sopra Steria Group at a glance

Corporate name: Sopra Steria Group

Until 2 September 2014, the name of the Company was “Sopra Group”. As a result of the successful public exchange offer made by Sopra Group for the shares of Groupe Steria SCA (see press release dated 6 August 2014), the Board of Directors met on 3 September 2014, with Pierre Pasquier presiding, and recorded the entry into effect of several resolutions conditionally adopted at the General Meeting of 27 June 2014.

Among the consequences of the implementation of these resolutions was the change in the corporate name from “Sopra Group” to “Sopra Steria Group”.

Registered office: PAE Les Glaisins, Annecy-le-Vieux, 74940 Annecy – France. Phone: +33(0)4 50 33 30 30.

Date of incorporation: 5 January 1968, with a term of fifty years as from 25 January 1968, renewed at the General Meeting of 19 June 2012 for a subsequent term of ninety-nine years.

To engage, in France and elsewhere, in consulting, expertise, research and training with regard to corporate organisation and information processing, in computer analysis and programming and in the performance of customised work.

The design and creation of automation and management systems, including the purchase and assembly of components and equipment, and appropriate software.

The creation or acquisition of and the operation of other businesses or establishments of a similar type.

-

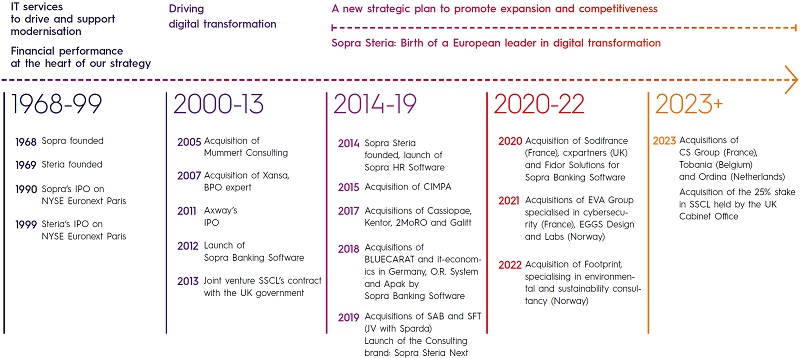

2.History of Sopra Steria Group

A long history of entrepreneurship

Backed by our strong entrepreneurial culture and our sense of collective purpose, we work every day to deliver a range of solutions to our clients’ information systems, from consulting to systems integration. We aim to be the benchmark partner for large public authorities, financial and industrial operators, and strategic companies in the main countries where we operate. We focus on being relevant at all times and ensuring that our impact is a positive one, both for society and from a business perspective.

-

3.Digital services market

3.1.Main markets – Competitive environment of the digital services sector

In 2023, the digital services market in Western Europe was worth an estimated $362 billion (1), up 7.1% (2). For 2024, Gartner predicts growth of 8.3% (at constant US dollars).

Digital services market in Western Europe (excluding hardware and software)

Three countries (the United Kingdom, Germany and France) account for 58% of IT services spending (1).

According to market research, in 2023 the market (1) grew by 6.5% (2) in France, 6.6% in Germany and 6.8% in the United Kingdom. For 2024, growth is expected to continue, amounting to 7.5% in France, 7.5% in Germany and 8.2% in the United Kingdom.

Gartner expects this trend to continue over the next few years, with market growth in Western Europe estimated at around 8% to 10% per year between 2024 and 2027.

Digital services market in Western Europe (excluding hardware and software)

In terms of business segments, according to Gartner, consulting was up 7.6% (2) in 2023 and implementation services grew by 6.8%. The Group’s other activities also experienced a year of growth: Outsourced infrastructure and cloud services were up 6.9%, with business process outsourcing up 7.2%.

For 2024, Gartner predicts growth of 10.4% in consulting, 7.0% in implementation services and 8.1% in outsourced infrastructure and cloud services. Business process outsourcing is expected to grow by 8.4%.

Furthermore, the IT services market remains fragmented despite some consolidation, with the leading player in the European market holding a 6% share. Against this backdrop, Sopra Steria is one of the 13 largest digital services companies operating in Europe (excluding software) with an average market share of just under 2%. In France (third in the market) and Norway (fourth in the market), the Group’s market share is over 5%. In the other major European countries, its market share is around 1%.

Sopra Steria’s main competitors in Europe are: Accenture, Atos, Capgemini, CGI, DXC and IBM, all of which are present worldwide. It also faces competition from Indian groups, chiefly in the United Kingdom (such as TCS, Cognizant, Wipro and Infosys), and local companies with a strong regional presence (Indra in Spain, Fujitsu in the United Kingdom, Tietoevry in Scandinavia, etc.).

-

4.Sopra Steria’s activities

4.1.Major European player in digital transformation

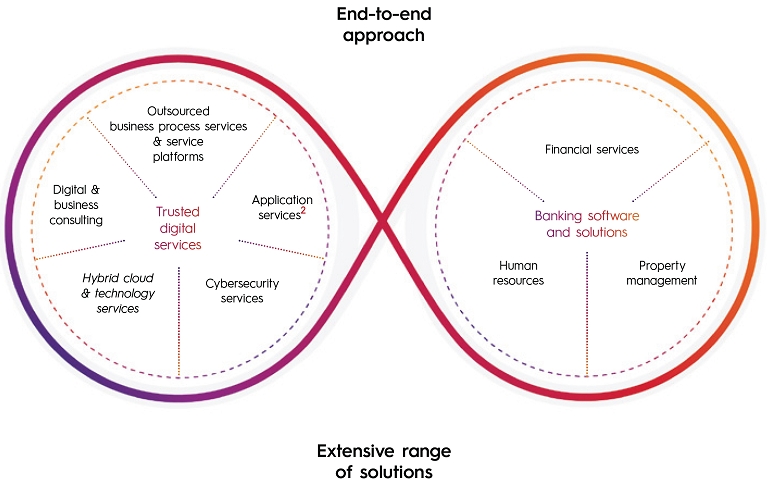

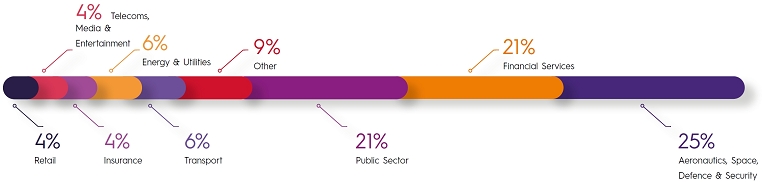

Sopra Steria, a major actor in Europe’s consulting, digital services and solutions market, helps its clients drive their digital transformation and obtain tangible and sustainable benefits, thanks to one of the most comprehensive portfolios of offerings on the market, encompassing consulting and systems integration, industry- and technology-specific solutions, hybrid cloud and technology services, cybersecurity and business process services.

The Group provides end-to-end solutions to make large companies and organisations more competitive by combining in-depth knowledge of a wide range of business sectors and innovative technologies with a fully collaborative approach: from strategic analysis, programme definition and implementation, and IT infrastructure transformation and operation, to designing and implementing solutions and outsourcing business processes.

For Sopra Steria, helping clients succeed in their digital transformation means breaking down their strategic and business challenges into digital initiatives through an exclusive end-to-end offering. Thanks to very close relationships with its clients and its multi-disciplinary teams, the Group is able to continually innovate to guarantee that its offerings remain relevant to the strategic challenges of each of its vertical markets.

Sopra Steria’s teams are trained in new microservices platforms, DevOps and cloud computing. They are also adopting new methods of designing, delivering and embedding teams. Sopra Steria is therefore able to offer the two key ingredients for successful digital transformation: speed of execution and openness to external ecosystems.

Sopra Steria Group is also the preferred partner of Axway Software, whose exchange and digital enablement platforms play an important role in modernising information systems and opening them up to digital technology.

Sopra Steria is an independent Group whose founders and managers control 22.2% of its share capital and 33.7% of its theoretical voting rights. With 56,000 employees in nearly 30 countries, it pursues a strategy based on European key accounts.

4.1.1.Consulting and systems integration – 63% of 2023 revenue

a.Consulting – 8% of 2023 revenue

Sopra Steria Next, the Group’s consulting brand, is a leading consulting firm. Sopra Steria Next has over 40 years’ experience in business and technological consultancy for large companies and public bodies, with nearly 4,000 consultants in France and Europe. Its aim is to accelerate the development and competitiveness of its clients by supporting them in their digital transformation while addressing their sustainability challenges in keeping with our clients’ Corporate Responsibility policies. This support involves understanding clients’ business issues using substantial sector-specific expertise, and then working to design transformation roadmaps (business processes, data architecture, change management, etc.) to make the most of new digital technologies such as data and AI. It involves supporting the IT departments of our clients, grasping their new challenges and assisting them with their overall transformation projects as well as the modernisation of their legacy systems.

b.Systems integration – 55% of 2023 revenue

Systems integration is Sopra Steria’s original core business and covers all aspects of the information system lifecycle and major transformation programmes. Sopra Steria is equipped to address the full range of its clients’ software asset needs:

Design and integration

Sopra Steria’s teams help their clients implement agile and industrial-scale projects. The Group undertakes to design and deliver systems in line with business requirements that are flexible and adapted to the new requirements of digital transformation as well as sector-specific regulatory constraints. This is made possible by working closely with the Sopra Steria Next teams.

Performance and transformation

In addition to standard information systems maintenance, Sopra Steria takes a continuous transformation approach to these systems to guarantee optimised operational efficiency for its clients, suited to changes in their business. The transformation approach includes a well-equipped and documented procedure making it possible to combine the issues involved in reducing the time to market with improved competitiveness and continuity of service.

A world of data

Once the systems and technologies are implemented, the information system gives access to reliable, relevant and critical data and services, offering better analysis of user satisfaction and optimisation of business performance.

With the increasing number of diverse data sources relating to fundamental changes in use, data is more valuable to the company than ever. To increase the value of this data, Sopra Steria has developed specific know-how and expertise to manage the exponential growth in data volumes and associated skills (AI, data science, smart machines, automation, artificial intelligence) by integrating them into a global solution, securing the data regardless of its origin (mobile devices, smart objects, data privacy, the cloud, multimodal and multichannel systems, etc.) and using the data by means of contextualised algorithms, taking into account associated ethics.

The Group’s systems integration offering thus meets the challenges posed by both the obsolescence and modernisation of information systems, ensuring optimal flexibility and value creation.

Product Lifecycle Management (PLM)

CIMPA provides comprehensive expertise via its PLM offering, which covers all the various facets of PLM services:

- ■PLM strategy creation or optimisation;

- ■deployment of strategy-related tools, processes or methods;

- ■user training and support.

4.1.2.Hybrid cloud & technology services – 10% of 2023 revenue

With over 30 years’ experience and a team of over 6,500 experts around the world, Sopra Steria is a partner of choice for a controlled, secure and responsible information system transformation. A leader in the hybridisation of information systems and a major player in digital transformation, we offer solutions tailored to our clients and backed by our Service Centres in Europe and India. Our expertise, which spans Hybrid Cloud management to the transformation of infrastructures and operational models, encompasses end-to-end consulting, transformation projects and outsourcing. We are committed to simplifying operations and strengthening the performance and resilience of information systems, while also enhancing business agility and transparency.

Our area of expertise covers two business lines that are essential to support information system transformation for our clients:

- ■our Dynamic Operations Platform facilitates alignment with client business lines, bringing together flexibility and the best in technology, agile business models and organisational structures to achieve optimum resilience, performance and innovation in IT systems;

- ■our Dynamic Support Experience offers fully user-centric support focused on the user’s business context. Our personalised approach helps them develop autonomy in managing their day-to-day challenges and increase their productivity.

Sopra Steria’s expertise in legacy applications, its close working relationship with its clients and its DNA as a sovereign and responsible company are all valuable elements that enable it to address the challenges faced by organisations.

4.1.3.Cybersecurity services

With over 2,200 experts and several state-of-the-art cybersecurity centres in Europe and worldwide, Sopra Steria has an international reach as a European leader in protecting critical systems and sensitive information assets for major institutional and private clients.

We have developed a portfolio of services that enable our clients to address their strategic challenges as they face the threat of increasingly frequent and sophisticated attacks.

This range of services covers the entire cybersecurity value chain, from risk prevention and the safeguarding of sensitive information to detection and response:

- ■prevention: drawing up a cybersecurity strategy that is adapted to the risks of the business and complies with the regulations in force, and spreading a culture of security within the organisation;

- ■protection: ensuring the continuous monitoring of assets by securing multi-cloud and hybrid environments, end-to-end encryption of applications and sensitive data;

- ■detection and response: adopting an overall defence strategy that mobilises all stakeholders to work together (detection, response, cyber threat intelligence, investigation, vulnerability management, etc.) towards a shared goal – recognising attackers and countering cyberattacks.

With the acquisition of CS Group in 2023, Sopra Steria further enhanced its portfolio of sovereign solutions, including hardened operating systems, digital trust services and event correlation tools.

Lastly, we have developed specific offerings designed to address our clients’ current priority concerns: Crisis management and cyber resilience, cloud security and industrial security.

Sopra Steria’s business model based around value centres and products is designed to maximise the cyber value of the services delivered by the Group. It can be rolled out locally, through service centres (in France, nearshore in Poland and offshore in India) or in hybrid form, with a “follow-the-sun” capability to help our clients at all times.

4.1.4.Development of business solutions – 13% of 2023 revenue

Sopra Steria offers its business expertise to clients via packaged solutions in three areas: banks and other financial institutions via Sopra Banking Software, human resources via Sopra HR Software, and real estate owners and agents with its property management solutions. The Group offers its clients the most powerful solutions, in line with their objectives and representing the state of the art in terms of technology, know-how and expertise in each of these three areas.

Sopra Banking Software: Solutions developer for the financial services industry

Drawing on its technologies and the strength of its commitment, Sopra Banking Software, a wholly-owned subsidiary of the Group, supports its clients – financial institutions – all over the world on a daily basis.

Customer experience, operational excellence, cost control, compliance and risk reduction are among the key transformation priorities for:

- ■banks in Europe and Africa: from direct- and branch-based retail banks and private banks to microfinance companies, Islamic financial institutions and centralised payment or credit factories;

- ■financing and lending institutions around the world: serving individuals and companies, the automotive and capital goods sectors, as well as equipment and real estate leasing and even market financing.

With over 4,000 experts worldwide, Sopra Banking Software addresses its clients’ challenges across all geographies and in all business areas, covering issues such as communicating new offerings, the quality of customer relationships, production, accounting integration and regulatory reporting.

Solutions

Sopra Banking Software offers two services: Sopra Banking Platform, intended to respond to banks’ day-to-day needs, and Sopra Financing Platform, which specialises in managing financing:

- ■Sopra Banking Platform is a banking processing platform that relies on an architecture of independent and pre-integrated business components. It makes it possible to manage all banking operations (deposits and savings, management of the loan lifecycle, payments, reporting) and offers innovative features in a digital and mobile environment.

- ■Sopra Financing Platform is a flexible, robust financing management platform able to deal with all types of financing tools within the framework of advanced process automation.

These solutions can be used either on-site at the client’s premises, on the cloud (public or private) or in SaaS mode.

Services

An end-to-end provider, Sopra Banking Software offers solutions as well as consulting, implementation, maintenance and training services. This means that financial institutions are able to maintain their day-to-day operations while shifting towards greater innovation and agility, with the aim of securing sustainable growth. Through its market-leading solutions backed by more than 50 years of experience in its field, Sopra Banking Software is committed to working with its clients and staff to build the financial world of the future.

Sopra HR Software: a market leader in human resource management

Sopra Steria Group also develops human resource management solutions via Sopra HR Software (a wholly-owned subsidiary of Sopra Steria). Sopra HR Software is present in 10 countries, providing comprehensive HR solutions perfectly suited to the needs of human resources departments. Sopra HR Software currently has a workforce of 2,000 people and manages the payrolls of 900 clients with over 12 million employees.

Sopra HR Software is a partner for successful digital transformation of companies and anticipates new generations of HR solutions.

Solutions

The solutions offered by Sopra HR Software are based on the most innovative business practices and cover a wide range of functions, including core HR, payroll, time and activity tracking, talent management, employee experience and HR analytics. The offering is based on two product lines, HR Access® and Pléiades®, aimed at large and medium-sized public or private organisations in any sector and of varying organisational complexity, irrespective of their location. In response to new hybrid working patterns, the new generation of Sopra HR 4YOU solutions offers a fully digital HR space that helps businesses stay closely connected with their employees and optimise HR performance and the quality of HR services.

Services

Sopra HR Software, a comprehensive service provider, offers a number of services linked to its solution offering and its HR ecosystem. Sopra HR Software supports its clients throughout their projects, from consulting through to implementation, including staff training, maintenance and business process services (BPS).

Sopra HR Software implements its own solutions either on-premise or in the cloud and also offers a wide range of managed services.

Sopra Real Estate Software: Driving digital transformation in the real estate market

Sopra Real Estate Software is the leading developer, distributor, integrator, and service manager of property management software in France. Sopra Steria offers major public and private sector real estate players (institutional investors, social housing operators, property management firms, property managers and major users) comprehensive business software solutions providing a huge range of functionality.

Sopra Real Estate Software’s 650 real estate experts help our 400 clients realise their digital transformation so as to boost their return on assets, optimise practices and strengthen relationships with tenants and service providers.

Sopra Real Estate Software also offers a technical real estate asset management solution that is particularly well suited to helping our clients better understand their assets and manage their energy performance.

Solutions

From property management to building information management, we offer a range of solutions built around providing digital real estate services to tenants and partners.

Services

Sopra Real Estate Software supports its clients with an end-to-end service offering based on its solutions, from consulting to integration and managed services.

4.1.5.Business process services – 14% of 2023 revenue

Sopra Steria offers a full range of business process services (BPS) solutions: consulting for the identification of target operating models, development of transition and transformation plans, and managed services. The Group delivers innovation with purpose, combining its longstanding experience in BPS and end-to-end digital expertise – including next-generation technologies such as artificial intelligence (AI), robotics, and natural language processing (NLP).

Sopra Steria manages two of Europe’s largest shared services organisations: Shared Services Connected Limited (SSCL) and NHS Shared Business Services (NHS SBS). SSCL was formed originally as a joint venture between Sopra Steria and the UK Cabinet Office in 2013, and became a wholly owned subsidiary of Sopra Steria in Q4 2023. NHS Shared Business Services is a joint venture between Sopra Steria and the Department for Health and Social Care that provides support services to NHS trusts and UK health bodies. Together with these shared-service powerhouses, Sopra Steria provides a full range of business support services to major government departments, the police and UK government agencies.

The Group’s BPS offering goes hand in hand with digital transformation and a host of high-potential next-generation technologies. Sopra Steria is at the forefront of utilising AI technology to revolutionise how its customers’ business operations and user experiences are delivered. In 2023 we were successful at NS&I Bank in winning two major contracts to deploy AI to transform and manage all aspects of business and citizen contact to meet the demands of an increasingly demanding customer base. At the UK’s Home Office Border Force, the Group’s subsidiary SSCL won a recruitment management contract that will see it using AI to transform the candidate experience and recruitment outcomes. Whether through AI, robotics, chatbots or natural language processing, the Group streamlines the execution of processes, empowering workforces and driving new approaches for its clients every day through the application of cutting-edge digital solutions.

Sopra Steria is a trusted integrator, bringing together its own platforms with offerings from a dynamic network of global BPS partners, and, through its open innovation expertise, the niche, highly coveted capabilities of startups and SMEs to deliver best-in-class solutions to its customers.

To deliver sustainable transformation, the Group puts people before processes and tools. Sopra Steria’s change management experts work alongside clients to help engage their workforce as co-beneficiaries of transformation. The Group’s ability to approach change from a human and business perspective allows it to support our clients wherever their digital journey takes them, driving purposeful, future-proof business outcomes.

-

5.Strategy and objectives

5.1.Strong, original positioning in Europe

Sopra Steria’s ambition is to be a European leader in digital transformation. Its high value-added solutions, delivered by applying an end-to-end approach to transformation, enable its clients to make the best use of digital technology to innovate, transform their models (business as well as operating models), and optimise their performance.

The Group’s aim is to be the benchmark partner for large public authorities, financial and industrial operators and strategic companies in the main countries in which it operates.

- ■leading positions in priority verticals (Financial Services, Aerospace, Defence & Security, Public Sector);

- ■very close relationships with its clients, thanks to its roots in the regions where it operates and its ability to meet core business requirements;

- ■a strong European footprint with numerous locations in many of the region’s countries which, when combined with these close relationships, raises its profile among large public authorities and strategic companies throughout Europe as a trusted and preferred partner for all projects involving digital sovereignty;

- ■business software solutions which, when combined with the Group’s full range of services, make its offering unique.

-

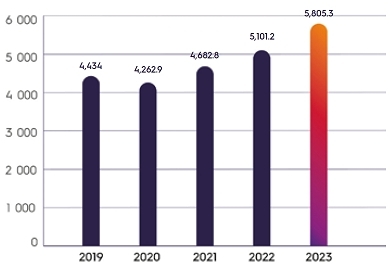

6.2023 Full-year results

6.1.Comments on 2023 performance

“Thanks to the commitment of our 56,000 employees, who work hard every day to advance their clients’ digital transformation, Sopra Steria performed very well in financial year 2023. I’d like to commend all our teams on the results they achieved.

We made significant headway with a range of transformative initiatives: developing our Consulting business, shifting our technology solutions further up the value chain, gradually adjusting our operating model, reinforcing our human resources policy and boosting our operational efficiency. We plan to keep scaling up our efforts in these areas over the coming quarters.

In the first half of 2023, we launched rAIse®: a large-scale programme to embrace generative AI, which will feed into everything our business consulting teams do, our internal development tools and our partnership strategy.

With the acquisition of CS Group, we have considerably strengthened our positions in Defence & Security and established a presence in the Space segment, which has substantial growth potential. The purchases of Tobania and Ordina have given us a key presence in the Benelux market, with over 4,000 employees and around €700 million in revenue over the full year.

Lastly, I’m very proud to share that Sopra Steria has once again made the CDP(6) A List – recognising the world’s most transparent and most proactive companies in the fight against climate change – for the 7th year in a row.

Our priorities for 2024 are clear: successfully integrate the companies we have acquired, execute the recently announced plan to dispose of our banking software activities, speed up our internal transformation initiatives and boost our performance."

Details on 2023 operating performance

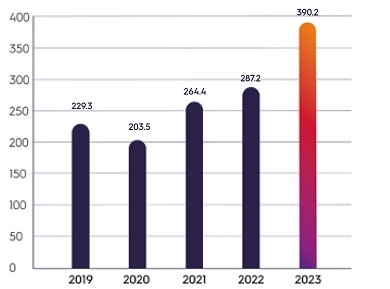

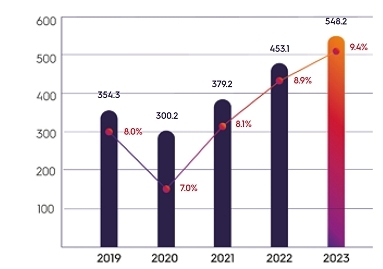

Consolidated revenue totalled €5,805.3 million, an increase of 13.8%. Changes in scope had a positive impact of €420.6 million, and currency fluctuations had a negative impact of €74 million. At constant exchange rates and scope of consolidation, revenue growth was 6.6%.

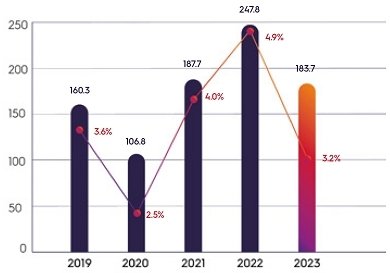

Operating profit on business activity came to €548.2 million, up 21.0% relative to 2022. The operating margin on business activity increased by 0.5 points to 9.4% (8.9% in 2022).

The France reporting unit (41% of the Group total), revenue grew sharply (16.9%) to €2,384.3 million. CS Group was consolidated in Sopra Steria’s accounts for ten months and contributed €257.4 million in revenue, posting 10.2% growth. Excluding changes in scope, organic growth came to 5.0%. Growth continued – albeit at a slower pace – in the fourth quarter, with organic growth running at 2.3%. The year’s best‑performing vertical markets overall were defence, aerospace and transport. The operating margin on business activity came to 9.6% (10.0% in 2022). As expected, the consolidation of CS Group had a dilutive effect on the operating margin on business activity for the financial year. The benefits of operational synergies are expected to show up from 2024.

Revenue for the United Kingdom (16% of the Group total) was €940.9 million, representing organic growth of 7.7%, driven by the aerospace, defence and security sector, which posted growth of 23.1%, as well as by NHS SBS and SSCL, the two business process services platforms for the public sector, which posted growth of 9.7% and 15.3%, respectively. The private sector posted full-year growth of 2.4%. The reporting unit’s operating margin on business activity improved by 0.5 points to 11.0%.

The Other Europe reporting unit (30% of the Group total) posted organic revenue growth of 18.6% to €1,746.9 million. At constant scope and exchange rates, revenue grew 8.8%. The fastest growth was seen in Scandinavia and Spain, which both posted double-digit growth. Following the consolidation of Ordina in the final quarter of 2023, Benelux contributed €309.7 million to full-year revenue, representing organic growth of 5.3%. The reporting unit’s overall operating margin on business activity was 8.7%, up 2.5 points from 2022 (6.2%).

Revenue for Sopra Banking Software (8% of the Group total) came to €445.1 million, representing organic growth of 4.8%, driven in particular by the digital solutions offered by Sopra Banking Platform and Sopra Financing Platform. This resulted in a 9.8% increase in subscription revenue. Software revenue was up 4.2% while services revenue grew 5.8%. The operating margin on business activity came to 5.4%, as anticipated, equating to a moderate decline from 6.5% in 2022.

The Other Solutions reporting unit (5% of the Group total) posted revenue of €288.2 million, representing organic growth of 5.9%. The Human Resources Solutions business grew by 6.7%. Property Management Solutions posted a 4.1% increase in revenue. The operating margin on business activity grew 0.7 points to 13.7% (13.0% in 2022).

-

7.Subsequent events

- ■At 6:15 pm on 21 February 2024 – Sopra Steria announced the plan to sell to Axway Software most of Sopra Banking Software’s activities, which generate around €340 million in revenue, for an enterprise value of €330 million. Concurrently, the plan is to sell to Sopra GMT 3.619 million Axway shares previously held by Sopra Steria. The price tag for the sale will be €95.9 million or €26.5 per share.

Sopra Steria’s business model is focused on independence and sustainable value creation for its stakeholders. As such, the Group is clarifying its strategy with the announcement of the plan to dispose of its banking software activities. - The objective is to complete these transactions by the end of the second quarter of 2024 or during the third at the latest. These transactions will be subject to the requisite regulatory approvals, including a decision by the AMF not requiring a public offer to be filed, and the AMF’s approval of the prospectus to be filed by Axway in connection with its rights issue.

- ■At 6:15 pm on 21 February 2024 – Sopra Steria announced the plan to sell to Axway Software most of Sopra Banking Software’s activities, which generate around €340 million in revenue, for an enterprise value of €330 million. Concurrently, the plan is to sell to Sopra GMT 3.619 million Axway shares previously held by Sopra Steria. The price tag for the sale will be €95.9 million or €26.5 per share.

-

9.Group organisation

Sopra Steria Group’s governance consists of a Board of Directors, Chairman and Chief Executive Officer.

The organisation is supported by a permanent operational and functional structure as well as temporary structures for the management of particular deals and projects.

Sopra GMT, the holding company that takes an active role in managing the Group, takes part in conducting Group operations through:

- ■its presence on the Board of Directors and the three Board committees;

- ■a tripartite assistance agreement entered into with Sopra Steria and Axway, concerning services relating to strategic decision-making, coordination of general policy between Sopra Steria and Axway, and the development of synergies between these two companies, as well as consulting and assistance services, particularly with respect to finance and control.

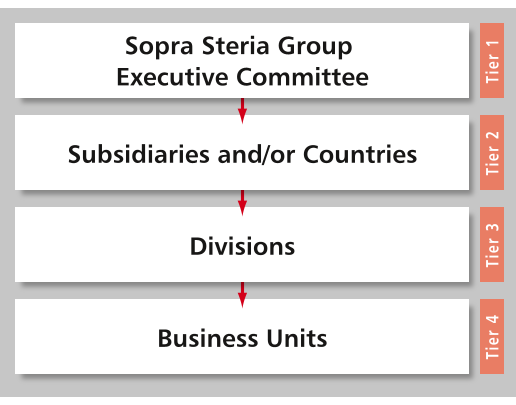

9.1.Permanent structure

The Group’s permanent structure is composed of four operational tiers and their associated functional structures.

9.1.1.Level 1: Executive management and the Executive Committee

The Executive Committee (ExCom) is led by the Chief Executive Officer and consists of the heads of the main operating and functional entities.

The 18 members of Sopra Steria Group’s Executive Committee supervise the Group’s organisation, management system, major contracts and support functions and entities. The Executive Committee is involved in the Group’s strategic planning and implementation. Three of its members are women.

Members of the Sopra Steria Executive Committee:

- ■Cyril Malargé, Chief Executive Officer

- ■Laurent Giovachini, Deputy Chief Executive Officer, Defence & Security

- ■Éric Pasquier, Strategy, Software and Solutions

- ■Fabrice Asvazadourian, Sopra Steria Next

- ■Yvane Bernard-Hulin, Legal

- ■Éric Bierry, Sopra Banking Software

- ■Pierre-Yves Commanay, Continental Europe

- ■Dominique Lapère, Industrial Approach

- ■Axelle Lemaire, Corporate Responsibility

- ■Béatrice Mandine, Communications

- ■Jo Maes, Benelux

- ■Louis-Maxime Nègre, Human Resources

- ■John Neilson, United Kingdom

- ■Xavier Pecquet, Key Accounts and Partnerships, Aeroline

- ■Kjell Rusti, Scandinavia

- ■Mohammed Sijelmassi, Technology

- ■Étienne du Vignaux, Finance

- ■Grégory Wintrebert, France

The Group Management Committee consists of the members of the Group Executive Committee, together with 44 operational directors and functional directors. Nine of the Group Management Committee’s members are women.

9.1.2.Level 2: Subsidiaries or countries

- ■a specific line of business (consulting and systems integration, development of business solutions, infrastructure management and cloud services, cybersecurity services and business process services);

- ■geographic area (country).

These entities are managed by their own Management Committee, comprising in particular the Director and management of Tier 3 entities.

9.1.3.Level 3: Divisions

9.1.4.Level 4: Business units

Each division is made up of business units, which are the organisation’s primary building blocks. They operate as profit centres and enjoy genuine autonomy. They have responsibility for their human resources, budget and profit and loss account. Management meetings focusing on sales and marketing strategy and human resources are held weekly, and the operating accounts and budget are reviewed on a monthly basis.

9.1.5.Operational support functions

The operational organisation is strengthened by operational support entities responsible for managing major transformations:

- ■the Key Accounts and Partnerships Department (DGCP), responsible for promoting the Key Accounts policy and developing relations with partners. The role of this department is to coordinate the commercial and production approaches for our major clients, particularly when different entities are involved;

- ■the Digital Transformation Office (DTO), responsible for designing and managing the Group’s digital transformation. It also manages the Group’s innovation approach;

- ■the Industrial Department, responsible for industrialising working methods and organising subcontracting on X-shore platforms. It also checks that projects are properly executed.

9.1.6.Functional structures

The Group’s functional divisions are the Human Resources Department, the Communications and Marketing Department, the Corporate Responsibility and Sustainable Development Department, the Internal Control Department, the Finance Department, the Legal Department, the Real Estate Department, the Purchasing Department, and the Information Systems Department.

These centralised functions ensure Group-wide consistency. Functional managers transmit and ensure commitment to the Group’s core values, serve the operational entities and report directly to Executive Management.

The Group’s functional structures standardise management rules (information system resources, IT systems, financial reporting, etc.) and monitor the application of strategies and rules. In this manner, they contribute to overall supervision and enable the operational entities to focus on business operations.

9.1.7.Solid, efficient industrial organisation

Sopra Steria manages complex and large-scale programmes and projects in a market where delivery commitments are increasing and becoming globalised. The Group has an increasingly wide range of skills to support multi-site projects that generate strong gains in productivity with delivery models that guarantee clients an optimal cost structure.

- ■production culture: passing on know-how and expertise in the field;

- ■choice of personnel: human resources are central to the approach, providing training, support and improved skills for each employee;

- ■organisation: the Industrial Department and its representatives in the business units control production quality and performance, identify and manage risks, support project managers and roll out industrialised production processes;

- ■state-of-the-art industrial-scale foundation: the Delivery Rule Book (DRB), the Digital Enablement Platform (DEP) and the Quality System across the Group’s various entities;

- ■global delivery model: rationalising production by pooling resources and expertise within service centres, with services located based on the needs of each client (local services and skill centres in various entities, shared service centres nearshore in Spain and Poland, and offshore shared service centres in India).

-

2.Risk factors

and internal control1.Risk factors

1.1.Risk identification and assessment

Within the Group, risk management plays an integral part in business management processes at all levels, from project units to the corporate level. Risks are first managed at a local level, in areas where they are likely to occur, before being considered on a global basis, in cases where they are managed at Group level, depending on the Group’s ability to take corrective action or to accept them. In any event, the level of risk must remain consistent with the Group’s plans, support its position and help it to achieve its medium-term growth objectives. Taking risks that potentially extend beyond the control of the entity concerned requires approval from a higher level. For example, in the case of business opportunities, local management must seek the Group’s opinion and support if the amounts involved, the lack of sufficient resources, the scale of the investment, the maturity and organisational framework of the client and/or changes to the business model are likely to have repercussions on the Group’s performance and/or reputation. The engineering methodologies used by the Group’s business lines are predicated on the risk-based approach, helping disseminate this culture of risk management.

Risks are therefore identified and the implementation of associated mitigation plans assessed and monitored on an ongoing basis by the various operational and functional units via the risk management system. This system, a pillar of the Group’s risk management system, is based on regular weekly, monthly and annual cycles that are followed at every level of the organisation, corresponding to monthly, annual and multi-year planning horizons (see description in Section 3.3.2 of this chapter, page 48). These cycles help the Group maintain an overall view that takes into account opportunities and risks at every level (strategy, market, operations, social, compliance, etc.). They are synchronised so as to facilitate higher-level consolidation.

Every year, when the annual cycles take place, information gathered at Group level is used to update the general mapping of risks. This exercise, coordinated by the Internal Control Department, consists of identifying the risks that could limit Sopra Steria’s ability to achieve its objectives and complete its corporate plan, as well as assessing their likelihood of occurrence and their impact.

Risks are assessed on a scale of four levels: low, medium, high, very high, in terms of likelihood; and minor, moderate, major, severe for impact. In terms of impact, several aspects are taken into account: the financial impact on operating profit, the level of operational disruption and the extent of reputational repercussions. As of this financial year, the time frame used is three years, instead of five years as was previously the case.

This analysis is based on contributors’ expertise, analysis of historical and forecast data and monitoring of changes in the external environment. The Group’s main operational and functional managers are involved through individual interviews and group validation workshops. The results are discussed in detail by the Group Executive Committee and then presented by the Internal Control Department to the Audit Committee of the Board of Directors.

The risk mapping covers all internal and external risks and includes both financial and non-financial issues. Non-financial risks are handled in the same way as other risks. Specific mapping for corruption and influence-peddling risks and risks relating to duty of vigilance are used in this general risk mapping.

The most significant risks specific to Sopra Steria are set out below by category and in decreasing order of criticality (based on the crossover between likelihood of occurrence and the estimated extent of their impact), taking account of mitigation measures implemented. As such, this presentation of residual risks is not intended to show all Sopra Steria’s risks. The assessment of this order of materiality may be changed at any time, in particular due to the appearance of new external factors, changes in operations or a change in the effects of risk management measures.

-

2.Insurance

The Group’s insurance policy is closely linked to its risk prevention and management practices, in order to ensure coverage for its major risks. The Group’s Legal Department is responsible for the centralised management of its insurance programme.

The aim of Sopra Steria Group’s international insurance programmes is to provide, in compliance with local regulations, uniform and adapted coverage of the risks facing the company and its employees for all Group entities at reasonable and optimised terms. With this in mind, the Company set up its own captive reinsurance company in late 2021.

The scope and coverage limits of these various insurance programmes are reassessed annually in light of changes in the size of Sopra Steria Group, developments in its business activities as well as changes in the insurance market and based on the results of the most recent risk mapping exercise. The insurance programmes provide sufficient coverage for risks with high financial stakes.

All Group companies are insured with leading insurance companies for all major risks that could have a material impact on its operations, business results or financial position. Companies acquired during 2023 have been included in these programmes.

- ■premises and operations liability and professional indemnity insurance:

- ●this programme covers all of the Group’s companies for monetary consequences arising as a result of their civil and professional liability in connection with their activities, due to bodily injury, material or non-material damage caused to its clients and third parties;

- ■property damage and business interruption insurance:

- ●this programme covers all of the Group’s sites for the direct material damage to property they may suffer as well as any consequential losses in the event of reduced business activity or business interruption occasioned by the occurrence of an insured event.

- ■premises and operations liability and professional indemnity insurance:

-

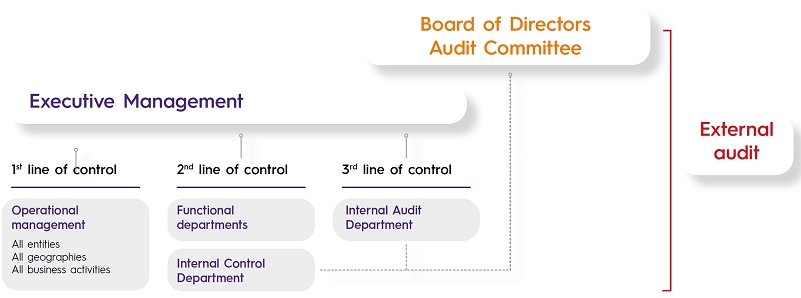

3.Internal control and risk management

This section of the report outlines Sopra Steria’s internal control and risk management systems. These systems are based on the reference framework issued by the AMF. A specific subsection addresses the preparation of accounting and financial information.

The management control system is one of the fundamental components of internal control at Sopra Steria Group. It supports risk management and the internal dissemination of information as well as the various reporting procedures and the implementation of controls.

3.1.Objectives and framework for the internal control and risk management system

3.1.1.Objectives of the internal control and risk management system

In order to address the identified risks presented in the preceding chapter, Sopra Steria has adopted a governance approach as well as a set of rules, policies, procedures and checks together constituting its internal control and risk management system.

In accordance with the AMF reference framework, the internal control and risk management system, which is under the responsibility of the Group’s Chief Executive Officer, is designed to provide reasonable assurance regarding the achievement of objectives in the following categories:

- ■compliance with laws and regulations;

- ■implementation of instructions, guidelines and rules set forth by Executive Management;

- ■proper functioning of the Company’s internal processes, particularly those intended to safeguard its assets;

- ■quality and reliability of financial and accounting information.

More generally, the Group’s internal control and risk management system contributes to the control of its business activities, the effectiveness of its operations and the efficient use of its resources.

This system is updated on a regular basis, in application of a continuous improvement process, in order to best measure the level of risk to which the Group is exposed as well as the effectiveness of the action plans put in place to mitigate risks.

Nevertheless, the internal control and risk management system cannot provide an absolute guarantee that the Company’s objectives will be achieved and that all risks will be eliminated.

3.1.2.Reference framework and regulatory context

-

4.Procedures relating to the preparation and processing of accounting and financial information

4.1.Coordination of the accounting and finance function

4.1.1.Organisation of the accounting and finance function

Limited number of accounting entities

By keeping the number of legal entities, and therefore accounting entities, relatively low, the Group can drive reductions in operating costs and minimise risks.

Centralised coordination of the accounting and finance function

The activities of Sopra Steria’s accounting and finance function are overseen by the Group’s Finance Department, which reports directly to Executive Management.

The responsibilities of the Group Finance Department mainly include the production of the accounts, financial controlling, tax issues, financing and cash management, and participation in financial communications.

Each subsidiary has its own finance team that reports functionally to the Group’s Finance Department.

Supervision of the accounting and finance function by Executive Management and the Board of Directors

The Finance Department reports to the Group’s Executive Management. As with all other Group entities, it follows the management reporting and controlling cycle described above: weekly meetings to address current business activities, monthly and quarterly meetings devoted to a detailed examination of figures (actual and forecast), the organisation of the function and the monitoring of large-scale projects.

Executive Management is involved in the planning and supervision process as well as in preparing the period close.

The Board of Directors is responsible for the oversight of accounting and financial information. It reviews and approves for publication the interim and annual financial statements. It is supported by the Audit Committee, as described in Section 1.3.3, “Committees of the Board of Directors” of Chapter 3, “Corporate governance” of this Universal Registration Document (pages 84 to 87).

4.1.2.Organisation of the accounting information system

Accounting

The configuration and maintenance of the accounting and financial information system are centralised at Group level. Central teams manage access permissions, and update them at least once a year. The granting of these permissions is validated by Finance teams at the subsidiaries.

All Group companies prepare, at a minimum, complete quarterly financial statements on which the Group bases its published quarterly revenue figures and interim financial statements.

Monthly cash flow forecasts for the entire year are regularly prepared for all companies and consolidated at Group level.

Accounting policies and presentation

-

3.Corporate governance

This chapter describes the organisation and operation of governance as well as the compensation policy for company officers and its application during financial year 2023. It lists and explains any points of divergence from or partial compliance with the recommendations of the AFEP-MEDEF Code. (1)

1.Organisation and operation of governance

1.1.Executive company officers

1.1.1.Separation of the roles of Chairman of the Board of Directors and Chief Executive Officer

On 19 June 2012, the Board of Directors decided to separate the roles of Chairman and Chief Executive Officer. It confirmed this decision in 2018 and 2021. It believes that this separation of roles remains the best way of addressing the Group’s strategic and operational priorities. Given the close relationship between the Chairman of the Board of Directors and the Chief Executive Officer, there is close collaboration and an ongoing dialogue between them. In summary, the current framework contributes to fluid and flexible governance arrangements. It means that the Group is able to act as quickly as needed and ensures decisions are taken with due care, while taking into account strategic priorities.

1.1.2.Role of the executive company officers

The Chairman is tasked with managing strategy, while the Chief Executive Officer is responsible for operations.

- ■guides the implementation of the Group’s strategy and all related matters, including mergers and acquisitions;

- ■assists Executive Management with the transformation of the Group;

- ■oversees investor relations and manages the Board’s relations with shareholders.

- ■works with the Chairman to formulate strategy;

- ■supervises the implementation of decisions adopted;

- ■ensures the operational management of all Group entities.

1.1.3.Succession plan for executive company officers

The Nomination, Governance, Ethics and Corporate Responsibility Committee conducts an annual review of the succession plan for the Chairman of the Board of Directors and the Chief Executive Officer so any unforeseen vacancies can be dealt with appropriately. As part of this process, it meets with the Chairman of the Board of Directors. It makes sure the plan covers existing requirements and the Group’s culture. It assesses the relevance of the proposed changes. It approves the actions laid down in the short- to medium-term plan.

1.1.4.Overview of the activities of the Chairman of the Board of Directors in 2023

The Chairman of the Board of Directors carried out activities on a full-time basis throughout the year. This involved steering the work of the Board and other assignments entrusted to him.

The Chairman’s assignments include the governance of strategy, acquisitions and the Board of Director’s shareholder relations. He is involved in several key areas that will shape the Group’s future and transformation (HR, digital and industrial transformation; key organisational and operating principles; employee share ownership; promotion of Group values and compliance). These matters were approved by the Chief Executive Officer at the beginning of the year.

The Chairman is responsible for maintaining balance between the Group’s various stakeholders: shareholders, employees and the community. He ensures that the social and environmental implications of the Group’s business activities are suitably taken into account.

In crisis situations, the ability to rank priorities, uphold the Group’s values, and consider its options from a longer-term perspective thanks to the commitment provided by the core shareholder is absolutely critical.

The various matters placed under the Chairman’s responsibility require a perfect knowledge of operational realities. Close relations with the Chief Executive Officer and the Executive Committee foster information flows between them. It facilitates effective coordination on:

- ■decisions required for the delivery of the medium-term strategic plan;

- ■monitoring of the implementation of such decisions over the long term.

- ■the roles defined in the internal rules and regulations of the Board of Directors;

- ■compliance with the respective prerogative powers of the Chairman and the Chief Executive Officer;

- ■a trust-based relationship established over the long term;

- ■a very good fit between the holders of the two positions.

1.1.5.Agreement with Sopra GMT, the holding company that manages and controls Sopra Steria Group

In carrying out all of his assignments, the Chairman seeks out advice from former executives and may draw on certain resources across the Group. He is supported by a permanent team at Sopra GMT, the holding company that manages and controls the Group.

a.The Sopra GMT team

Of the four Sopra GMT employees, three of them have spent much of their careers with Sopra Steria Group. This team therefore has knowledge of the Group, its main managers and its organisational structure that an external service provider could not have. Its position within Sopra GMT means this team has an outside perspective and greater independence. These resources enhance the Board of Directors’ ability to oversee the smooth running of the Company.

The team was initially formed when Axway Software was spun off. It performs duties for Sopra Steria Group and Axway Software, in which Sopra Steria Group holds an ownership of approximately 32%. Sopra GMT provides both companies with its support and ensures synergies and best practices are implemented.

The members of this team carry out duties not undertaken by Sopra Steria Group: oversight of acquisitions, corporate secretarial affairs for the Board of Directors and its Committees. They may also assist the Sopra Steria Group’s functional divisions. They are also active participants in various steering committees (acquisitions, corporate responsibility, internal control, internal audit, employee share ownership). They may join working groups tackling key issues for the Company. They provide the benefit of their technical expertise and an independent opinion.

b.Invoicing principles

The costs rebilled by Sopra GMT comprise the portion of payroll and related personnel costs allocated to the assignments performed for Sopra Steria Group. They also comprise, under the same conditions, any external expenses incurred by Sopra GMT (such as specialised advisors’ fees). As such, this organisational method does not increase the expenses borne by Sopra Steria Group. If the assignments handled by Sopra GMT’s employees were not entrusted to them, they would need to be reallocated within Sopra Steria Group.

Pierre Pasquier’s compensation at Sopra GMT reflects his oversight of the assignments performed by the Sopra GMT team for Sopra Steria Group and Axway Software. It is not rebilled to these two companies.

Sopra Steria Group charges Sopra GMT fees for providing premises, IT resources, and assistance from the Group’s functional divisions as well as provision of appropriate expertise for Sopra GMT’s assignments.

The work performed by this team and the principle for the rebilling to the Company of the costs incurred are covered in a framework agreement for assistance. The General Meeting approved the implementation of this related-party agreement. The Board of Directors reviews it annually.

Around 85% of Sopra GMT’s total operating expenses are rebilled. The remaining 15% comprises the expenses arising from Sopra GMT’s own internal operations. Expenses are rebilled on a cost-plus basis including a 7% margin. By definition, Sopra GMT generally records a small operating loss. The annual breakdown varies according to the respective needs of Sopra Steria Group and Axway Software. On average, since 2011, two thirds of the rebilling have concerned Sopra Steria Group.

c.Implementation of the agreement in 2023

The Board of Directors reviewed the implementation of this agreement at its meeting on 25 January 2023. It unanimously agreed to maintain the previously granted authorisation for the current financial year. The members of the Board of Directors associated with Sopra GMT (Pierre Pasquier, Eric Pasquier, Kathleen Clark) did not take part in the discussion or vote on this decision and all other directors were present.

1.1.6.Executive management

Cyril Malargé has been with the Company for almost 20 years. He first served as Managing Director of the France reporting unit. For the 18 months prior to his appointment as Chief Executive Officer, Cyril Malargé also served as the Group’s Chief Operating Officer. He has been a member of the Executive Committee since 2015.

The Chief Executive Officer has authority over the entire Group. He directs, administers and coordinates all of its activities. To this end, he is supported by Executive Management, the Executive Committee and the Management Committee. These Committees comprise the Chief Executive Officer, Deputy Chief Executive Officer and other key operational and functional managers from Sopra Steria Group and its subsidiaries.

The Chief Executive Officer has the broadest possible powers to act in all circumstances in the name of Sopra Steria Group SA, the parent company of Sopra Steria Group. He/she represents the Company in its dealings with third parties.

Certain decisions relating to strategy implementation and internal organisation require prior approval by the Board of Directors or its Chairman. Decisions “that are highly strategic in nature or that are likely to have a significant impact on the financial position or commitments of the Company or any of its subsidiaries” are defined in the internal rules and regulations of the Board of Directors (see Chapter 8, “Additional information” of this Universal Registration Document, pages 330 to 336).

1.1.7.Agreement with Éric Hayat Conseil

This agreement relates to the provision to Executive Management of consulting and assistance services. These services are provided in connection with strategic deals connected with business development among other areas. They are charged at a per diem rate of €2,500 (excluding taxes). The duties performed under this agreement are distinct from those performed by virtue of Éric Hayat’s directorship. For example, this may involve but is not limited to the following, in consultation with the Group’s operational managers:

- ■taking part in top-level market meetings;

- ■maintaining contacts with civil society;

- ■taking part in high-level meetings with certain key clients in France and abroad;

- ■preparing for and participating in delegations of corporate executives to priority countries for the Group.

This enables the Company to benefit from the experience and knowledge of the Group gained by Éric Hayat throughout his career. This knowledge extends to its environment and some of its major clients. Éric Hayat was a co-founder of Steria. He also previously chaired the digital sector employers’ organisation and subsequently the broader “Fédération Syntec”, and is a former member of MEDEF’s Executive Committee. His skills and experience are thus particularly well suited to the responsibilities entrusted to him, which mainly relate to major business opportunities.

This means that the number of Directors on the Board that are directly involved in addressing the Group’s priorities in terms of strategic and commercial positioning is increased, thus enriching the Board’s debates. Éric Hayat, in his capacity as a member of the Compensation Committee and the Nomination, Governance, Ethics and Corporate Responsibility Committee, provides these committees with the benefit of the knowledge of the Group’s operational managers accumulated and maintained in the course of these assignments. Lastly, he has access to information channels within the Company that are helpful for feeding information back to the Board of Directors and its Committees.