BDC 2025

-

Chairman’s message

“ In the face of global operators, the Group has positioned itself as a trusted, credible European alternative”

Recent events have confirmed and amplified the profound upheavals that have been taking place for a number of years now: new political realities on the national and international stage, regional conflicts, technological acceleration, the energy transition… The result, in early 2025, is a particularly uncertain environment.

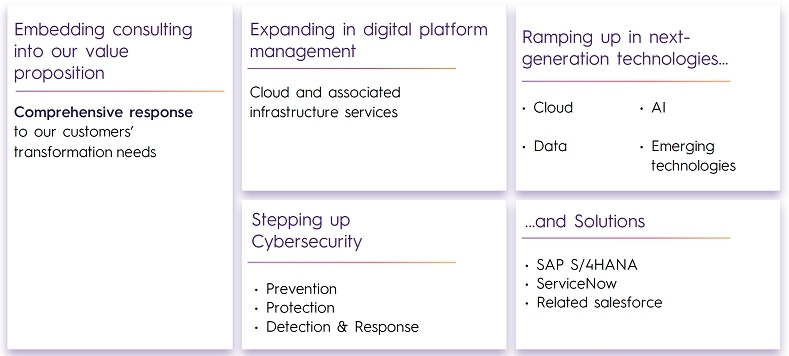

Against this backdrop, Sopra Steria is holding its course and rolling out its strategy. The Group has established itself as a European leader in consulting and digital services. In the face of global operators, it has positioned itself as a trusted, credible European alternative to help transform large organisations through technology and artificial intelligence.

In line with this strategy, in 2024 we decided to dispose of our banking software activities to refocus on consulting and digital services, and to unlock flexibility to invest in our transformation.

This transformation encompasses in particular our offers, our operating model, and our managerial and human resources. In the medium term, our goal is to streamline our business model, reinforce our consulting capacity, and generate more than 60% of the Group’s revenue through digital and cognitive technologies.

We are convinced that, in a rapidly changing environment and an increasingly digital economy, technology is a powerful driver of resilience, performance and organisational transformation.

Artificial intelligence, which is rapidly ramping up, is an additional transformation vector. For Sopra Steria, AI has created a vast range of opportunities that we will seize, while taking an ethical, sovereign approach.

For the past several quarters, our market environment has appeared less buoyant. Despite the wait-and-see attitude that has prevailed in a number of sectors, Sopra Steria showed resilience in 2024. Revenue held relatively steady (down slightly [0.5%]), operating performance was solid (with an operating margin of around 10%, up 0.4 percentage points from 2023), and debt levels were brought down nearly 60% (to around 19% of equity).

Backed by this healthy, robust position, we are determined to step up the pace of the Group’s transformation in 2025 to pursue our ambitious corporate plan.

-

1. Agenda and fomalities governing participation in the General Meeting

1. Agenda

The shareholders of Sopra Steria Group are invited to attend the Combined General Meeting to be held on Wednesday, 21 May 2025, at 2:30 p.m., at Pavillon Dauphine, Place du Maréchal de Lattre de Tassigny, 75116 Paris (France), to vote on the following agenda.

1.1. Item on the agenda without a resolution subject to a vote by the shareholders

-

2. Procedures governing participation in the General Meeting

2.1. Participation in the General Meeting

Sopra Steria Group’s share capital is made up of 20,547,701 shares. Double voting rights are allocated to all fully paid-up shares that are proved to have been registered in the name of the same shareholder for at least two years.

Every shareholder has the right to participate in the General Meeting, regardless of the number of shares held.

In accordance with Article R. 22-10-28 of the French Commercial Code, the only shareholders allowed to take part in the General Meeting or to be represented by proxy are those able to prove their status by showing that their shares are held in accounts in their name, or in the name of their authorised financial intermediary, no later than the second business day preceding the General Meeting, i.e. by Monday, 19 May 2025 at 0.00 a.m. (Paris time):

- for holders of directly registered (nominatif pur) or intermediary-registered (nominatif administré) shares: in registered share accounts;

- for holders of bearer shares: in bearer share accounts kept by the authorised intermediary responsible for managing the account, the Securities Account Holder.

Any shareholder who has already submitted their remote voting and proxy form (the Combined Form) may sell all or a portion of their shares up to the date of the General Meeting.

However, only sales completed before the second business day preceding the General Meeting, i.e. before Monday, 19 May 2025 at 0.00 a.m. (Paris time), will be taken into consideration. Only in such cases, the Securities Account Holder is required to send notification of the sale and provide the information necessary to cancel the vote or to change the number of shares and votes corresponding to the vote.

No share transfers completed after the second business day preceding the General Meeting, i.e. after Monday, 19 May 2025 at 0.00 a.m. (Paris time), irrespective of the means employed, are to be taken into consideration, notwithstanding any agreement to the contrary.

Société Générale Securities Services is the centralising agent for the General Meeting. Requests submitted by post to the centralising agent must be addressed to Société Générale Securities Services – Service des Assemblées, CS 30812, 44308 Nantes CEDEX 3 (France).

Shareholders who are able to do so are encouraged to give priority to the use of the secure Votaccess platform. This platform allows them to quickly and securely select their means of participation in the General Meeting.

The secure Votaccess platform will be open from Friday, 2 May 2025 at 9.00 a.m to Tuesday, 20 May 2025 at 3.00 p.m. (Paris time).

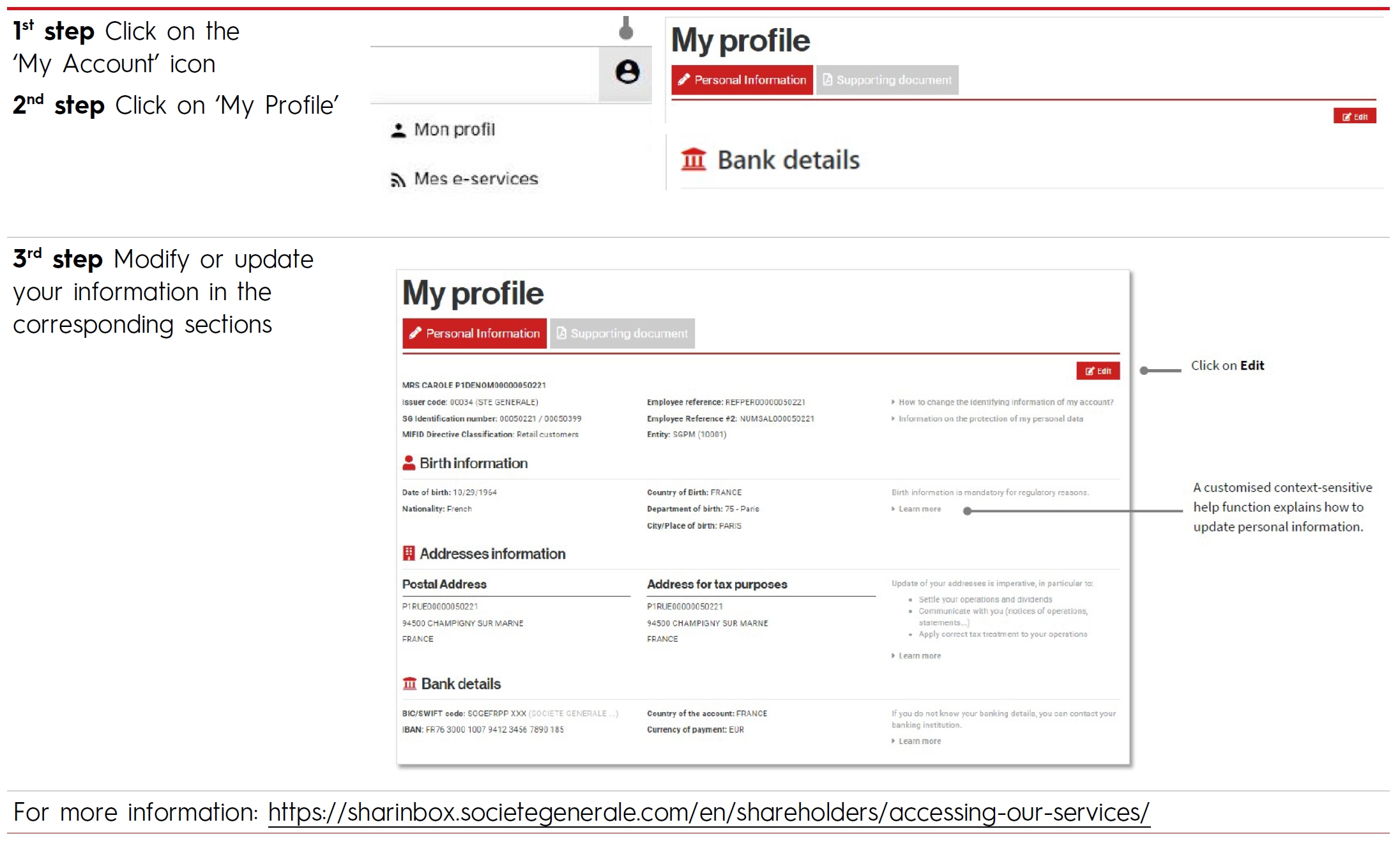

Holders of directly registered or intermediary-registered shares will need to sign in to the https://sharinbox.societegenerale.com website, then click on the “Replay” button in the “General Meeting” box on the homepage, and finally click on “Participe” to access the secure Votaccess platform.

- Holders of directly registered shares will need to use their usual access code to activate their Sharinbox By SG Markets account. On the Sharinbox welcome page, shareholders will find all information necessary to guide them through the process. If the shareholder has already activated their account using their email address as their username, their access code is not required, and they can use this email address to log in. Shareholders will have received their password by post when opening their registered account with Société Générale, or by post over the past few days. If this has not yet been done, shareholders activate their account so as to benefit from the latest version of authentication.

If a shareholder losses or forgets their password, they follow the procedure online on the authentication page.

- Holders of intermediary-registered shares will need to log in using the access code and password provided for this purpose by Société Générale Securities Services.

- Holders of bearer shares will need to log in to their Securities Account Holder’s website, using their usual access code and password, then access the secure Votaccess platform by following the on-screen instructions. Holders of bearer shares are recommended to contact their Securities Account Holder to find out whether access to this service is subject to any specific terms and conditions of use.

Shareholders are encouraged to log in to the secure Votaccess platform as soon as it opens, and in any event before the day before the General Meeting.

- attending the General Meeting in person;

- voting remotely prior to the General Meeting;

- appointing as their proxy:

- the Chairman (or if a shareholder does not name a proxy holder in a proxy form submitted to the Company), it being specified that in such a case, the Chairman of the General Meeting shall vote in favour of proposed resolutions submitted for approval by the Board of Directors, and against any other proposed resolutions,

- another shareholder, their spouse, the partner with whom they have entered into a pacte civil de solidarité (PACS, the French civil union contract), or any other individual or legal entity of their choosing under the conditions set out in Articles L. 225-106 and L. 22-10-39 of the French Commercial Code.

Pursuant to Article R. 22-10-28 III of the French Commercial Code, all shareholders who, having requested their admission card, have voted remotely or appointed a proxy, may no longer opt for any other means of participation.

Shareholders who wish to attend the General Meeting in person must bring proof of their identity and their admission card.

Shareholders may request an admission card online on the secure Votaccess platform by following the on-screen instructions after having logged in as described above in Section B. “Means of participation in the General Meeting”/ “Centralisation of the General Meeting – Use of the secure Votaccess platform”.

- Holders of directly registered or intermediary-registered shares must ensure their request for an admission card is received before 19 May 2025 at 12.00 noon (Paris time) by Société Générale Securities Services, using the Combined Form and the prepaid envelope attached to the notice of meeting.

- Holders of bearer shares must ask their Securities Account Holder to send them an admission card. Société Générale Securities Services must receive all requests by the Securities Account Holder no later than 19 May 2025 at 12.00 noon (Paris time). If, despite having submitted a request, holders of bearer shares have not received their admission card by 19 May 2025, they must ask their Securities Account Holder to provide them with a certificate of investment, which will allow them to prove their status as a shareholder to be admitted to the General Meeting.

Shareholders who arrive on the date of the General Meeting without an admission card or a certificate of investment are responsible for contacting their Securities Account Holder and requesting to be sent the certificate of investment required to attend the General Meeting.

On the day of the General Meeting, the certificate of investment shall be accepted either in print or electronic format, provided that, for the latter format, the shareholder is able to send it to the email address that will be provided upon arrival at the venue.

Shareholders may submit their voting instructions online on the secure Votaccess platform by following the on-screen instructions after having logged in as described above in Section B. “Means of participation in the General Meeting”/ “Centralisation of the General Meeting – Use of the secure Votaccess platform”.

- Registered shareholders must fill out and sign the Combined Form attached to the notice of meeting and send it back using the prepaid envelope to Société Générale Securities Services.

- Holders of bearer shares must: 1) ask their Securities Account Holder to send them the Combined Form; 2) send the completed signed Combined Form together with their voting instructions to their Securities Account Holder. The Securities Account Holder is responsible for sending the Combined Form, together with a certificate of investment, directly to Société Générale Securities Services – Service des Assemblées, CS 30812, 44308 Nantes CEDEX 3 (France).

In order to be taken into account, Combined Forms must be received by Société Générale Securities Services no later than Monday, 19 May 2025 at 12.00 noon (Paris time).

Shareholders may appoint a proxy or rescind a proxy appointment online on the secure Votaccess platform by following the on-screen instructions after having logged in as described above in Section B. “Means of participation in the General Meeting”/“Centralisation of the General Meeting – Use of the secure Votaccess platform”.

If and only if their Account Holder has not joined the Votaccess system, holders of bearer shares can send an email to the following address: assembleegenerale@soprasteria.com. The message must specify the full name and address of the principal shareholder, as well as those of the proxy appointed or whose appointment is rescinded. Holders of bearer shares must ask their Securities Account Holder to send Société Générale Securities Services a certificate of investment to prove their status as a shareholder.

-

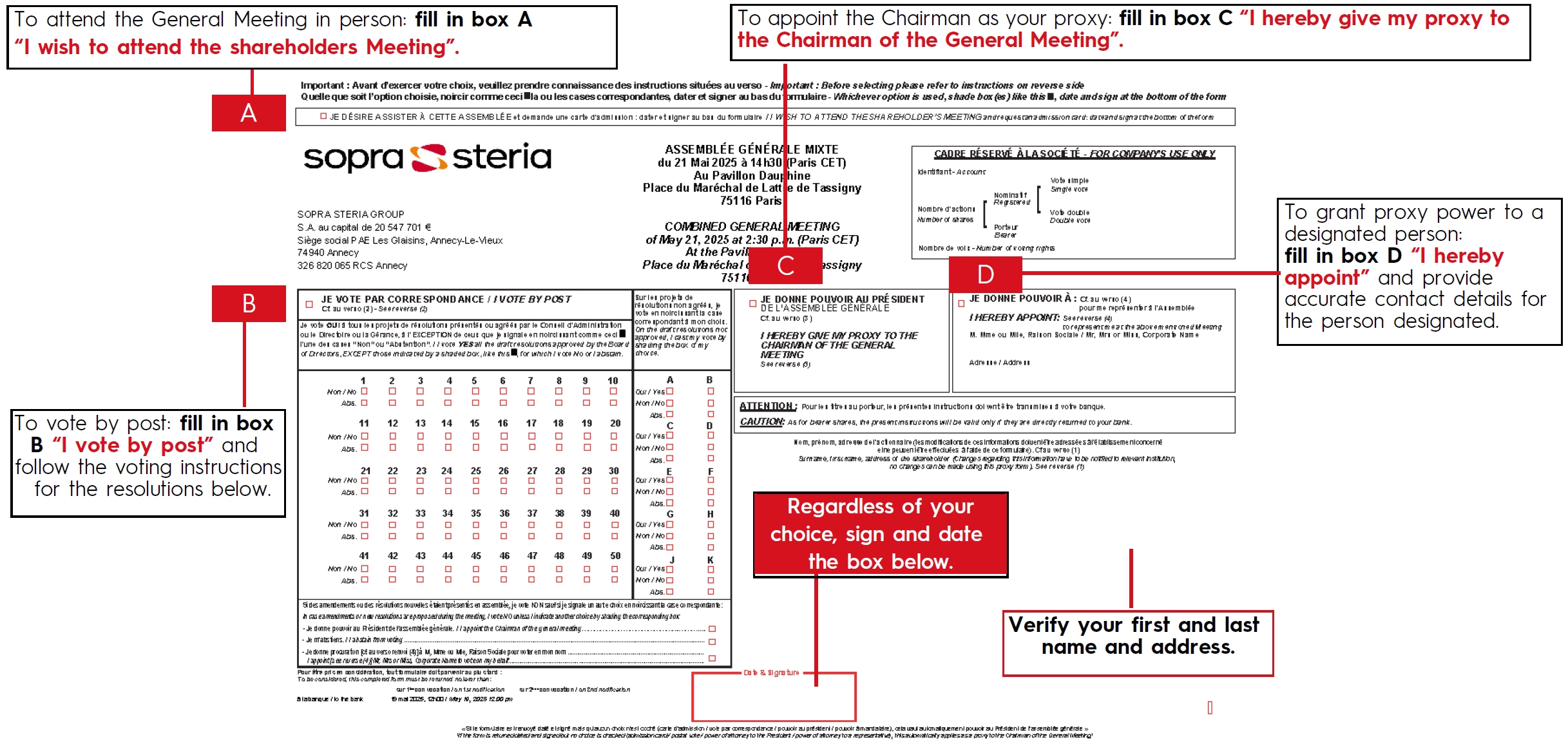

3. Instructions for filling out the voting form

- To vote by post: fill in box B [I am voting by post], each numbered box corresponding to the draft resolutions presented by the Board of Directors and appearing in the notice of meeting. Then complete as follows:

- to vote “FOR”, leave the boxes empty;

- to vote “AGAINST” on any of these proposed resolutions, fill in the individual boxes corresponding to the resolutions;

- to vote “ABSTAIN” on any of these proposed resolutions, fill in the individual boxes corresponding to the resolutions.

Any shareholder may be represented by his or her spouse, the partner with whom he or she has entered into a pacte civil de solidarité (PACS, the French civil union contract), another shareholder or any other private individual or legal entity of his or her choice.

-

Request for documents and informations

COMBINED GENERAL MEETING OF

SHAREHOLDERSWednesday 21st May 2025 at 2:30 PM

Pursuant to Article R. 225-88 of the French Commercial Code, from the time that notice of a General Meeting is given until the fifth day (inclusive) before the meeting, any shareholder (owning registered shares or showing proof of ownership of bearer shares) may use the form below to ask the Company to send the documents and information described in Articles R. 225-81 and 83 of said Commercial Code.

Send this form to:

SOPRA STERIA GROUP For the attention of Lima Abdellaoui

Or by postal mail:

6 Avenue Kleber, 75116 PARIS

Or by email at:

lima.abdellaoui@soprasteria.com

requests to have sent to the address above the documents and information described in Articles R. 225-81 and 83 of the French Commercial Code, with the exception of those that were attached to the postal voting / proxy form.

Registered shareholders may send a single request to have the Company send the documents and information described above for each subsequent General Meeting. The same right is accorded to all holders of bearer shares who can prove their ownership by submitting a deposit certificate for a securities account in the name of the shareholder (attestation d’inscription en compte) kept by an intermediary, as set out in Article L. 211-3 of the French Monetary and Financial Code.

-

2. Sopra Steria Group’s presentation

1. Activities and strategy

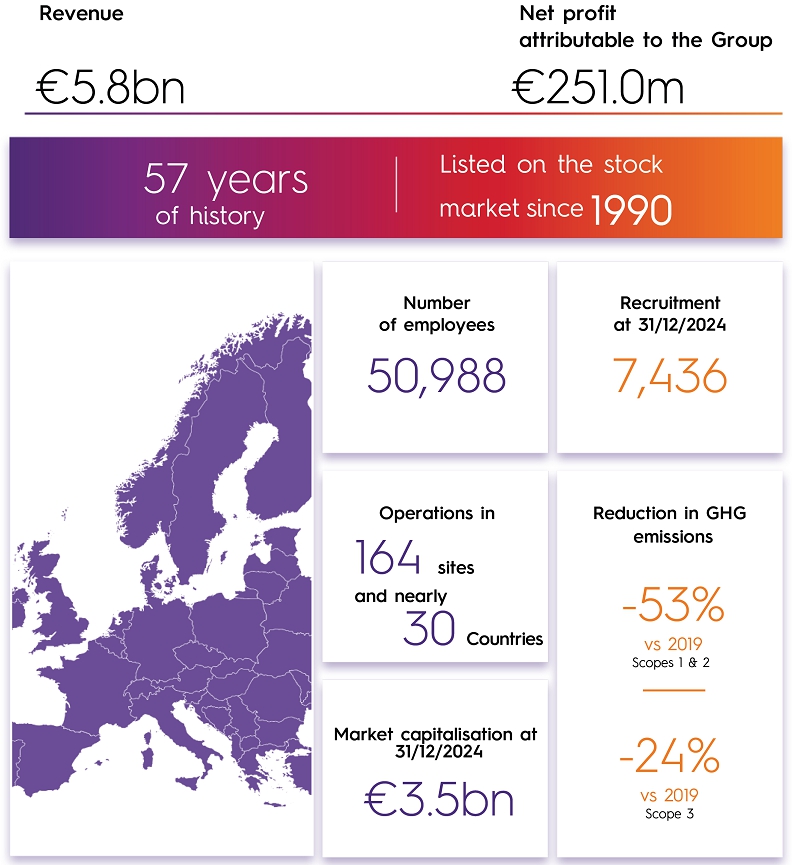

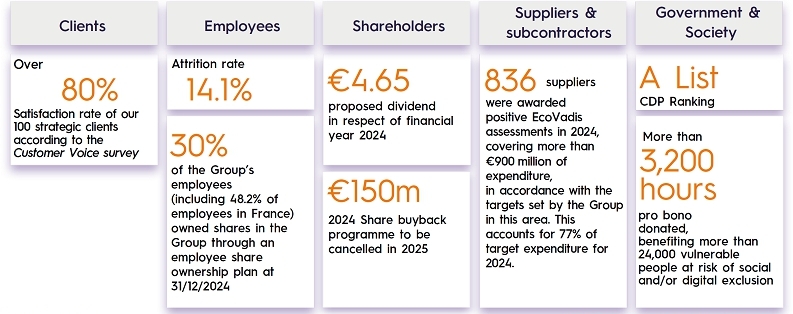

1.1. Key figures

-

2. Financial performance

2.1. 2024 Full-year results

“Sopra Steria proved resilient in 2024 even as market conditions deteriorated, particularly in the fourth quarter. Group revenue held up well thanks to our business strategy focused on our top 100 strategic clients, which enabled us to renew a significant number of major contracts and extend some of our positions.

Against this backdrop, we delivered robust operating performance. We achieved the target we set three years ago of delivering an operating margin on business activity of around 10%, free cash flow exceeded 7% of revenue and the return on capital employed before tax rose to 21.5%.

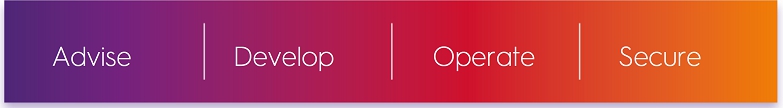

We also reaffirmed our strategy over the course of the year. Sopra Steria is keen to establish itself as a European leader in consulting and digital services and position itself as a trusted, credible European alternative to global operators. This positioning is aimed at harnessing technology and artificial intelligence to help major public and private sector organisations navigate transformation.

The company’s transformation in support of this goal is already underway. It encompasses our offerings, our operating model, human resources and industrialisation and includes an external growth component. In 2024, the shift from a service-based approach to high value-added offers translated in particular into the creation of two cross-functional service lines: Digital Platform Services, representing revenue of over €600 million, and Cybersecurity, representing revenue of over €200 million. A Group Chief Operating Officer was appointed to accelerate the evolution of our operating model. In human resources, we increased our experts’ technology certifications by 32% and trained all our employees in artificial intelligence. Lastly, all the Group’s developers now have access to development platforms augmented by generative AI agents.

Faced with an uncertain environment in this early part of 2025, we are determined to drive the Group’s transformation to generate more value for our clients, more opportunities for our employees and more performance for our shareholders..”

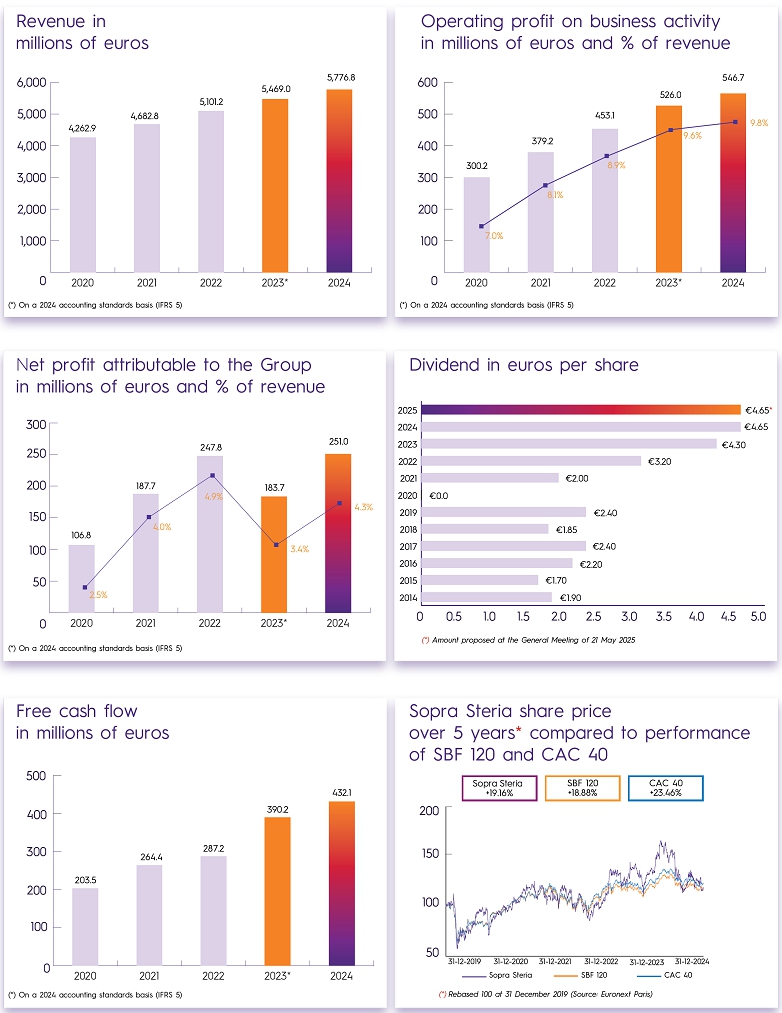

Consolidated revenue totalled €5,776.8 million, down a modest 0.5% compared with the reported 2023 figure. Changes in scope had a €15.7 million negative impact. Acquisitions added €320.6 million of revenue (CS Group, Tobania, and Ordina after adjusting to exclude “agent” revenue totalling -€82 million over 12 months(1)). The sale of the Sopra Banking Software business reduced revenue by €336.3 million. Currency fluctuations had a positive impact of €18.1 million. At constant scope and exchange rates, revenue growth was -0.5%.

Operating profit on business activity came to €564.7 million, up 3.0% relative to 2023. This gives an operating margin on business activity of 9.8%, up 0.4 percentage points, thus achieving the target set three years ago (target for 2024 set in 2022: “Operating margin on business activity of around 10%”).

In France (42% of the Group total), revenue came in at €2,437.9 million, equating to negative organic growth of 1.6%. Revenue declined 2.0% in the fourth quarter. It was hit by a sharp slowdown in the aeronautics sector, where quarterly volumes are thought to have reached a low point. Excluding aeronautics, the reporting unit’s revenue held more or less steady in the fourth quarter (up 0.5%). Over the full year, sector trends were positive in defence and the public sector. Other sectors lost ground. The reporting unit’s operating margin on business activity came out at 9.0% (9.6% in 2023), mainly as a result of the decline in activity in the aeronautics sector. Meanwhile, CS Group confirmed a 1.9-point uplift in its profitability compared with 2023.

Revenue for the United Kingdom (17% of the Group total) was €962.1 million, down 0.5%. Revenue was down 9.4% in the fourth quarter. This change mainly arose from a particularly high basis of comparison for the SSCL platform (which saw 25.2% growth in Q4 2023). It also reflects the completion of a major contract, while another major contract, originally scheduled for the fourth quarter, was pushed back to the beginning of the second quarter of 2025. Overall, across the full year, the public sector contracted while the private sector posted strong growth. The reporting unit’s operating margin on business activity improved by 1.1 points to 12.1%.

In Europe (35% of the Group total), revenue grew 0.5% on an organic basis to €2,049.0 million. The most buoyant growth was in Scandinavia, Spain and Italy, where revenue grew by between 8% and 10%. Other countries saw revenue decline by between 3% and 5%. The reporting unit’s operating margin on business activity was 9.1%, up 0.4 points from 2023.

The Solutions reporting unit (6% of the Group total) posted revenue of €327.8 million, representing organic growth of 1.1%. Human Resources Solutions posted growth of 3.6%. Property Management Solutions contracted by 1.7%. Excluding the impact of changes in scope (reallocation of business previously within the scope of SBS following its disposal), the reporting unit’s operating margin on business activity improved by 1.6 percentage points compared with 2023.

- Recognition of revenue generated by Ordina through the sale of external expertise was harmonised with effect from 1 January 2024. This revenue is recognised on a net basis where it meets the IFRS 15 definition of revenue generated by an agent.

Profit from recurring operations came in at €514.9 million, equating to growth of 10.2%. It included a €17.3 million share-based payment expense (versus €43.0 million in 2023) and a €32.5 million amortisation expense on allocated intangible assets (versus €38.0 million in 2023).

Operating profit came in at €460.3 million, up 39.5%, after a net expense of €54.7 million for Other operating income and expenses (compared with a net expense of €137.4 million in 2023), which included a capital gain of €11.1 million, not allocated to any reporting unit, in connection with the disposal of 74Software shares(1).

The tax expense totalled €96.8 million, for an effective tax rate of 23.0%. Restated for non-recurring items, the normative tax rate was 26%.

Net profit/loss from associates amounted to a loss of €6.7 million (compared with €6.7 million in 2023).

Net profit attributable to the Group from continuing operations came in at €309.3 million, up 68.4%, giving a margin of 5.4%.

Consolidated net profit came in at €259.9 million, up 37.5%, and net profit attributable to the Group came to €251.0 million, up 36.6%, after deducting €9.0 million attributable to non-controlling interests.

Free cash flow was very strong, at €432.1 million (compared with €390.2 million in 2023). This reflects a 3.6% increase in EBITDA and includes exceptional net cash flow of around €45 million linked to the scheduled conclusion of a major migration programme in Germany.

Net financial debt totalled €382.2 million, down 59.6% from its level at 31 December 2023. At that date, it was equal to 19.3% of equity and 0.61x pro forma EBITDA for 2024 before the impact of IFRS 16 (with the financial covenant stipulating a maximum of 3x).

The €150 million share buyback programme launched on 2 October 2024 concluded on 28 January 2025. During the share buyback period, which ran from 2 October 2024 to 28 January 2025, Sopra Steria bought back 858,163 shares (4.2% of capital) at an average price of €174.79 per share, for a total amount of €150 million. The shares bought back under this programme will be retired in 2025.

At the next General Meeting of Shareholders, to be held on Wednesday 21 May 2025, Sopra Steria will propose the payment of a dividend of €4.65 per share (vs. €4.65 per share in respect of financial year 2023). The ex-dividend date will be 3 June 2025. The dividend will be paid as of 5 June 2025.

At end-December 2024, the Group’s net headcount came to 50,988(2) employees, compared with 51,768 employees at year-end 2023. Around 7,900 staff were employed at international service centres, unchanged at constant scope from 2023.

Sopra Steria sees its contribution to society as sustainable, human-focused and purposeful, guided by the firm belief that making digital solutions work for people is a source of opportunity and progress.

With regard to the environment, CDP(4) confirmed in February 2025 that Sopra Steria had made its A List – recognising the world’s most transparent and most proactive companies in the fight against climate change – for the 8th year in a row.

This recognition notably reflects the Group’s Net-Zero target(5) of achieving a 54% reduction in its greenhouse gas emissions from Scopes 1 & 2 and a 37.5% reduction for Scope 3 by 2030. As at end-December 2024, the Group had achieved a 52.7% reduction in Scope 1 & 2 emissions and a 23.9% reduction in Scope 3 emissions.

In the social arena, the proportion of women in the 3% most senior positions increased 1.3 percentage points in 2024 to 21.4%, while the proportion in the 10% most senior positions increased 0.8 points to 22.3%.

- Formerly “Axway”.

- Workforce excluding interns, in accordance with the requirements of the CSRD. Including interns, the workforce totalled 51,237 at 31 December 2024 and 52,041 at 31 December 2023.

- Attrition rate including top performers, who left less than six months after they were recruited, in accordance with the requirements of the CSRD.

- Every year, more than 24,800 companies and organisations around the world provide details on their environmental performance to CDP for independent assessment against its scoring methodology for the benefit of investors, purchasers and other stakeholders.

- Target approved by the Science Based Targets initiative (SBTi) on 16 June 2023 and aligned with the aim of limiting the increase in the average global temperature to 1.5°C Reduction targets versus 2019 baseline.

- Annual organic revenue growth of between 2% and 5%

- Operating margin on business activity of between 10% and 11%

- Free cash flow of between 5% and 7% of revenue

- Return on capital employed (RoCE) before tax of around 20%

The European market is expected to remain unfavourable in the first half of the year as a result of a still uncertain climate, particularly in France.

- Organic revenue growth of between -2.5% and +0.5% Revenue is expected to bottom out in the first quarter, down by between 5% and 6%;

- Operating margin on business activity of between 9.3% and 9.8%, including a dilutive effect of around 0.3 points arising from increases in employers’ payroll contributions enacted by the UK and French governments for 2025

- Free cash flow of between 5% and 7% of revenue

The sale of Sopra Banking Software, announced on 21 February 2024 as part of Sopra Steria’s process of refocusing its activities on digital services and solutions, was finalised on 2 September 2024. The activities sold were recognised in discontinued operations (in accordance with IFRS 5) with effect from the financial statements for the first half of 2024.

The total amount received by Sopra Steria in 2024 in connection with the refocusing of its activities (sale of SBS, sale of 16.7% of 74Software and sale of 74Software subscription rights in connection with the latter’s capital increase) was €410.6 million. Sopra Steria retains an 11.1% stake in 74Software’s share capital.

In 2024, €43.5 million was invested in infrastructure and technical facilities, compared with €54.1 million in 2023.

- land and buildings: €0.2m (€0.1m);

- fixtures, fittings and furniture: €20.4m (€36.3m);

- IT: €22.9m (€17.7m).

(in millions of euros) Notes Financial

year 2024Financial

year 2023Revenue 4.1 5,776.8 5,469.0 Staff costs 5.1 -3,611.7 -3,345.4 External expenses and purchases 4.2.1 -1,387.3 -1,419.0 Taxes and duties -42.8 -39.4 Depreciation, amortisation, provisions and impairment -186.8 -165.7 Other current operating income and expenses 4.2.2 16.5 26.5 Operating profit on business activity 564.7 526.0 as % of revenue 9.8% 9.6% Expenses related to stock options and related items 5.4 -17.3 -34.3 Amortisation of allocated intangible assets 8.2 -32.5 -28.9 Profit from recurring operations 514.9 462.8 as % of revenue 8.9% 8.5% Other operating income and expenses 4.2.3 -54.7 -78.5 Operating profit 460.3 384.3 as % of revenue 8.0% 7.0% Cost of net financial debt 12.1.1 -35.4 -19.5 Other financial income and expenses 12.1.2 -3.2 6.1 Tax expense 6.1 -96.8 -114.2 Net profit from associates 10.1 -6.7 6.7 Net profit from continuing operations 318.2 263.5 Net profit from discontinued operations 2.2 -58.3 -74.4 Consolidated net profit 259.9 189.1 as % of revenue 4.5% 3.5% Non-controlling interests 14.1.5 9.0 5.4 NET PROFIT ATTRIBUTABLE TO THE GROUP 251.0 183.7 as % of revenue 4.3% 3.4% EARNINGS PER SHARE (IN EUROS) NOTES Basic earnings per share 14.2 12.46 9.08 Diluted earnings per share 14.2 12.34 8.94 Basic earnings per share from continuing operations 14.2 15.36 12.76 Diluted earnings per share from continuing operations 14.2 15.21 12.56 Basic earnings per share from discontinued operations 14.2 -2.90 -3.68 Diluted earnings per share from discontinued operations 14.2 -2.87 -3.62 The sale of Sopra Banking Software was preceded in the first half of the year by the legal carve-out of those activities of Sopra Banking Software to be sold and the transfer to Group entities of those activities to be retained (see Note 2.2).. As such, the “France” reporting unit now includes software integration activities. The “Other Europe” reporting unit now includes activities relating to a credit management solution in Belgium, solutions managed by the subsidiary previously held by Sopra Banking Software in Germany, and the service centre in Spain for projects included in the “France” reporting unit. Lastly, the activities of Sopra Solutions were combined and are now presented as part of the “Solutions” reporting unit. Segment figures for financial year 2023 were restated, in accordance with the requirements for classifying Sopra Banking Software as a discontinued operation. The Sopra Banking Software segment is no longer included in segment information. Lastly, the “Not allocated” segment is used to reconcile the Group’s operating profit and includes profit from the sale of Axway Software shares described in Note 2.2 for €11.1 million.

(in millions of euros) Financial year 2024 Financial year 2023 Revenue 2,437.9 2,426.3 Operating profit on business activity 220.4 9.0% 235.6 9.7% Profit from recurring operations 201.6 8.3% 207.7 8.6% Operating profit 182.1 7.5% 198.9 8.2% b. United Kingdom (in millions of euros) Financial year 2024 Financial year 2023 Revenue 962.1 940.9 Operating profit on business activity 116.9 12.1% 103.2 11.0% Profit from recurring operations 107.8 11.2% 89.4 9.5% Operating profit 100.7 10.5% 79.1 8.4% c. Europe (in millions of euros) Financial year 2024 Financial year 2023 Revenue 2,049.0 1,777.5 Operating profit on business activity 186.4 9.1% 151.7 8.5% Profit from recurring operations 165.7 8.1% 139.0 7.8% Operating profit 128.5 6.3% 105.0 5.9% d. Solutions (in millions of euros) Financial year 2024 Financial year 2023 Revenue 327.8 324.2 Operating profit on business activity 41.0 12.5% 35.4 10.9% Profit from recurring operations 39.9 12.2% 26.7 8.2% Operating profit 38.0 11.6% 1.4 0.4% e. Not allocated (in millions of euros) Financial year 2024 Financial year 2023 Revenue - - Operating profit on business activity - - Profit from recurring operations - - Operating profit 11.1 - f. Group (in millions of euros) Financial year 2024 Financial year 2023 Revenue 5,776.8 5,469.0 Operating profit on business activity 564.7 9.8% 526.0 9.6% Profit from recurring operations 514.9 8.9% 462.8 8.5% Operating profit 460.3 8.0% 384.3 7.0% ASSETS (in millions of euros) Notes 31/12/2024 31/12/2023 Goodwill 8.1 2,348.2 2,586.2 Intangible assets 8.2 238.5 322.6 Property, plant and equipment 8.3 148.7 164.6 Right-of-use assets 9.1 384.4 457.1 Equity-accounted investments 10.2 1.0 185.9 Other non-current assets 7.1 224.6 135.2 Retirement benefits and similar obligations 5.3 47.1 40.6 Deferred tax assets 6.3 115.1 184.1 Non-current assets 3,507.6 4,076.4 Trade receivables and related accounts 7.2 1,291.4 1,372.4 Other current assets 7.3 419.8 454.2 Cash and cash equivalents 12.2 423.4 191.7 Current assets 2,134.5 2,018.3 Assets held for sale 2.2 0.0 - TOTAL ASSETS 5,642.2 6,094.6 LIABILITIES AND EQUITY (in millions of euros) Notes 31/12/2024 31/12/2023 Share capital 20.5 20.5 Share premium 531.5 531.5 Consolidated reserves and other reserves 1,375.4 1,324.7 Equity attributable to the Group 1,927.4 1,876.7 Non-controlling interests 57.1 48.4 TOTAL EQUITY 14.1 1,984.5 1,925.1 Financial debt – Non-current portion 12.3 616.7 619.5 Lease liabilities – Non-current portion 9.2 322.1 392.9 Deferred tax liabilities 6.3 42.0 114.1 Retirement benefits and similar obligations 5.3 199.7 226.2 Non-current provisions 11.1 88.3 59.4 Other non-current liabilities 7.4 19.4 21.6 Non-current liabilities 1,288.3 1,433.6 Financial debt – Current portion 12.3 188.8 518.2 Lease liabilities – Current portion 9.2 105.1 110.0 Current provisions 11.1 36.8 53.9 Trade payables and related accounts 354.2 354.5 Other current liabilities 7.5 1,684.5 1,699.2 Current liabilities 2,369.4 2,735.9 Liabilities held for sale 2.2 -0.0 - TOTAL LIABILITIES 3,657.7 4,169.5 TOTAL LIABILITIES AND EQUITY 5,642.2 6,094.6 Alternative performance measures

- Restated revenue: Revenue for the prior year, expressed on the basis of the scope and exchange rates for the current year.

- Organic revenue growth: Increase in revenue between the period under review and restated revenue for the same period in the prior financial year.

- EBITDA: This measure, as defined in the Universal Registration Document, is equal to consolidated operating profit on business activity after adding back depreciation, amortisation and provisions included in operating profit on business activity.

- Free cash flow: Net cash from operating activities; less investments (net of disposals) in property, plant and equipment, and intangible assets; less lease payments; less net interest paid; and less additional contributions to address any deficits in defined-benefit pension plans.

- Operating profit on business activity: This measure, as defined in the Universal Registration Document, is equal to profit from recurring operations adjusted to exclude the share-based payment expense for stock options and free shares and charges to amortisation of allocated intangible assets.

- Profit from recurring operations: Operating profit before other operating income and expenses, which includes any particularly significant items of operating income and expense that are unusual, abnormal, infrequent or not foreseeable, presented separately in order to give a clearer picture of performance based on ordinary activities.

- Basic recurring earnings per share: This measure is equal to basic earnings per share before other operating income and expenses net of tax.

- Return on capital employed (RoCE): (Profit from recurring operations after tax + Profit from equity-accounted companies) / (Equity + Net financial debt).

- Downtime: Number of days between two contracts (excluding training, sick leave, other leave and pre-sales) divided by the total number of business days.

(in thousands of euros) 2024 2023 2022 2021 2020 Financial position at year-end ■ Share capital 20,548 20,548 20,548 20,548 20,548 ■ Number of shares issued 20,548 20,548 20,548 20,548 20,548 ■ Number of bonds convertible into shares 0 0 0 0 0 Results of operations for the year ■ Revenue excluding VAT 1,984,730 1,965,561 1,891,556 1,717,658 1,512,781 ■ Profit before tax, depreciation, amortisation and provisions -50,886 753,383 230,059 174,360 131,796 ■ Corporate income tax -16,567 -30,407 -16,032 -15,468 -20,835 ■ Profit after tax, depreciation, amortisation and provisions 176,642 31,709 167,666 156,867 142,276 ■ Amount of profit distributed as dividends 0 95,547 88,355 65,754 41,095 Earnings per share ■ Profit after tax but before depreciation, amortisation and provisions -1.67 38.14 11.98 9.24 7.43 ■ Profit after tax, depreciation, amortisation and provisions 8.60 1.54 8.16 7.63 6.92 Dividend paid per share 4.65 4.30 3.20 2.00 Employee data ■ Number of employees 13,377 13,438 13,336 13,236 12,997 ■ Total payroll 737,166 714,752 684,774 665,161 625,364 Amount paid in respect of employee benefits

(social security, employee discounts, etc.)343,682 348,989 317,064 300,241 277,481 -

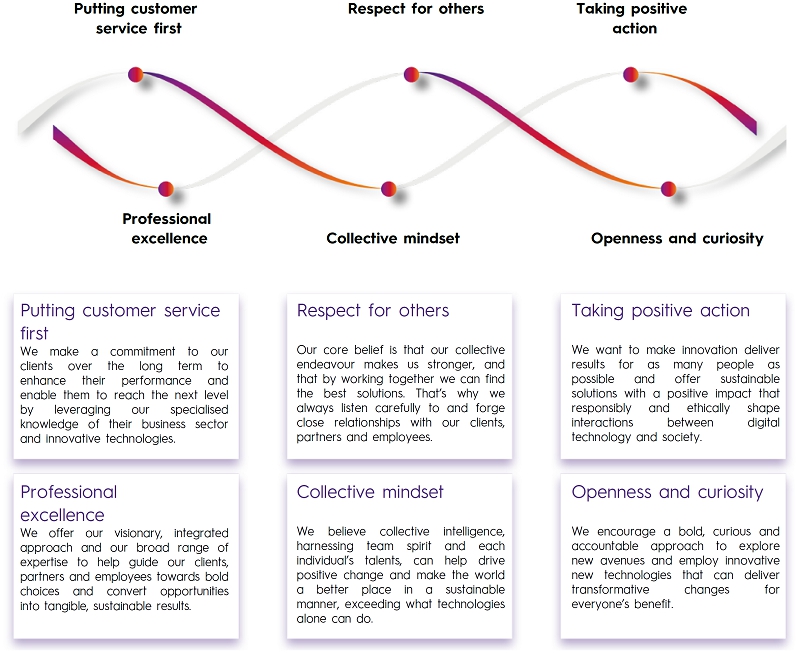

3. Our mission, values and Sustainability Report

Technology serves as a gateway to infinite possibilities. As fascinating as this never-ending stream of innovations is, it also raises questions as to what is actually behind the frantic race for novelty and change.

Solutions are never straightforward or obvious, and there is certainly never just one way of doing things.

At Sopra Steria, our mission is to guide our clients, partners and employees towards bold choices to build a positive future by putting digital technology to work in service of humanity.

Beyond technology, we set great store by collective intelligence, in the firm belief it can help make the world a better place.

Together, we are building a highly promising future by delivering tangible benefits: sustainable solutions with positive impacts that take full account of interactions between digital technology and society. There’s still so much more we can achieve together.

At Sopra Steria, we strive to create a stimulating, group-oriented environment inspiring free thinkers to engage in open, frank discussions. Our goal is to foster the development of skills and entrepreneurship in a community driven by a desire for collective success.

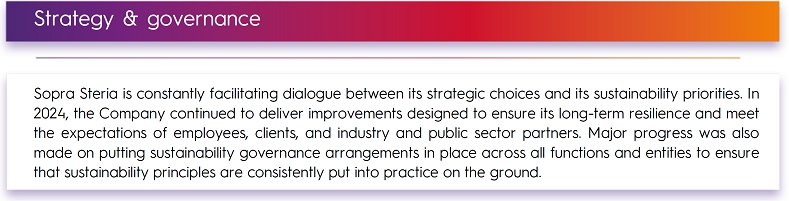

“Sustainability and digital technology are intrinsically linked and must be used to drive responsible, lasting growth.” In 2024, we ramped up our social and environmental commitments and made notable progress in decarbonisation and diversity. The Corporate Sustainability Reporting Directive (CSRD) marks the next step in ensuring that our commitments are transparent. We will continue to innovate and mobilise our stakeholders to build a more peaceful and sustainable future.”

Sopra Steria conducted a double materiality assessment1, the outcome of which confirmed the Company’s priorities, some of them longstanding, while providing a fresh perspective on the value chain.

These priorities reflect Sopra Steria’s identity, strategy and business model, which are intrinsically linked to the quality of its relationships with its partners and the role of digital technology in society.

- Climate change adaptation (ESRS E1)

- Reducing and mitigating the carbon footprint (ESRS E1)

- Resource and waste management (ESRS E5)

- Priority placed on training and skills (ESRS S1)

- Equal opportunities and diversity (ESRS S1)

- Employee protection and trust (ESRS S1)

- Social dialogue (ESRS S1)

- Regional presence (ESRS S3)

- Contribution to essential public services (ESRS S4)

- Business conduct and compliance (ESRS G1)

- Cybersecurity and digital sovereignty

- Developing responsible digital technology

1_Analysis conducted in accordance with the requirements of the Corporate Sustainability Reporting Directive (CSRD)

Sopra Steria is fully committed to managing its corporate responsibility priorities to ensure that it delivers as a responsible corporate citizen and meets its stakeholders’ expectations. The results achieved are testament to the Group’s tangible commitment in relation to social, environmental and societal issues.

-

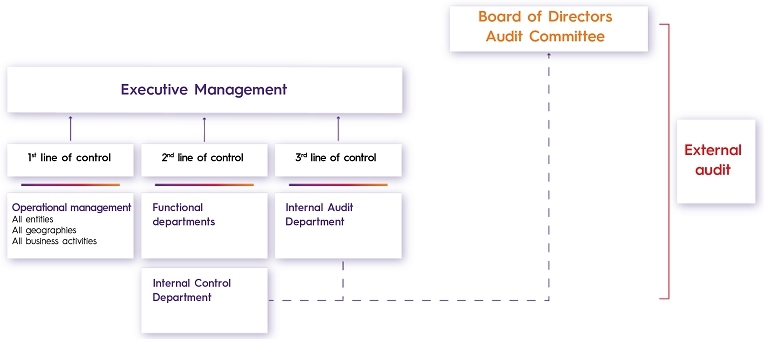

4. Governance

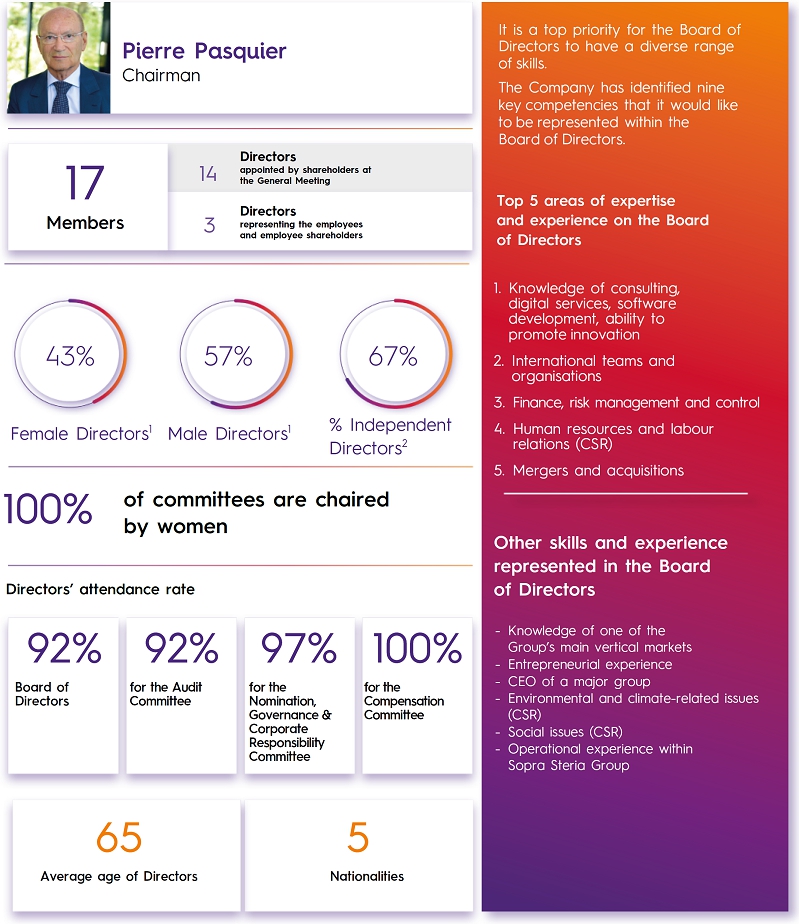

- _ 6/14 women – 8/14 men

- _ 10/14 Board members qualify as independent based on the AFEP-MEDEF Code’s requirements

On 19 June 2012, the Board of Directors decided to separate the roles of Chairman and Chief Executive Officer. It confirmed this decision in 2018, 2021 and again in 2024. It believes that this separation of roles remains the best way of addressing the Group’s strategic and operational priorities. Given the close relationship between the Chairman of the Board of Directors and the Chief Executive Officer, there is close collaboration and an ongoing dialogue between them. The current governance structure therefore helps streamline management of the Company. It means that the Group is able to act as quickly as needed and ensures decisions are taken with due care, while taking into account strategic priorities.

The Chairman is tasked with managing strategy, while the Chief Executive Officer is responsible for operations.

- guides the implementation of the Group’s strategy and all related matters, including mergers and acquisitions;

- assists Executive Management with the transformation of the Group;

- oversees investor relations and manages the Board’s relations with shareholders.

- works with the Chairman to formulate strategy;

- supervises the implementation of decisions adopted;

- ensures the operational management of all Group entities.

The Nomination, Governance & Corporate Responsibility Committee conducts an annual review of the succession plan for the Chairman of the Board of Directors and the Chief Executive Officer so any unforeseen vacancies can be dealt with appropriately. As part of this process, it meets with the Chairman of the Board of Directors. It makes sure the plan covers existing requirements and the Group’s culture. It assesses the relevance of any proposed changes. It debates action to be taken in the short and medium term in view of reappointments and expiring terms of office.

The Chairman of the Board of Directors carried out activities on a full-time basis throughout the year. This included overseeing the work of the Board and other assignments entrusted to him.

The Chairman’s assignments include the governance of strategy, acquisitions and the Board of Directors’ relations with shareholders. He is involved in several areas that are key to the Group’s future and transformation (HR, digital and industrial transformation; key organisational and operating principles; employee share ownership; promotion of Group values and compliance). This list of key matters is approved at the beginning of each year together with the Chief Executive Officer.

The Chairman is responsible for maintaining balance between the Group’s various stakeholders: shareholders, employees and the community. He ensures that the Group’s social and environmental priorities are properly taken into account.

In crisis situations, the ability to prioritise issues, uphold the Group’s values, and consider its options from a longer-term perspective thanks to the commitment provided by the core shareholder is absolutely critical.

The various matters placed under the Chairman’s responsibility require thorough knowledge of operational realities. Close relations with the Chief Executive Officer and the members of the Executive Committee facilitate information-sharing. It facilitates effective coordination on:

- decisions required for the implementation of the medium-term strategic plan and the Group’s transformation;

- monitoring of the implementation of such decisions over the long term.

- the roles defined in the internal rules and regulations of the Board of Directors;

- compliance with the respective prerogative powers of the Chairman of the Board of Directors and the Chief Executive Officer;

- a trust-based relationship established over the long term;

- a very good fit between the holders of the two positions.

In carrying out all of his assignments, the Chairman seeks out advice from former executives and may draw on certain resources across the Group. He is supported by a permanent team at Sopra GMT, the holding company that manages and controls the Group.

Of the five Sopra GMT employees, four of them have spent much of their careers with Sopra Steria Group. This team therefore has knowledge of the Group, its main managers and its organisational structure that an external service provider could not have. Its position within Sopra GMT means this team has an outside perspective and greater independence. These resources enhance the Board of Directors’ ability to oversee the smooth running of the Company.

The team was initially formed when 74Software(1) was spun off. It performs duties for Sopra Steria Group and 74Software, in which Sopra Steria Group still retains an ownership interest of approximately 11%. Sopra GMT provides both companies with its support and ensures synergies and best practices are implemented.

The members of this team carry out duties not undertaken by Sopra Steria Group: oversight of acquisitions, corporate secretarial affairs for the Board of Directors and its Committees. They may also assist Sopra Steria Group’s functional divisions. They are also active participants in various steering committees (acquisitions, corporate responsibility and sustainable development, internal control, internal audit, employee share ownership). They may join working groups tackling key issues for the Company. They provide the benefit of their technical expertise and an independent opinion.

The costs rebilled by Sopra GMT comprise the portion of payroll and related operational personnel costs allocated to the assignments performed for Sopra Steria Group. They also comprise, under the same conditions, any external expenses incurred by Sopra GMT (such as specialised advisors’ fees). As such, this organisational method does not increase the expenses borne by Sopra Steria Group. If the assignments handled by Sopra GMT’s employees were not entrusted to them, they would need to be reallocated within Sopra Steria Group.

Pierre Pasquier’s compensation at Sopra GMT reflects his oversight of the assignments performed by the Sopra GMT team for Sopra Steria Group and 74Software(1). His compensation is not rebilled to these two companies.

Sopra Steria Group charges Sopra GMT fees for providing premises, IT resources, and assistance from the Group’s functional divisions as well as providing appropriate expertise for Sopra GMT’s assignments.

The work performed by this team and the principle for the rebilling to the Company of the costs incurred are covered in a framework agreement for assistance. The General Meeting approved the implementation of this related-party agreement. The Board of Directors reviews it annually.

Around 85% of Sopra GMT’s total operating expenses are rebilled. The remaining 15% comprises the expenses arising from Sopra GMT’s own internal operations. Expenses are rebilled on a cost-plus basis including a 7% margin. By definition, Sopra GMT generally records a small operating loss. The annual breakdown varies according to the respective needs of Sopra Steria Group and 74Software(1). On average, since 2011, two thirds of the amounts rebilled have concerned Sopra Steria Group. With the sale of most of the activities of Sopra Banking Software to 74Software in 2024(1), the portion of the rebilling allocated to Sopra Steria Group was reduced to half of the total.

The Board of Directors reviewed the implementation of this agreement at its meeting on 30 January 2025. It unanimously agreed to maintain the previously granted authorisation for the current financial year. The members of the Board of Directors associated with Sopra GMT (Pierre Pasquier, Éric Pasquier, Kathleen Clark) did not take part in the discussion or vote on this decision and all other Directors were present.

Cyril Malargé has been with the Company for over 20 years. He first served as Managing Director of the France reporting unit. For the 18 months prior to his appointment as Chief Executive Officer, Cyril Malargé also served as the Group’s Chief Operating Officer. He has been a member of the Executive Committee since 2015.

The Chief Executive Officer has authority over the entire Group. He directs, administers and coordinates all of its activities. To this end, he is supported by the Group’s Executive Committee and its Management Committee. These Committees comprise key operational and functional managers from Sopra Steria Group and its subsidiaries as well as the Chief Executive Officer.

The Chief Executive Officer has the broadest possible powers to act in all circumstances in the name of Sopra Steria Group SA, the parent company of Sopra Steria Group. They represents the Company in its dealings with third parties.

Certain decisions relating to strategy implementation and internal organisation require prior approval by the Board of Directors or its Chairman. Decisions “that are highly strategic in nature or that are likely to have a significant impact on the financial position or commitments of the Company or any of its subsidiaries” are defined in the internal rules and regulations of the Board of Directors (see Chapter 8, “Additional information” of the 2024 Universal Registration Document, page 384).

This agreement related to the provision to Executive Management of consulting and assistance services. These services were provided in connection with strategic deals connected with business development among other areas. They were charged at a per diem rate of €2,500 (excluding taxes). The duties performed under this agreement were distinct from those performed by virtue of Éric Hayat’s directorship. For example, this involved but was not limited to the following, in consultation with the Group’s operational managers:

- taking part in top-level market meetings;

- maintaining contacts with civil society;

- taking part in high-level meetings with certain key clients in France and abroad;

- preparing for and participating in delegations of corporate executives to priority countries for the Group.

- Following the acquisition of Sopra Banking Software, the shareholders of Axway Software decided on 6 December 2024 to change the company’s name to 74Software (with the latter continuing to use Axway Software as one of its trademarks).

This enabled the Company to benefit from the experience and knowledge of the Group gained by Éric Hayat throughout his career. This knowledge extends to its environment and some of its major clients. Éric Hayat was a co-founder of Steria. He also previously chaired France’s digital sector employers’ organisation and subsequently the broader “Fédération Syntec”, and is a former member of MEDEF’s Executive Committee. His skills and experience were thus particularly well suited to the responsibilities entrusted to him, which mainly related to major business opportunities.

This also meant that the number of Directors on the Board that were directly involved in addressing the Group’s priorities in terms of strategic and commercial positioning increased, thus enriching the Board’s debates. Éric Hayat, in his capacity as a member of the Compensation Committee and the Nomination, Governance & Corporate Responsibility Committee, provided these committees with the benefit of the knowledge of the Group’s operational managers accumulated and maintained in the course of these assignments. Lastly, he had access to information channels within the Company that were helpful for feeding information back to the Board of Directors and its committees.

On the date at which the 2024 Universal Registration Document was published, the Board of Directors had 17 members with the right to vote. The General Meeting directly nominated 14 Directors and 3 Directors represent the employees and employee shareholders.

The renewal of three current terms of office will be proposed at the General Meeting to be held on 21 May 2025 (see the summary of resolutions in Chapter 3, “Draft resolutions submitted to the shareholders’ meeting” of this document, pages 79 to 85). The Directors concerned are as follows:

The shareholders at the General Meeting will also be asked to appoint a Director representing the employee shareholders, the directorship currently held by Astrid Anciaux, which will end at the close of the next General Meeting.

Collectively, the members of the Board of Directors and the Chief Executive Officer hold around 20% of the Company’s share capital and 30% of its voting rights.

PIERRE PASQUIER ÉRIC PASQUIER SOPRA GMT

KATHLEEN CLARKSONIA CRISEO PASCAL DALOZ ANDRE EINAUDI Chairman of the Board of Directors Vice-Chairman of the Board of Directors Permanent representative of Sopra GMT Independent Director Independent Director Independent Director

MICHAEL GOLLNER ÉRIC HAYAT NOËLLE LENOIR SYLVIE REMOND MARIE-HELENE RIGAL-DROGERYS JESSICA SCALE Independent Director Director Independent Director Independent Director Independent Director Independent Director

YVES DE TALHOUËT REMY WEBER ASTRID ANCIAUX HELENE BADOSA WILLIAM BEAUMOND Independent Director Independent Director Director representing employee shareholders Director representing the employees Director representing the employees Owing to their professional experience as well as activities pursued outside the Company, the members of the Board of Directors have all acquired expertise in the area of management and some of them also have gained expertise in the Company’s industry sector.

- any conflict of interest affecting the exercise of their duties and responsibilities;

- any family relationship with another member of the Board of Directors, with the exception of Éric Pasquier, who is related to Pierre Pasquier;

- any conviction during the last five years in relation to fraudulent offences;

- been incriminated and/or been the focus of an official public sanction issued by statutory or regulatory authorities, nor barred by a court from serving as a member of a supervisory board, board of directors or other management body of an issuer or from taking part in the management or conduct of an issuer’s business affairs at any point during the past five years;

- been involved in any bankruptcy proceedings or been subject to property sequestration during the last five years as a member of a board of directors, a management body or a supervisory board.

Furthermore, there are no service agreements binding the members of governing and management bodies to the issuer or to any one of its subsidiaries that provide benefits upon the termination of such agreements.

Personal information Position on the Board Attendance at meetings in financial year 2024 Name Age* Gender Nationality Number of

shares

ownedNumber of

directorships

at listed

companies

(excluding

Sopra

Steria

Group)Status** Start of

current

termEnd of

current

termYears of

service on

the Board *Board of

DirectorsAudit

CommitteeNomination,

Governance &

Corporate

Responsibility

CommitteeCompensation

CommitteePierre Pasquier

Chairman of the Board of Directors

89 M FRA 108,113 1 ECO 21/05/2024 AGM 2028 56 100% N/A Éric Pasquier

Vice-Chairman of the Board of Directors

53 M FRA 6,720 0 ExCo 21/05/2024 AGM 2028 10 100% 100% Sopra GMT, represented by Kathleen Clark

Chairwoman of the Nomination, Governance & Corporate Responsibility Committee

57 W USA/FRA 4,035,669 1 NSP 21/05/2024 AGM 2028 10 100% 100% 100% Sonia Criseo

Director

53 W IRL 10 0 ID 24/05/2023 AGM 2025 1 92% N/A Pascal Daloz

Director

55 M FRA 25 1 ID 24/05/2023 AGM 2026 1 58% N/A André Einaudi

Director

69 M FRA 100 0 ID 01/06/2022 AGM 2026 4 67% N/A Michael Gollner

Director

66 M USA/GBR 100 1 ID 24/05/2023 AGM 2027 6 92% 71% Éric Hayat

Director

83 M FRA 34,230 0 NSP 21/05/2024 AGM 2028 10 100% 100% Noëlle Lenoir

Director

76 W FRA 101 0 ID 01/06/2022 AGM 2026 4 92% 100% Sylvie Rémond

Chairwoman of the Compensation Committee

61 W FRA 152 0 ID 24/05/2023 AGM 2027 9 100% 100% 100% Marie-Hélène Rigal-Drogerys Chairwoman of the Audit Committee

54 W FRA 100 1 ID 21/05/2024 AGM 2026 10 100% 100% Jessica Scale

Director

62 W FRA/GBR 10 0 ID 24/05/2023 AGM 2027 8 100% 100% Yves de Talhouët

Director

66 M FRA 10 0 ID 01/06/2022 AGM 2025 2 83% 83% Rémy Weber

Director

67 M FRA 10 1 ID 24/05/2023 AGM 2025 1 100% N/A Astrid Anciaux

Director representing employee shareholders

59 W BEL 2,189 0 E 26/05/2021 AGM 2025 10 100% Hélène Badosa

Director representing the employees

66 W FRA 0 0 E 27/06/2024 AGM 2028 6 91% 100% William Beaumond

Director representing the employees

61 M FRA 0 0 E 11/07/2024 AGM 2028 - 100% ** Meaning of acronyms: ECO: executive company officer; ExCo: member of the Executive Committee (salaried); NSP: non-salaried position; ID: Independent Director; E: employee

At 31 December 2024, the average length of service on the Board of Directors was eight years.The percentage of Independent Directors who had been sitting on the Board of Directors for less than six years was 60%.

Departures Appointments Reappointments Board of Directors David Elmalem (21/05/2024)

Jean-Luc Placet (21/05/2024)

William Beaumond (11/07/2024) Hélène Badosa (27/06/2024)

Sopra GMT, represented by Kathleen Clark (21/05/2024)

Éric Hayat (21/05/2024)

Pierre Pasquier (21/05/2024)

Éric Pasquier (21/05/2024)

Marie-Hélène Rigal-Drogerys (21/05/2024)

Audit Committee Éric Pasquier (21/05/2024) Marie-Hélène Rigal-Drogerys (21/05/2024) Nomination, Governance & Corporate Responsibility Committee Éric Hayat (30/01/2025)

Jean-Luc Placet (21/05/2024)

Pierre Pasquier (21/05/2024)

Jessica Scale (30/01/2025)

Pascal Daloz (30/01/2025)

Éric Pasquier (21/05/2024)

Pierre Pasquier (30/01/2025)

Rémy Weber (30/01/2025)

Sopra GMT, represented by Kathleen Clark (21/05/2024)

Éric Hayat (21/05/2024)

Compensation Committee Jean-Luc Placet (21/05/2024) Sonia Criseo (30/01/2025)

André Einaudi (30/01/2025)

Hélène Badosa (27/06/2024)

Sopra GMT, represented by Kathleen Clark (21/05/2024)

Éric Hayat (21/05/2024)

The Nomination, Governance & Corporate Responsibility Committee plays a central role throughout the four phases of the selection process for Independent Directors. The same process applies to Directors who are not independent as defined by the AFEP-MEDEF Code from Phase 3 as set out below.

Phase 1. This is the needs analysis phase. The Committee identifies the end dates of Directors’ terms of office and explores the possibility of renewing them. It takes into account the objectives of the diversity policy and the skills required. It accommodates imperatives arising from compliance with the law and with the Code of Corporate Governance. This analysis is undertaken for the Board of Directors itself and its committees. It focuses on the needs due to arise first and makes projections for the years ahead.

Phase 2. A list of potential candidates is drawn up based on the needs identified. This list is made up of the following:

- by members of the Nomination, Governance & Corporate Responsibility Committee,

- and by members of the Board of Directors more generally;

- names put forward by recruitment firms;

- names proposed by Executive Management;

- unsolicited applications received by the Company.

The Chairwoman of the Nomination, Governance & Corporate Responsibility Committee approves the list of potential candidates. A file is put together based on publicly available information about the candidates.

After reviewing this file, the Nomination, Governance & Corporate Responsibility Committee decides which candidates to contact and meet.

Phase 3. Members of the Nomination, Governance & Corporate Responsibility Committee arrange meetings with the selected candidates. At their meetings, the Committee’s members compare their opinions. For each candidate, the Committee endeavours to assess the depth of their experience and how closely it fits the Company’s needs. What they would bring to the Board from a diversity perspective and their motivation are also considered. Lastly, the Committee checks their availability, whether they have any conflicts of interest, and whether they meet the independence criteria in the Code of Corporate Governance. Additional actions are agreed upon as necessary to complete the list of candidates.

- is made aware of the findings of the previous phases;

- discusses the candidates put forward by the Nomination, Governance & Corporate Responsibility Committee;

- decides which candidates will be put to the vote at a General Meeting of Shareholders.

In the specific case of Directors representing the employees and the Director representing employee shareholders, the Company decided to launch an extensive call for applications across the Group.

As regards Directors representing the employees, the Company opted for the following methods of appointment from the various options available under Article L. 225-27-1 of the French Commercial Code:

- the first Director representing the employees shall be appointed by the trade union that won the most votes in the first round of elections to the Works Council of the Company and its direct and indirect subsidiaries having their registered offices in France,

- and the second Director representing the employees shall be appointed by the European Works Council.

The General Meeting of Shareholders elects the Director representing employee shareholders from among the candidates put forward by employee shareholders. After reviewing the candidates, the Nomination, Governance & Corporate Responsibility Committee may recommend that the Board of Directors support an appointment resolution to be put to the shareholders at a General Meeting. The candidate elected is the one whose appointment resolution gains the required majority and the most votes, in the event of multiple candidacies.

The goal of the Board of Directors’ diversity policy is to bring together the perspectives, skills and experience required for effective collective decision-making. It aims to meet the needs and reflect the characteristics of the Group while remaining a reasonably sized team. Each of its members must show good judgement and foresight, and uphold the ethical conduct standards expected of a Director.

The impact on diversity and the integration of future Directors is considered every time a proposal is made to appoint Directors. The Nomination, Governance & Corporate Responsibility Committee plays a key role in this regard.

Diversity is often assessed using measurable indicators related to gender equality, age and nationality.

With regard to gender equality, the Company aims to continue moving toward gender equality to the greatest extent possible. Each gender should account for at least 40% of the Directors. It is actively seeking to achieve gender equality in its Board’s specialised committees.

Women currently account for six of the fourteen appointments made at the General Meeting (43%). The three standing committees are chaired by a female Director. The five female Independent Directors are members of at least one committee.

The targets for increasing the proportion of women in senior management positions, set with reference to the AFEP-MEDEF Code, are presented in Section 3.1.4.2. “Equal opportunities and diversity action plans” of the “Sustainability Report” in the 2024 Universall Registration Document (pages 180 to 188). They were reviewed and discussed at several meetings of the Nomination, Governance & Corporate Responsibility Committee and adopted by the Board of Directors. They take into account the Group’s proactive approach to corporate social responsibility, its management needs, and the proportion of women in its business sector and at the Company. On Executive Management’s recommendation, the Board of Directors has approved targets, an action plan and practical arrangements that will make a real difference. They focus on delivering far-reaching action over the long term. The proportion of women in senior management positions forms part of those quantifiable targets on which the Chief Executive Officer’s variable compensation, and that of Group management more generally, is based.

Age is not a criterion that is considered. The Company has not set a minimum or maximum age requirement for directorships. However, the Articles of Association (Art. 14) limit the proportion of Directors aged over 75 to one third. The average age of the members of the Board of Directors is 65 (at 31/12/2024). Three out of 17 Directors are over 75 years old.

Given the international dimension of the Group’s business, it is considered desirable to have foreign nationals sitting on the Board of Directors. As far as possible, Directors who are foreign nationals come from or live in countries in which the Group operates or is seeking to develop business (France, United Kingdom, Benelux). Countries recognised for their technological and digital industries are also represented on the Board of Directors (United States, Ireland). To attract Directors living outside France, the internal rules and regulations of the Board of Directors permit Directors to take part in meetings using videoconferencing or conference call systems, and the Company can cover their travel costs. Furthermore, an adjustment to the method used to apportion compensation among Board members has been agreed to better reflect the constraints on foreign Directors. This consists of adding an additional 20% weighting to attendance at meetings of the Board and its committees for Directors living outside France. This does not apply to Directors who carry out their work within the Group. Five out of 17 Directors hold citizenship from a country other than France.

It is also a priority for the Board of Directors to have a diverse range of skills. The Company has identified nine key competencies that it would like to be represented within the Board of Directors. These skills and areas of experience are as follows:

- Knowledge of the digital sector and consulting, and the ability to promote technological innovation: This expertise will have been gained at a digital services company, software vendor or consulting firm, or in an industry sector focused on technological innovation in B2B services.

- Knowledge of one of the Group’s main vertical markets: This expertise flows from knowledge of the digital services requirements in one or more of the Group’s main markets. Ideally, it will have been gained working for a client of the Group or one of its competitors. It may also be acquired through long sales experience in one of these markets.

- Entrepreneurial experience: Entrepreneurial experience will have been gained by starting up or taking over an industrial or commercial business and through contact with the various stakeholders (clients, employees, lending shareholders, suppliers, authorities).

- CEO of a major group: This presupposes past or current experience as a non-salaried executive company officer (Chairman, CEO or Deputy CEO) of a company established in more than one country or that employed more than 25,000 people.

- Finance, control and risk management: This expertise requires professional experience gained in finance, audit or internal control or while holding a corporate office.

- Corporate social responsibility:

– Human resources and labour relations: This expertise requires professional experience gained in human resources, either in a company or as an external consultant, in institutions, industry bodies, trade unions or public benefit organisations or while holding a corporate office.

– Environmental and climate-related issues: This expertise presupposes familiarity with institutions, non-governmental organisations or public benefit organisations and expertise in handling climate-related and environmental issues from a business perspective.

– Social issues: This expertise presupposes familiarity with institutions, industry bodies, trade unions or public benefit organisations and expertise in handling social issues from a business perspective.

- International dimension: This indicates skills in cross-cultural management combined with being versed in more than one culture, working as an expatriate or holding corporate office in an international group.

- Mergers and acquisitions: This experience is gained through involvement in external growth transactions as an executive company officer or professional (development director, investment banker, legal or financial advisor).

- Operational experience within Sopra Steria Group: This experience presupposes long-standing current or past service within Sopra Steria Group, as an employee or equivalent, and in-depth knowledge of the Group, its working practices and its management. A corporate office of at least four years in a company recently acquired by the Group may also be taken into consideration.

Each of these 9 key areas of expertise and experience are currently represented on the Board of Directors by several Directors (see table below): Expertise Knowledge of

the digital

sector and

consulting, the

ability to

promote

technological

innovationKnowledge

of one of

the Group’s

main

vertical

marketsEntrepreneurial

experienceCEO of a

major

groupFinance,

risk

management and

controlCSR

International

teams

and

organisationsMergers

and acquisitionsOperational

experience

within

Sopra

Steria

GroupHuman

resources

and labour

relationsEnvironmen

tal and

climate-

related

issuesSocial

issuesAstrid Anciaux

Hélène Badosa

William Beaumond

Kathleen Clark

Sopra GMT representative

Sonia Criseo

Pascal Daloz

André Einaudi

Michael Gollner

Éric Hayat

Noëlle Lenoir

Éric Pasquier

Pierre Pasquier

Sylvie Rémond

Marie-Hélène Rigal-Drogerys

Jessica Scale

Yves de Talhouët

Rémy Weber

Representation of key competency Board of Directors A B B B A A C B A A B Audit Committee (three members) C C C - A - C C A A - Nomination, Governance & Corporate Responsibility Committee (seven members) A A C A A A C C A A B Compensation Committee (seven members) A A B C C B C A A A A In addition to these 9 key areas of expertise and experience, given Sopra Steria Group’s ownership structure, the Nomination, Governance & Corporate Responsibility Committee also considers experience of corporate governance within family-owned listed companies to be of benefit to potential Board members. Such experience promotes the use of key strengths and harnesses an understanding of the challenges faced by family-owned companies in pursuit of sustainable and profitable growth. It is primarily gained through serving as a corporate officer or senior manager in a company – either listed or with a broad shareholder base – whose main shareholder is either an individual or a family. The family shareholder must hold at least 10% of the voting rights and either run the company or have the ability to choose who runs it.

- A Director representing the employees was appointed on 27 June 2024 by the trade union that won the most votes in the first round of elections to the Works Council of the Company. This Director is Hélène Badosa, a member of the Compensation Committee.

- One Director representing the employees was designated on 11 July 2024 by the European Works Council. This Director is William Beaumond.

- A Director representing employee shareholders, Astrid Anciaux, was elected at the General Meeting of Shareholders held on 26 May 2021. Her term of office will end at the close of the next General Meeting of Shareholders, on 21 May 2025.

The Nomination, Governance & Corporate Responsibility Committee also monitors the proportion of Independent Directors on the Board.

Ten Directors are considered independent by the Board of Directors. They account for 71% of Directors appointed by the shareholders at a General Meeting.

A procedure has been laid down for selecting Independent Directors (see Section 4.1.2.2 of this chapter, pages 42 to 43).

Every year, the Nomination, Governance & Corporate Responsibility Committee and then the Board of Directors review the status of each member of the Board of Directors with respect to the requirements for Independent Directors set out in Article 10 of the AFEP-MEDEF Code of Corporate Governance for Listed Companies: Requirement 1: Employee or executive company officer in the past five years

Must not have been at any time over the preceding five years and must not currently be:

- an employee or executive company officer of the Company;

- an employee, executive company officer or director of a company that the Company consolidates;

- an employee, executive company officer or director of the parent company or of a company consolidated by that parent company.

Requirement 2: Cross-directorships

Must not be an executive company officer of a company in which the Company directly or indirectly holds a directorship, or in which an employee appointed as such or an executive company officer of the Company (currently serving or having served within the preceding five years) holds a directorship.

Requirement 3: Material business relationships

Must not be a customer, supplier, commercial banker, corporate banker or consultant:

- of material importance to the Company or Group;

- or a material portion of whose business is transacted with the Company or Group.

The Board considers the materiality of the relationship with the Company or its Group. The quantitative and qualitative criteria used to formulate its opinion (continuity, economic reliance, exclusivity, etc.) are detailed in the Annual Report.

Requirement 4: Family ties

Must not have close family ties with a company officer.

Requirement 5: Statutory Auditor

Must not have been a Statutory Auditor of the Company during the preceding five years.

Requirement 6: Term of office of over 12 years

Must not have been a Director of the Company for more than 12 years. Directors lose their Independent Director status on the 12th anniversary date of their appointment.

Requirement 7: Non-executive company officer

A non-executive company officer may not be considered independent if they receive their variable compensation in cash, shares or any other payment linked to the performance of the Company or the Group.

Requirement 8: Major shareholder

Directors representing major shareholders of the Company or its parent company may be considered independent if these shareholders do not have full or partial control of the Company. However, if the relevant major shareholders hold more than 10% of the share capital or of voting rights, the Board, based on a report by the Nomination, Governance & Corporate Responsibility Committee, considers as a matter of course the Directors’ independent status with regard to the composition of the Company’s share capital and any potential conflicts of interest.

Criteria(1) Sonia

CriseoPascal

DalozAndré

EinaudiMichael

GollnerNoëlle

LenoirSylvie

RémondMarie-

Hélène

Rigal-

DrogerysJessica

ScaleYves de

TalhouëtRémy

WeberRequirement 1: Employee or executive company officer in the past five years

Requirement 2: Cross-directorships

Requirement 3: Material business relationships

Requirement 4: Family ties

Requirement 5: Statutory Auditor

Requirement 6: Term of office of over 12 years

Requirement 7: Non-executive company officer

Requirement 8: Major shareholder

- In this table,

represents an independence requirement that is satisfied and

represents an independence requirement that is satisfied and  an independence requirement that is not satisfied.

an independence requirement that is not satisfied.

Like Sopra Steria Group, 74Software is fully consolidated by Sopra GMT. According to the Nomination, Governance & Corporate Responsibility Committee, a current term of office on 74Software’s Board of Directors does not call into question the status of Independent Director:

- Sopra Steria Group’s Board of Directors is periodically informed of 74Software’s situation. Following the strategic refocusing completed in 2024, plus the sale of part of its shareholding in 74Software, Sopra Steria Group has retained a residual 11% holding in the company’s share capital;

- the procedure for handling potential conflicts of interest applies to the consideration of any matters related to 74Software;

- the Independent Directors present on both Sopra Steria Group’s and 74Software’s Boards of Directors ensure that opinions independent of the core shareholder are heard on issues concerning both companies and their strategy.

The Directors in question are Marie-Hélène Rigal-Drogerys, Michael Gollner and Yves de Talhouët, whose terms of office as 74Software Directors ended in 2024. Sopra Steria Group’s Board of Directors unanimously came to the same conclusions as the Nomination, Governance & Corporate Responsibility Committee.

In addition, Sonia Criseo was Director of CS Group until 2023. This company – the listed holding company for the CS Group, which has since merged with Sopra Steria Group – is not consolidated in the latter’s financial statements.

Following an extended review that went beyond the criteria set out in the AFEP-MEDEF Code, the Board of Directors concluded that this previous directorship does not give rise to any conflict of interest in relation to the Board’s decisions. Consequently, the Board decided to consider Sonia Criseo as being independent within the meaning of the AFEP-MEDEF Code. Like all members of the Board of Directors, Sonia Criseo remains subject to the procedure for managing one-off conflicts of interest, where applicable.

Members of the Board of Directors may hold an office or have an interest in companies that have potential business relationships with Sopra Steria Group or its core shareholder. The Board of Directors shall assess whether the nature, purpose and significance of this affiliation may affect their standing as Independent Directors. It will draw, in particular, on the prior work done by the Nomination, Governance & Corporate Responsibility Committee.

In the case of a business relationship, its significance is inferred by reference to various criteria, including in particular the following:

- whether the service provided is of a strategic nature;

- whether there is reciprocal dependence;

- the volume of business transacted (particularly where this equates to more than 1% of annual revenue);

- the selection procedure used and how often the business is put out to tender;

- whether the Director is involved in the business relationship.

A real estate investment trust held by André Einaudi owns the premises occupied by the Company for a number of years at its Aix-en-Provence site. The Board of Directors considers that these circumstances do not constitute a material business relationship. In reaching this conclusion, the Board took into account the age, term and amount of the lease, signed prior to André Einaudi’s appointment as a Director. It also noted that it is customary for the Group to rent its premises: Apart from in exceptional circumstances, the Group does not own its premises. Lastly, the Board confirmed that no dependency is created for the lessor in relation to this lease.