BDC 2023

-

1.Agenda and formalities governing participation in the General Meeting

-

Agenda

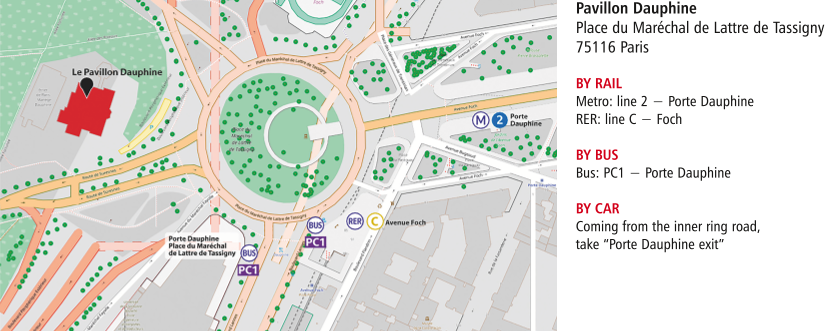

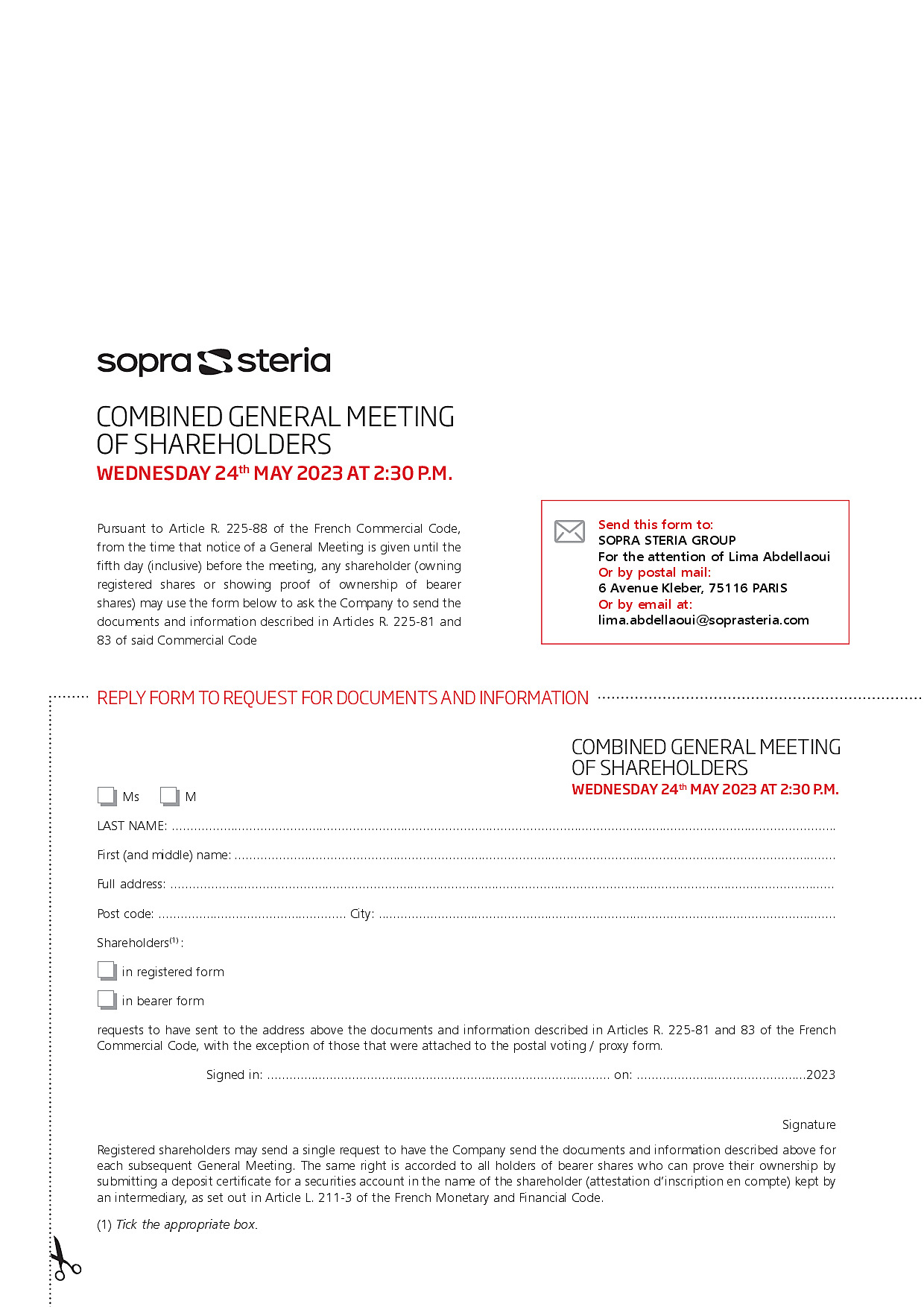

The shareholders of Sopra Steria Group are invited to attend the Combined General Meeting to be held on Wednesday, 24 May 2023, at 2:30 p.m., at Pavillon Dauphine, Place du Maréchal de Lattre de Tassigny, 75116 Paris (France), to vote on the following agenda.

Requiring the approval of the Ordinary General Meeting

- Approval of the parent company financial statements for financial year 2022;

- Approval of the consolidated financial statements for financial year 2022;

- Appropriation of earnings for financial year 2022 and setting of the dividend;

- Approval of disclosures relating to the compensation of company officers mentioned in Article L. 22-10-9 I of the French Commercial Code, in accordance with Article L. 22-10-34 I of the French Commercial Code;

- Approval of the fixed, variable and exceptional items of compensation making up the total compensation and benefits of any kind paid during financial year 2022 or allotted in respect of that period to Pierre Pasquier, Chairman of the Board of Directors;

- Approval of the fixed, variable and exceptional items of compensation making up the total compensation and benefits of any kind paid during financial year 2022 or allotted in respect of that period to Vincent Paris, Chief Executive Officer (from 1 January to 28 February 2022);

- Approval of the fixed, variable and exceptional items of compensation making up the total compensation and benefits of any kind paid during financial year 2022 or allotted in respect of that period to Cyril Malargé, Chief Executive Officer (from 1 March to 31 December 2022);

- Approval of the compensation policy for the Chairman of the Board of Directors;

- Approval of the compensation policy for the Chief Executive Officer;

- Approval of the compensation policy for Directors for their service;

- Decision setting the total annual amount of compensation awarded to Directors for their service at €700,000;

- Reappointment of Sylvie Rémond as a Director for a term of office of four years;

- Reappointment of Jessica Scale as a Director for a term of office of four years;

- Reappointment of Michael Gollner as a Director for a term of office of four years;

- Appointment of Sonia Criseo as a Director for a term of office of two years;

- Appointment of Pascal Daloz as a Director for a term of office of three years;

- Appointment of Rémy Weber as a Director for a term of office of two years;

- Authorisation to be granted to the Board of Directors to trade in the Company’s shares up to a maximum of 10% of the share capital;

-

Procedures governing participation in the General Meeting

I.Participation in the General Meeting

A.RIGHT TO PARTICIPATEB IN THE GENERAL MEETING

Sopra Steria Group’s share capital is made up of 20,547,701 shares. Double voting rights are allocated to all fully paid-up shares that are proved to have been registered in the name of the same shareholder for at least two years.

Every shareholder has the right to participate in the General Meeting, regardless of the number of shares held.

In accordance with Article R. 22-10-28 of the French Commercial Code, the only shareholders allowed to take part in the General Meeting or to be represented by proxy are those able to prove their status by showing that their shares are held in accounts in their name, or in the name of their authorised financial intermediary, no later than the second business day preceding the General Meeting, i.e. by Monday, 22 May 2023 at 0.00 a.m. (Paris time):

- ■for holders of directly registered (nominatif pur) or intermediary-registered (nominatif administré) shares: in registered share accounts;

- ■for holders of bearer shares: in bearer share accounts kept by the authorised intermediary responsible for managing the account, the Securities Account Holder.

Any shareholder who has already submitted their remote voting and proxy form (the Combined Form) may sell all or a portion of their shares up to the date of the General Meeting.

However, only sales completed before the second business day preceding the General Meeting, i.e. before Monday, 22 May 2023 at 0.00 a.m. (Paris time), will be taken into consideration. Only in such cases, the Securities Account Holder is required to send notification of the sale and provide the information necessary to cancel the vote or to change the number of shares and votes corresponding to the vote.

No share transfers completed after the second business day preceding the General Meeting, i.e. after Monday, 22 May 2023 at 0.00 a.m. (Paris time), irrespective of the means employed, are to be taken into consideration, notwithstanding any agreement to the contrary.

B.MEANS OF PARTICIPATION IN THE GENERAL MEETING

Société Générale Securities Services is the centralising agent for the General Meeting. Requests submitted by post to the centralising agent must be addressed to Société Générale Securities Services – Service des Assemblées, CS 30812,44308 Nantes CEDEX 3 (France).

Shareholders who are able to do so are encouraged to give priority to the use of the secure Votaccess platform. This platform allows them to quickly and securely select their means of participation in the General Meeting. The secure Votaccess platform will be open from Friday, 5 May 2023 at 9.00 a.m to Tuesday, 23 May 2023 at 3.00 p.m. (Paris time).

Holders of directly registered or intermediary-registered shares will need to sign in to the www.sharinbox.societegenerale.com website, then click on the “Replay” button in the “General Meeting” box on the homepage, and finally click on “Participe” to access the secure Votaccess platform.

- ■Holders of directly registered shares will need to use their usual access code to activate their Sharinbox By SG Markets account. On the Sharinbox welcome page, shareholders will find all information necessary to guide them through the process. If the shareholder has already activated their account using their email address as their username, their access code is not required, and they can use this email address to log in. Shareholders will have received their password by post when opening their registered account with Société Générale, or by post over the past few days. If this has not yet been done, shareholders activate their account so as to benefit from the latest version of authentication.

If a shareholder losses or forgets their password, they follow the procedure online on the authentication page.

- ■Holders of intermediary-registered shares will need to log in using the access code and password provided for this purpose by Société Générale Securities Services.

- ■Holders of bearer shares will need to log in to their Securities Account Holder’s website, using their usual access code and password, then access the secure Votaccess platform by following the on-screen instructions. Holders of bearer shares are recommended to contact their Securities Account Holder to find out whether access to this service is subject to any specific terms and conditions of use.

Shareholders are encouraged to log in to the secure Votaccess platform as soon as it opens, and in any event before the day before the General Meeting.

- attending the General Meeting in person;

- voting remotely prior to the General Meeting

- appointing as their proxy:

- ■the Chairman (or if a shareholder does not name a proxy holder in a proxy form submitted to the Company), it being specified that in such a case, the Chairman of the General Meeting shall vote in favour of proposed resolutions submitted for approval by the Board of Directors, and against any other proposed resolutions,

- ■another shareholder, their spouse, the partner with whom they have entered into a pacte civil de solidarité (PACS, the French civil union contract), or any other individual or legal entity of their choosing under the conditions set out in Articles L.225-106 and L.22-10-39 of the French Commercial Code.

Pursuant to Article R.22-10-28 III of the French Commercial Code, all shareholders who, having requested their admission card, have voted remotely or appointed a proxy, may no longer opt for any other means of participation.

Shareholders who wish to attend the General Meeting in person must bring proof of their identity and their admission card.

Shareholders may request an admission card online on the secure Votaccess platform by following the on-screen instructions after having logged in as described above in Section B. “Means of participation in the General Meeting”/“Centralisation of the General Meeting – Use of the secure Votaccess platform”.

- Holders of directly registered or intermediary-registered shares must ensure their request for an admission card is received before 22 May 2023 at 12.00 noon (Paris time) by Société Générale Securities Services, using the Combined Form and the prepaid envelope attached to the notice of meeting.

- Holders of bearer shares must ask their Securities Account Holder to send them an admission card. Société Générale Securities Services must receive all requests by the Securities Account Holder no later than 22 May 2023 at 12.00 noon (Paris time). If, despite having submitted a request, holders of bearer shares have not received their admission card by 22 May 2023, they must ask their Securities Account Holder to provide them with a certificate of investment, which will allow them to prove their status as a shareholder to be admitted to the General Meeting.

Shareholders who arrive on the date of the General Meeting without an admission card or a certificate of investment are responsible for contacting their Securities Account Holder and requesting to be sent the certificate of investment required to attend the General Meeting.

On the day of the General Meeting, the certificate of investment shall be accepted either in print or electronic format, provided that, for the latter format, the shareholder is able to send it to the email address that will be provided upon arrival at the venue.

Shareholders may submit their voting instructions online on the secure Votaccess platform by following the on-screen instructions after having logged in as described above in Section B. “Means of participation in the General Meeting”/“Centralisation of the General Meeting – Use of the secure Votaccess platform”.

- Registered shareholders must fill out and sign the Combined Form attached to the notice of meeting and send it back using the prepaid envelope to Société Générale Securities Services.

- Holders of bearer shares must: 1) ask their Securities Account Holder to send them the Combined Form; 2) send the completed signed Combined Form together with their voting instructions to their Securities Account Holder. The Securities Account Holder is responsible for sending the Combined Form, together with a certificate of investment, directly to Société Générale Securities Services – Service des Assemblées, CS 30812, 44308 Nantes CEDEX 3 (France).

In order to be taken into account, Combined Forms must be received by Société Générale Securities Services no later than Monday, 22 May 2023 at 12.00 noon (Paris time).

Shareholders may appoint a proxy or rescind a proxy appointment online on the secure Votaccess platform by following the on-screen instructions after having logged in as described above in Section B. “Means of participation in the General Meeting”/“Centralisation of the General Meeting – Use of the secure Votaccess platform”. If and only if their Account Holder has not joined the Votaccess system, holders of bearer shares can send an email to the following address: assembleegenerale@soprasteria.com. The message must specify the full name and address of the principal shareholder, as well as those of the proxy appointed or whose appointment is rescinded. Holders of bearer shares must ask their Securities Account Holder to send Société Générale Securities Services a certificate of investment to prove their status as a shareholder.

-

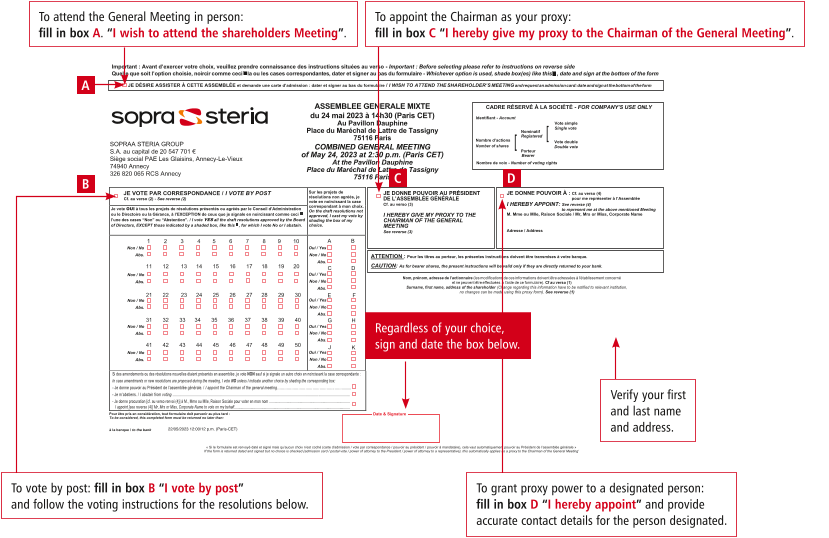

Instructions for filling out the voting form

- To attend the General Meeting in person: fill in box A

[I wish to attend the shareholders Meeting]. - To vote by post: fill in box B [I am voting by post], each numbered box corresponding to the draft resolutions presented by the Board of Directors and appearing in the notice of meeting. Then complete as follows:

- ●to vote “FOR”, leave the boxes empty;

- ●to vote “AGAINST” on any of these proposed resolutions, fill in the individual boxes corresponding to the resolutions;

- ●to vote “ABSTAIN” on any of these proposed resolutions, fill in the individual boxes corresponding to the resolutions.

- To appoint the Chairman as your proxy: fill in box C

[I hereby give my proxy to the Chairman of the General Meeting] - To appoint a different proxy: fill in box D

[I hereby appoint…], and complete the required information.

Any shareholder may be represented by his or her spouse, the partner with whom he or she has entered into a pacte civil de solidarité (PACS, the French civil union contract), another shareholder or any other private individual or legal entity of his or her choice

- To attend the General Meeting in person: fill in box A

-

2.Sopra Steria Group's presentation

-

Organisation and operation of governance

Executive company officers

Separation of the roles of chairman of the board of directors and chief executive officer

On 19 June 2012, the Board of Directors decided to separate the roles of Chairman and Chief Executive Officer. It confirmed this decision in 2018 and 2021. It believes that this separation of roles remains the best way of addressing the Group’s strategic and operational priorities. Given the close relationship between the Chairman of the Board of Directors and the Chief Executive Officer, there is close collaboration and an ongoing dialogue between them. In summary, the current framework contributes to fluid and flexible governance arrangements. It means that the Group is able to act as quickly as needed and ensures decisions are taken with due care, while taking into account strategic priorities.

Role of the executive company officers

The Chairman is tasked with managing strategy, while the Chief Executive Officer is responsible for operations.

- ■guides the implementation of the Group’s strategy and all related matters, including mergers and acquisitions;

- ■assists Executive Management with the transformation of the Group;

- ■oversees investor relations and manages the Board’s relations with shareholders.

- ■works with the Chairman to formulate strategy;

- ■supervises the implementation of decisions adopted;

- ■ensures the operational management of all Group entities.

Succession plan for executive company officers

The Nomination, Governance, Ethics and Corporate Responsibility Committee conducts an annual review of the succession plan for the Chairman of the Board of Directors and the Chief Executive Officer so any unforeseen vacancies can be dealt with appropriately. As part of this process, it meets with the Chairman of the Board of Directors. It makes sure the plan covers existing requirements and the Group’s culture. It assesses the relevance of the proposed changes. It approves the actions laid down in the short- to medium-term plan.

In 2022, the Nomination, Governance, Ethics and Corporate Responsibility Committee conducted its annual review of the succession plan and adapted it to accommodate changes in Group governance.

Overview of the activities of the chairman of the board of directors in 2022

The Chairman of the Board of Directors carried out activities on a full-time basis throughout the year. This involved steering the work of the Board and other assignments entrusted to him.

The Chairman’s assignments include the governance of strategy, acquisitions and the Board of Director’s shareholder relations as well as the supervision of matters which were identified early in the year in coordination with the Chief Executive Officer. These matters all relate to long-term preparations required for the Group’s transformation (HR, digital and industrial transformation; key organisational and operating principles for the Group; employee share ownership; promotion of Group values and compliance).

The Chairman is responsible for maintaining balance between the Group’s various stakeholders: shareholders, employees and the community. He ensures that the social and environmental implications of the Group’s business activities are suitably taken into account.

In crisis situations, the ability to rank priorities, uphold the Group’s values, and consider its options from a longer-term perspective thanks to the commitment provided by the core shareholder is absolutely critical.

The various matters placed under the Chairman’s responsibility require a perfect knowledge of operational realities. Close relations with the Chief Executive Officer and the Executive Committee foster information flows between them. It facilitates effective coordination on:

- ■decisions required for the delivery of the medium-term strategic plan;

- ■monitoring of the implementation of such decisions over the long term.

- ■the roles defined in the internal rules and regulations of the Board of Directors;

- ■compliance with the respective prerogative powers of the Chairman and the Chief Executive Officer;

- ■a trust-based relationship established over the long term;

- ■a very good fit between the holders of these positions.

Agreement with sopra gmt, the holding company that manages and controls Sopra Steria Group

In carrying out all of his assignments, the Chairman may receive support from two advisors and draw on resources across the Group. He is supported by a permanent team of four individuals at the Sopra GMT holding company. Three of them have spent much of their careers with Sopra Steria Group. This team therefore has knowledge of the Group, its main managers and its organisational structure that an external service provider could not have. Its position within Sopra GMT means this team has an outside perspective and greater independence. These resources enhance the Board of Directors’ ability to oversee the smooth running of the Company.

The team was initially formed when Axway Software was spun off. It performs duties for Sopra Steria Group and Axway Software, in which Sopra Steria Group holds an ownership of approximately 32%. Sopra GMT provides both companies with its support and ensures synergies and best practices are implemented.

Sopra GMT’s employees carry out their own duties (oversight of acquisitions, corporate secretarial affairs for the Board of Directors and its Committees). They may also assist the Sopra Steria Group’s functional divisions. They are also active participants in various steering committees (acquisitions, corporate responsibility, internal control, internal audit, employee share ownership). They may join working groups tackling key issues for the Company. They provide the benefit of their technical expertise and an independent opinion.

The costs rebilled by Sopra GMT comprise the portion of payroll and related personnel costs allocated to the assignments performed for Sopra Steria Group. They also comprise, under the same conditions, any external expenses incurred by Sopra GMT (such as specialised advisors’ fees). As such, this organisational method does not increase the expenses borne by Sopra Steria Group. If the assignments handled by Sopra GMT’s employees were not entrusted to them, they would need to be reallocated within the Group.

Sopra Steria Group charges Sopra GMT fees for providing premises, IT resources, and assistance from the Group’s functional divisions as well as provision of appropriate expertise for Sopra GMT’s assignments.

The work performed by this team and the principle for the rebilling to the Company of the costs incurred are covered in a framework agreement for assistance. This agreement, approved as a related-party agreement by the General Meeting, is reviewed every year by the Board of Directors.

Pierre Pasquier’s compensation at Sopra GMT reflects his oversight of the assignments performed by the Sopra GMT team for Sopra Steria Group and Axway Software. It is not rebilled to these two companies.

Around 85% of Sopra GMT’s total operating expenses are rebilled. The remaining 15% comprises the expenses arising from Sopra GMT’s own internal operations. Expenses are rebilled on a cost-plus basis including a 7% margin. By definition, Sopra GMT generally records a small operating loss. The annual breakdown varies according to the respective needs of Sopra Steria Group and Axway Software. On average, since 2011, two thirds of the rebilling have concerned Sopra Steria Group.

The Board of Directors reviewed the implementation of this agreement at its meeting on 26 January 2023. It unanimously agreed to maintain the previously granted authorisation for the current financial year. The Directors directly or indirectly affected by this decision did not take part in either the discussion or the vote.

Executive management

Cyril Malargé has been with the Company for almost 20 years. He has served as Managing Director of the France reporting unit and, for the 18 months prior to his appointment as Chief Executive Officer, as the Group’s Chief Operating Officer. He has been a member of the Executive Committee since 2015.

The Chief Executive Officer has authority over the entire Group. He directs, administers and coordinates all of its activities. To this end, he is supported by Executive Management, the Executive Committee and the Management Committee. These Committees comprise the Chief Executive Officer, Deputy Chief Executive Officer and other key operational and functional managers from Sopra Steria Group and its subsidiaries.

The Chief Executive Officer has the broadest possible powers to act in all circumstances in the name of Sopra Steria Group SA, the parent company of Sopra Steria Group. He represents the Company in its dealings with third parties.

Certain decisions relating to strategy implementation and internal organisation require prior approval by the Board of Directors or its Chairman. Decisions “that are highly strategic in nature or that are likely to have a significant impact on the financial position or commitments of the Company or any of its subsidiaries” are defined in the internal rules and regulations of the Board of Directors. See Chapter 8, “Additional information” of the 2022 Universal Registration Document (page 310).

Agreement with éric hayat conseil

This agreement relates to the provision to Executive Management of consulting and assistance services. These services are provided in connection with strategic deals connected with business development among other areas. They are charged at a per diem rate of €2,500 (excluding taxes). The duties performed under this agreement are distinct from those performed by virtue of Éric Hayat’s directorship. For example, this may involve but is not limited to the following, in consultation with the Group’s operational managers:

- ■taking part in top-level market meetings;

- ■maintaining contacts with civil society;

- ■taking part in high-level meetings with certain key clients in France and abroad;

- ■preparing for and participating in delegations of corporate executives to priority countries for the Group.

This enables the Company to benefit from the experience and knowledge of the Group gained by Éric Hayat throughout his career. This knowledge extends to its environment and some of its major clients. Éric Hayat was a co-founder of Steria. He also previously chaired the digital sector employers’ organisation and subsequently the broader “Fédération Syntec”, and is a former member of MEDEF’s Executive Committee. His skills and experience are thus particularly well suited to the responsibilities entrusted to him, which mainly relate to major business opportunities.

This means that the number of Directors on the Board that are directly involved in addressing the Group’s priorities in terms of strategic and commercial positioning is increased, thus enriching the Board’s debates. Éric Hayat, in his capacity as a member of the Compensation Committee and the Nomination, Governance, Ethics and Corporate Responsibility Committee, provides these committees with the benefit of the knowledge of the Group’s operational managers accumulated and maintained in the course of these assignments. Lastly, he has access to information channels within the Company that are helpful for feeding information back to the Board of Directors and its Committees.

- ■expenses: €181 thousand;

- ■the Board of Directors reviewed the implementation of this agreement at its meeting on 26 January 2023. It unanimously agreed to maintain the previously granted authorisation for the current financial year. The Director affected by this decision did not take part in either the discussion or the vote.

-

Compensation policy

General principles

While paying particular attention to the stability of the principles used to determine and structure compensation for executive company officers, the Board of Directors re-examines their compensation packages on an annual basis to verify their fit with the Group’s requirements. In particular, the Board checks that compensation policy:

- ■continues to be in keeping with the Company’s best interests;

- ■contributes to the Company’s long-term success, takes into account its social and environmental priorities;

- ■is in keeping with the Company’s business strategy.

The Board also checks that compensation policy complies with the recommendations laid down in the AFEP-MEDEF Code. To this end, it is supported by the Compensation Committee, which helps it prepare its decisions in this area.

The Board of Directors considers that applying the compensation recommendations laid down in the AFEP-MEDEF Code of Corporate Governance protects the Company’s interests and encourages executives’ contribution to business strategy and the Company’s long-term success.

The Compensation Committee usually meets three to five times between October and February to help the Board prepare its decisions.

The Board of Directors generally discusses the strategic approach over the same period; this discussion has taken into account social and environmental issues associated with the Company’s business. For the past several years, the Group has been pursuing an independent, value-creating plan that combines growth and profitability. Priorities are adjusted each year based on the current state assessment undertaken at the end of the previous year.

The Committee reviews the current compensation policy applicable to company officers. It is then informed of estimates of how far the Chief Executive Officer has achieved their targets. These forecasts are refined in the course of the Committee’s various meetings. At the beginning of the year, the Compensation Committee determines the extent to which quantifiable targets set for the previous year have been achieved. It assesses the extent to which qualitative targets have been met. To this end, it meets with the Chairman of the Board of Directors and familiarises itself with any information that might be used in this assessment.

The Committee also takes into consideration the Group’s compensation policy and decisions on fixed and variable compensation payable to the members of the Group Executive Committee. It takes into account comparisons with other companies made available to it. However, sector consolidation has significantly reduced the number of companies allowing for a direct and relevant comparison.

The Committee also considers ways in which employees may be given a stake in the Company’s financial performance. It assesses the suitability of share ownership plans for all employees and long-term incentive plans for managers of the Company and its subsidiaries. The Board of Directors considers that employee and executive share ownership makes a lasting contribution to the Company’s priority focus on independence and value creation by ensuring that employees’ and executives’ interests are fully aligned with those of the company’s shareholders.

The Board of Directors has not, to date, fixed the number of shares that must be held and registered in the name of the Chairman of the Board of Directors who co-founded of the Company. Shares held directly or indirectly through Sopra GMT by the Chairman in a personal capacity or by the Chairman’s family group make up more than 10% of the Company’s share capital.

On the recommendation of the Compensation Committee, the Board of Directors set a requirement for the Chief Executive Officer to retain 50% of the performance shares actually awarded during his term of office. It also set a target for him to hold 50% of his compensation in the Company’s shares by the end of 2026.

When the Board of Directors reviews the budget for the current financial year, the company’s quantitative targets are a known quantity. The Compensation Committee takes them into account when determining the Chief Executive Officer’s quantitative targets for the financial year. It holds a further meeting with the Chairman of the Board of Directors to discuss potential qualitative targets.

The Compensation Committee then presents its recommendations to the Board of Directors, which deliberates without the interested parties in attendance. These recommendations relate to the Chief Executive Officer’s variable compensation for the previous financial year, fixed compensation payable to the Chairman of the Board of Directors, and the Chief Executive Officer’s fixed and variable compensation for the current financial year. The Committee also presents its observations on how compensation is apportioned among the Directors and any proposed adjustments. The total amount of the compensation referred to in Article L. 225-45 of the French Commercial Code subject to approval by the shareholders is agreed when the Board of Directors meets to prepare for the General Meeting of Shareholders.

As regards variable compensation, the Compensation Committee proposes the quantifiable criteria to be taken into account together with any qualitative criteria, as the case may be. It makes certain that the criteria adopted are mainly quantifiable and that criteria are precisely defined. As regards quantifiable criteria, it generally determines:

- ■a threshold below which variable remuneration is not paid;

- ■a target level at which 100% of compensation linked to the criterion in question becomes payable; and

- ■where applicable, an upper limit if there is the possibility that a target may be exceeded.

Performance is assessed by comparing actual performance with the target broken down into thresholds and targets, as the case may be. Where, by exception, compensation may exceed the target level, the extent to which it may do so is capped.

Based on the targets adopted, an amount equivalent to 60% of the annual fixed compensation cannot be exceeded. Even so, in the event of an outstanding performance relative to the quantitative targets, the Board of Directors may, after consulting the Compensation Committee, authorise the integration of targets being exceeding, subject to the cap on annual variable compensation set at 100% of annual fixed compensation. Effective payment of the Chief Executive Officer’s variable compensation will, in any event, be subject to shareholder approval at an Ordinary General Meeting.

Conversely, the Board of Directors may consider that the Group’s performance does not merit payment of variable compensation in respect of the financial year in question. That being the case, it does not take into account the extent to which qualitative targets have been met. It proposes to the shareholders that no variable compensation be paid in respect of that financial year.

Lastly, in the event of exceptional circumstances (such as an exogenous shock) leading to the suspension of the normal system of variable compensation for employees and Executive Committee members, the Compensation Committee would review the situation of the Chief Executive Officer. It could recommend to the Board of Directors that it ask the shareholders at the General Meeting to approve an improvement to the Chief Executive Officer’s variable compensation if that would serve the Company’s interests, subject to an upper limit of 60% of his annual fixed compensation.

Long-term incentive plans are based on awarding rights to shares. They are subject to the condition of being with the company over a period of time and performance conditions. The targets are set in the same way as for variable compensation.

Independently of the compensation policy, the company covers or reimburses company officers’ travel expenses (transportation and accommodation).

The Nomination, Governance, Ethics and Corporate Responsibility Committee and the Compensation Committee have four members in common. This overlap ensures that decisions are consistent between the two Committees.

The procedure for determining compensation policy applicable to executive company officers and the timing of that procedure are intended to ensure that all worthwhile information is taken into account when recommendations are drawn up and when the Board of Directors makes its final decision. This ensures that such decisions are consistent among themselves and aligned with the Company’s strategy.

The compensation policy applies to newly appointed company officers. However, in exceptional circumstances, such as to enable the replacement or appointment of a new executive company officer, the Board of Directors may waive application of the compensation policy. Such waivers must be temporary, aligned with the Company’s interests and necessary to secure the Company’s long-term success or viability. Furthermore, this option may only be adopted where there is consensus among the members of the Board of Directors as to the decision to be taken (i.e. no votes against). This may result in the awarding of components of compensation currently defined in the compensation policy as not applicable (severance pay, non-compete payment, supplementary pension plan), though any such items would be subject to approval at the following General Meeting.

-

Financial delegations in progress

Authorisations to issue securities granted to the Board of Directors at the Combined General Meeting of 1 June 2022

Issue with pre-emptive subscription rights

Securities transaction concerned

Date of GM and resolution

Duration of delegation (Expiry)

Maximum issue amount

Maximum amount of capital increase

Use during the year

Capital increase (ordinary shares and other securities giving access to the share capital)

1 June 2022 Resolution 19

26 months (August 2024)

Nominal amount of €2 billion, if securities giving access to the share capital are to be issued

50% of the nominal share capital

None

Capital increase (ordinary shares and other securities giving access to the share capital) in the event of oversubscription in accordance with Resolution 19

1 June 2022 Resolution 23

26 months (August 2024)

15% of the amount of the capital increase under Resolution 19, up to a maximum of €2 billion

15% of the amount of the capital increase under Resolution 19, up to a maximum of 50% of the total nominal share capital

None

Capital increase through the capitalisation of reserves or the issue of new shares

1 June 2022 Resolution 26

26 months (August 2024)

Amount of discretionary reserves

Amount of discretionary reserves

None

Issue without pre-emptive subscription rights

Securities transaction concerned

Resolution

Duration of delegation (Expiry)

Maximum issue amount

Maximum amount of capital increase

Use during the year

Capital increase (ordinary shares and other securities giving access to the share capital)

1 June 2022 Resolution 20

26 months (August 2024)

Nominal amount of €2 billion, if securities giving access to the share capital are to be issued

20% of the share capital, reduced to 10% of the share capital for non-equity securities

None

Capital increase by way of a public offering provided for under no. 1 of Article L. 411-2 of the French Monetary and Financial Code

1 June 2022 Resolution 21

26 months (August 2024)

Nominal amount of €2 billion, if securities giving access to the share capital are to be issued

10% of the share capital per year

None

Capital increase (ordinary shares and other securities giving access to the share capital) in the event of oversubscription in accordance with Resolution 20 or 21

1 June 2022 Resolution 23

26 months (August 2024)

15% of the amount of the capital increase under Resolution 20 or 21, up to a maximum of €2 billion

15% of the amount of the capital increase under Resolution 20 or 21, up to a maximum of 10%/20% of the share capital

None

Capital increase as consideration for securities tendered in the event of contributions in kind

1 June 2022 Resolution 24

26 months (August 2024)

10% of the share capital, up to a maximum of €2 billion

10% of the share capital

None

Capital increase as consideration for securities tendered in the event of a public exchange offer

1 June 2022 Resolution 25

26 months (August 2024)

10% of the share capital, up to a maximum of €2 billion

10% of the share capital

None

Authorisations for issues reserved for employees and company officers without pre-emptive subscription rights

Date of GM and resolution

Expiry date

Authorised percentage

Authorised percentage for executive company officers

Use during the year

Free share award

1 June 2022 Resolution 27

38 months

(August 2025)

1.1% (1)

0.055%

None

Capital increase for employees enrolled in a company savings plan

1 June 2022 Resolution 28

26 months

(July 2024)

2% (1)

None

(1) This upper limit, calculated on the basis of the share capital at the date of the authorisation, is cumulative for all issues reserved for employees and company officers.

1)Environmental, Social and Governance.2)Every year, more than 13,000 companies and organisations around the world provide details on their environmental performance to CDP for independent assessment against its scoring methodology for the benefit of investors, purchasers and other stakeholders.3)Return on capital employed (RoCE): see definition in the alternative performance measures appended to this document.4)Target approved by the Science Based Targets initiative (SBTi) and aligned with the aim of limiting the increase in the average global temperature to 1.5°C.5)Emissions from direct activities (Scopes 1 and 2 and business travel) excluding impact of Covid-19.6)This accreditation, developed by Arborus and audited by Bureau Veritas Certification, assesses and promotes firms that adopt a proactive approach to gender equality at both parent company and subsidiary level by putting in place effective tools to manage their gender equality policies. -

3.Draft resolutions submitted to the Shareholders’ Meeting

-

Summary of resolutions

Ordinary General Meeting

Approval of the parent company and consolidated financial statements of sopra steria group and appropriation of earnings (resolutions 1 to 3)

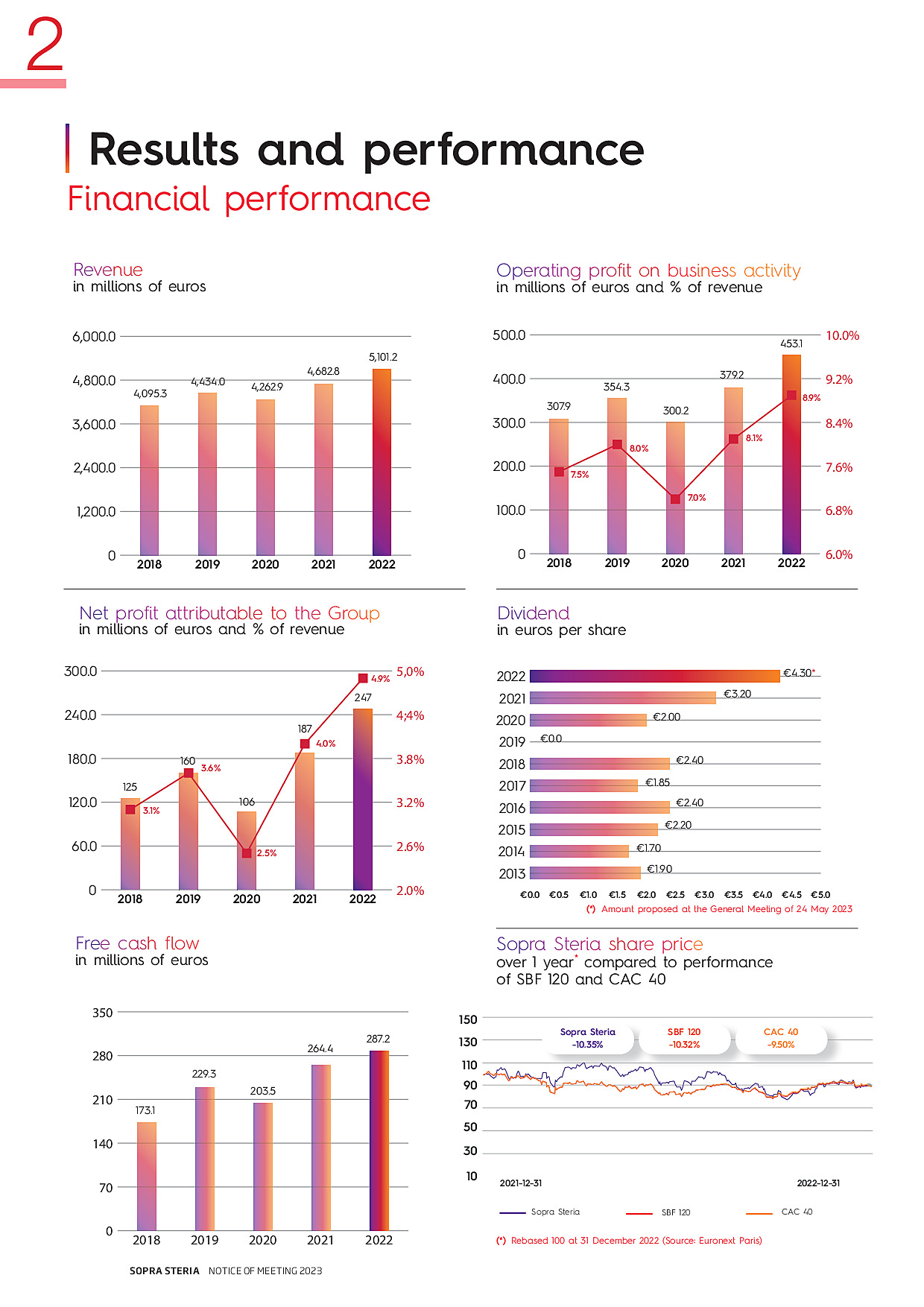

- ■the parent company financial statements (Resolution 1) of Sopra Steria Group for the year ended 31 December 2022, showing net profit of €167,666,165.65;

- ■the consolidated financial statements (Resolution 2) of Sopra Steria Group for the year ended 31 December 2022, showing profit attributable to the Group of €247,823,146;

- ■the list of non-deductible expenses totalling €756,421 and the corresponding tax charge (Resolution 1). These expenses consist of rental or lease payments and depreciation in respect of the Company’s vehicle fleet.

The Statutory Auditors’ report on the parent company financial statements of Sopra Steria Group are presented in Chapter 6 of the Universal Registration Document of the Company for the financial year ended 31 December 2022. The Statutory Auditors’ report on the consolidated financial statements of Sopra Steria Group are presented in Chapter 5 of the Universal Registration Document of the Company for the financial year ended 31 December 2022.

Sopra Steria Group SA generated net profit of €167,666,165.65 for the year ended 31 December 2022, giving consolidated net profit attributable to the Group of €247,823,146.

The Board of Directors proposes that a dividend per share of €4.30 be distributed, i.e. a total amount of €88,355,114.30, to be adjusted in the event of a change in the number of shares with dividend rights. The balance would be appropriated to discretionary reserves. In accordance with tax regulations in force, when paid to individual shareholders with tax residence in France, this dividend distribution is subject to mandatory lump-sum withholding at the rate of 30% (while remaining subject to income tax reporting requirements – “non libératoire”), in respect of income tax (12.8%) and social security contributions (17.2%).

When filing their income tax return, shareholders may opt either to maintain the withholding amount as indicated on the return or to have this dividend taxed instead at the progressive income tax rate (as an overall taxpayer option for all income subject to lump-sum withholding), after deducting the withholding amount already paid and after applying relief equal to 40% of the gross amount received (Article 158 3 2° of the French General Tax Code), and the deduction of a portion of the CSG (6.8%). The ex-dividend date would be 29 May 2023, before the market opens. The dividend will be payable as from 31 May 2023.

Compensation of company officers (resolutions 4 to 11)

The compensation policy for company officers, which was decided on by the Board of Directors on the recommendation of the Compensation Committee, is set out in Chapter 3 of the Company’s Universal Registration Document for the financial year ended 31 December 2022.

- Under Resolution 4 and in accordance with the provisions of Article L. 22-10-34 I of the French Commercial Code, you are asked to approve the disclosures relating to the compensation of company officers mentioned in Article L. 22-10-9 I of the French Commercial Code.

- Under Resolutions 5, 6 and 7 and in accordance with the provisions of Article L. 22-10-34 II of the French Commercial Code, you are kindly asked to approve the fixed, variable and exceptional items of compensation making up the total compensation and benefits of any kind paid during the financial year ended 31 December 2022 or allotted in respect of that period to the executive company officers, namely Pierre Pasquier, in his capacity as Chairman of the Board of Directors; Vincent Paris, in his capacity as Chief Executive Officer for the period from 1 January to 28 February 2022; and Cyril Malargé, in his capacity as Chief Executive Officer for the period from 1 March to 31 December 2022. These details are disclosed in the report on corporate governance prepared by the Board of Directors in accordance with Article L. 22-10-34 of the French Commercial Code. They are in line with the compensation policy approved by the shareholders at the Combined General Meeting on 1 June 2022.

- Pursuant to Article L. 22-10-34 II of the French Commercial Code, the payment to Vincent Paris and Cyril Malargé of the variable components of their compensation is contingent upon shareholder approval at the General Meeting of the items of compensation attributable to them in respect of the 2022 financial year.

- Under Resolutions 8, 9 and 10 and in accordance with the provisions of Article L. 22-10-8 of the French Commercial Code, you are kindly asked to approve the compensation policies applicable respectively to the Chairman of the Board of Directors (Resolution 8), the Chief Executive Officer (Resolution 9) and the members of the Board of Directors (Resolution 10). The compensation policy defined for the Chief Executive Officer would be applicable in the event of the appointment of a Deputy CEO.

- Under Resolution 11, after noting that this amount has remained unchanged since 2015 and after reviewing the average compensation of directors at companies of a comparable market capitalisation or operating in the Company’s business sector, you are asked to set the total annual amount of compensation awarded to Directors for their service, as referred to in Article L. 225-45 of the French Commercial Code, at €700,000.

- The shareholders at the General Meeting are asked to approve the proposed increase in this amount in order to take into account the change in the number of members of the Board of Directors. If the resolutions relating to the appointments of the three new Directors are approved by the shareholders at the General Meeting, the total number of Directors will increase from 15 to 18. This increase in the Board’s membership is also warranted by the increased workload and responsibilities incumbent upon Board members. It is agreed that this amount shall be divided up in full in accordance with the compensation policy (pursuant to Article L. 22-10-14 of the French Commercial Code) set out in Section “Compensation policy” of Chapter 2 of this Document.

Members of the board of directors (resolutions 12 to 17)

- Renewal of Directors' terms of office (Resolutions 12 to 14)

- Three Directors’ terms of office are due to expire at the close of the General Meeting of 24 May 2023. The Directors concerned are Sylvie Rémond, Jessica Scale and Michael Gollner. On the recommendation of the Nomination, Governance, Ethics and Corporate Responsibility Committee, the Board of Directors proposes that:

- ■Sylvie Rémond be reappointed as a Director for a term of office of four years (Resolution 12);

- ■Jessica Scale be reappointed as a Director for a term of office of four years (Resolution 13);

- ■Michael Gollner be reappointed as a Director for a term of office of four years (Resolution 14).

- Appointment of new Directors (Resolutions 15 to 17)

- Subsequent to the process used to select candidates for positions as Directors, which involved four potential candidates who were initially identified, the Nomination, Governance, Ethics and Corporate Responsibility Committee decided, taking into account in particular their expertise and their independence, to recommend that the Board submit the following proposals for shareholder approval at the General Meeting:

- ■appointment of Sonia Criseo as a new Director for the statutory term of office of two years (Resolution 15);

- ■appointment of Pascal Daloz as a new Director for the statutory term of office of three years (Resolution 16);

- ■appointment of Rémy Weber as a new Director for the statutory term of office of two years (Resolution 17).

- In accordance with the provisions of Article 14 of the Company’s Articles of Association, Directors may be appointed for a term of office of one, two or three years, in place of the term of office of four years stipulated in the Articles of Association, to allow for the staggering of terms of office for Board members.

- The process used to select candidates for positions as Directors is described in Section "Selection process for members of the Board of Directors" of Chapter 2, of this Document.

- The biographies of Sylvie Rémond, Jessica Scale, Michael Gollner, Sonia Criseo, Pascal Daloz and Rémy Weber are presented below.

Michael Gollner

Number of shares in the Company owned personally: 100

Independent Director

- ■Member of the Audit Committee

Date of first appointment: 12/06/2018

Date term of office ends: General Meeting to approve the financial statements for the year ended 31/12/2022

Term of office proposed for renewal for 4 years

Business address:

Operating Capital Partners

6075 Laurel St

New Orleans, Louisiana – USA

Nationality:

American and British

Age: 64

Main positions and appointments currently held

Appointments

Outside the Group

Outside

France

Listed

company

- ■Director of Axway Software

✔

✔

- ■Managing Partner of Operating Capital Partners

✔

Other directorships and offices held during the last five years

- ■Executive Chairman of Madison Sports Group

✔

- ■Director of Levelset

✔

Biography

Michael Gollner is an experienced entrepreneur, investor and member of several boards of directors. His expertise spans the media and technology sectors and the field of business transformation. Holder of an MA in international studies from the University of Pennsylvania and an MBA from the Wharton School, Michael Gollner began his career in investment banking. He worked at Marine Midland Bank from 1985 to 1987, Goldman Sachs from 1989 to 1994 and Lehman Brothers from 1994 to 1999.

With a passion for technology and media – sectors little understood by the market at the time – in 1999 he joined Citigroup Venture Capital (which later became Court Square Capital) as its Managing Director, Europe.

He founded investment firm Operating Capital Partners in London in 2008. As Managing Partner, Michael Gollner supports the development of a portfolio of companies in around 20 countries, mostly in the technology, media and cable sectors. He has extensive experience with issues relating to data processing and business model transformation.

Michael Gollner founded Madison Sports Group in 2013 and served as its Executive Chairman. He was also the founding shareholder of Levelset in 2012 and a Director. Mr. Gollner sold his investments in these two companies in 2021.

Michael Gollner has been a member of the Board of Directors of Axway Software since 2012 and of the Board of Directors of Sopra Steria since 2018, where he brings the perspective of a business financing specialist from the English-speaking world who is closely involved in the operational aspects of the companies he manages or supports.

Sylvie Rémond

Number of shares in the Company owned personally: 152

Independent Director

- ■Member of the Compensation Committee

Date of first appointment: 17/03/2015

Date term of office ends: General Meeting to approve the financial statements for the year ended 31/12/2022

Term of office proposed for renewal for 4 years

Business address:

Sopra Steria Group

6 avenue Kléber

75116 Paris – France

Nationality: French

Age: 59

Main positions and appointments currently held

Appointments

Outside the Group

Outside France

Listed company

- ■Director of Boursorama (Société Générale Group)

✔

- ■Director of Sogecap (Société Générale Group)

✔

- ■Director of Banque Degroof Petercam, Belgium

✔

✔

Other directorships and offices held during the last five years

- ■Group Chief Risk Officer, Société Générale Group

- ■Director of SGBT, Luxembourg (Société Générale group)

✔

✔

✔

- ■Director of Rosbank, Russia (Société Générale group)

✔

✔

- ■Director of KB Financial Group, Czech Republic (Société Générale group)

✔

✔

- ■Director of ALD SA, France (subsidiary of the Société Générale group)

✔

✔

Biography

Sylvie Rémond has over 35 years’ experience in customer relations, structured finance and risk management, acquired during her time with the Société Générale group, which she left in July 2021. She sat on the group’s Executive Committee from 2011 and served as Group Chief Risk Officer from 2018.

After graduating from the ESC Rouen business school, Sylvie Rémond joined Société Générale in 1985. She held a number of positions in the Individual Client division, where she gained an understanding of retail banking, and subsequently the Large Corporate division, where she developed a flair for customer relations, with a heavily international focus.

She joined the Structured Finance Department in 1992, where she helped numerous businesses fulfil their strategic plans by structuring acquisition finance and leveraged deals.

In 2000, Sylvie Rémond was appointed Head of Corporate and Acquisition Finance Syndication, a role in which she developed her knowledge of international financial and debt markets.

In 2004, she was appointed Head of Credit Risk for the Corporate and Investment Banking business. Supported by a large team of experts, she was involved in signing off all financing deals where the bank was lead arranger. After being appointed Deputy Group Chief Risk Officer in 2010, she was responsible for managing the impact of the financial crisis on the bank’s lending book.

In 2015, she moved back to the commercial side of the business as Global Co-Head of Coverage and Investment Banking, overseeing a broad range of activities from financing to equity.

Sylvie Rémond was appointed Group Chief Risk Officer in 2018. She managed all of the group’s credit, market and operational risks so that senior management can focus on transforming the bank in a way that is both profitable and resilient, in response to the challenges posed by increasingly strict regulations.

She has also served on the risk and audit committees of a number of French and foreign subsidiaries of Société Générale Group, bolstering her experience of corporate governance in listed and unlisted companies.

Since 2022, Sylvie Rémond has served as a Director for Banque Degroof Petercam in Belgium.

The proposed for renewal of Sylvie Rémond addresses the need for Sopra Steria Group’s Board of Directors to have members with a thorough understanding of the banking sector and its needs. Sopra Steria Group generates a significant proportion of its revenue – across all business lines and locations – in the financial sector, notably through its subsidiary Sopra Banking Software, a strategic technology partner to financial institutions. Furthermore, her experience in internal control and risk management is useful for the Audit Committee.

Jessica Scale

Number of shares in the Company owned personally: 10

Independent Director

- ■Member of the Compensation Committee

- ■Member of the Nomination, Governance, Ethics and Corporate Responsibility Committee

Date of first appointment: 22/06/2014

Date term of office ends: General Meeting to approve the financial statements for the year ended 31/12/2022

Term of office proposed for renewal for 4 years

Business address:

Sopra Steria Group

6 avenue Kléber

75116 Paris – France

Nationality: French

Age: 60

Main positions and appointments currently held

Appointments

Outside the Group

Outside France

Listed company

- ■Chairwoman of digitfit

✔

- ■Independent consultant specialising in the challenges posed by the digital transformation

Other directorships and offices held during the last five years

- ■Not applicable

Biography

Jessica Scale founded digifit, a hub that provides strategy consulting for senior executives, in 2014. She helps companies grow by taking advantage of the opportunities offered by the digital, social and environmental transitions.

A graduate of Sciences Po Paris and holder of a PhD in political science, she has taught strategy at Sciences Po Paris since 1990.

Jessica Scale began her career in strategy consulting (at Bossard and PwC) working for key account clients in a wide range of industry sectors.

In 2002, she moved into the tech sector, where she worked for major players, first as Transformation Director at IBM Global Services and then as Vice-President of Sales and Marketing at Unisys Europe, which she joined in 2005. She took on further international responsibilities in 2008, when she became Director of Global Outsourcing at Logica-CGI, where she was later appointed Global Client Director. As Director, France at Logica-CGI from 2010 to 2013, she also gained in-depth experience of issues connected with governance, ethics and labour relations.

Jessica Scale has written numerous articles and books, including in particular Bleu Blanc Pub: Trente Ans de Communication Gouvernementale en France, which remains a landmark work for anyone seeking to understand major public communication campaigns.

She has long been involved in international entrepreneurship networks, with a particular focus on promoting women in business. She is keenly interested in the issue of the raison d’être of companies.

Jessica Scale’s multicultural and operational experience dealing with digital, strategic and social issues at the international level enriches strategic thinking on Sopra Steria Group’s Board of Directors.

Sonia Criseo

Number of shares in the Company

owned personally: NoneNew appointment

Business address:

Allianz Trade France1 place des Saisons

92048 Paris La Défense Cedex

FranceDate of first appointment: 24/05/2023

Date term of office began: 24/05/2023

Date term of office ends: AGM 2025

Nationality: Irish

Age: 51

Main positions and appointments currently held

Appointments

Outside the Group

Outside France

Listed company

- ■Commercial Director at Allianz Trade for Multinationals (formerly Euler Hermes)

Other directorships and offices held during the last five years

- ■Director of CS Group

✔

Biography

After training as a bilingual assistant, Sonia Criseo started her career at law firm Linklaters & Paines. She then joined the US firm Baker McKenzie, where she was assistant to the firm’s then Chair Christine Lagarde. In 2005, she became Christine Lagarde’s personal assistant at the French Ministry of Foreign Trade. In 2007, she continued to work for Christine Lagarde as her Deputy Chief of Staff at the French Ministry for the Economy, Finance and Industry, with responsibility for special affairs. In 2012, she was appointed Chief of Staff to the Chairman of Moët Hennessy. In 2013, she joined credit insurer Euler Hermes France (which in 2022 became Allianz Trade) in the newly created post of Head of International Development. She has served as Commercial Director at Allianz Trade for Multinationals since 2017.

Sonia Criseo’s proposed appointment to the Board of Directors addresses the desire to have a Board member with in-depth knowledge of CS Group, recently acquired by the Company, to facilitate its integration. Her knowledge of the public sector and her experience in the credit insurance sector will be valuable assets to Sopra Steria Group, which generates a significant proportion of its revenue – across all product lines and locations – in the public sector and the banking and insurance sectors. Lastly, by virtue of her roots, Sonia Criseo will also bring a helpful dimension to the Group in relation to its aim of expanding internationally in continental Europe and the United Kingdom.

Under the strict application of the independence criteria set out in the AFEP-MEDEF Code, the Board of Directors does not consider Sonia Criseo independent due to her directorship at CS Group until March 2023.

Pascal Daloz

Number of shares in the Company

owned personally: NoneAppointment as Independent Director

Business address:

Dassault Systèmes

10 rue Marcel Dassault

78140 Vélizy-Villacoublay – France

Date of first appointment: 24/05/2023

Date term of office began: 24/05/2023

Date term of office ends: AGM 2026

Nationality: French

Age: 54

Main positions and appointments currently held

Appointments

Outside the Group

Outside France

Listed company

- ■Deputy CEO, Dassault Systèmes

✔

✔

- ■Company officer of direct and indirect subsidiaries of Dassault Systèmes

✔

- ■Director of Fondation Mines-Télécom

- ■Director of the PSL Foundation

- ■Honorary Co-Chair of Alliance Industrie du Futur

Other directorships and offices held during the last five years

- ■Company officer of direct and indirect subsidiaries of Dassault Systèmes

✔

- ■Director of the Nantes Institute for Advanced Studies

Biography

After gaining experience in strategy and technology innovation management with investment banks and consultancy firms, Pascal Daloz joined Dassault Systèmes in 2001 as Vice President R&D in charge of sales development. He became Vice President, Strategy and Business Development in 2003, then Executive Vice President, Strategy and Marketing in 2007. He was put in charge of all the group’s brands in 2010 as Executive Vice President, Corporate Strategy and Market Development, and then Executive Vice President, Brands and Corporate Development in 2014. In 2018, Pascal Daloz became Head of Corporate Finance and Strategy. In 2020, he became Chief Operating Officer and Head of the Operations Executive Committee of Dassault Systèmes. He continued to serve as Chief Financial Officer until the end of 2021. As Chief Operating Officer, he orchestrated the transformation of the company’s strategic functions with the aim of making it a market leader in three key areas of the economy: manufacturing industries, life sciences and healthcare, and infrastructure and urban development.

Pascal Daloz has served as a Director of Dassault Systèmes since 2020. He is Chairman of Medidata, a Dassault Systèmes brand that is a global leader in clinical trials, and 3DS Outscale, a cloud services company founded by Dassault Systèmes. He is also Co-Chair of Alliance Industrie du Futur, established on the initiative of the French government.

Pascal Daloz is a graduate of the École des Mines de Paris engineering school.

The proposed appointment of Pascal Daloz addresses the desire to strengthen industry expertise on the Company’s Board of Directors. His financial expertise and the experience he has gained in senior operational roles mean that his perspective on issues of concern to the Group will add value to the Board’s discussions. The Board of Directors has also taken into account Pascal Daloz’s in-depth understanding of family-owned businesses. The Board of Directors considers Pascal Daloz independent under the independence criteria set out in the AFEP-MEDEF Code.

Rémy Weber

Number of shares in the Company

owned personally: NoneAppointment as Independent Director

Business address:

Sopra Steria Group

6 avenue Kléber

75116 Paris – France

Date of first appointment: 24/05/2023

Date term of office began: 24/05/2023

Date term of office ends: AGM 2025

Nationality: French

Age: 65

Main positions and appointments currently held

Appointments

Outside the Group

Outside France

Listed company

- ■CEO of Suka Conseil

✔

- ■Chairman of the Supervisory Board of Kereis group

✔

- ■Chairman of the Supervisory Board of Empruntis group

✔

- ■Director of Vicat

✔

✔

- ■Member of the Supervisory Board of CDC Habitat

✔

- ■Member of the Supervisory Board of Primonial group

✔

- ■Chairman of the Board of Directors of the Opéra de Lyon

✔

Other directorships and offices held during the last five years

- ■Chairman of the Executive Board of La Banque Postale

✔

- ■Company officer of direct and indirect subsidiaries of La Banque Postale

✔

Biography

Rémy Weber began his career at the Large Corporates Department of Banque Française du Commerce Extérieur before joining the French Treasury as a project manager in the International Affairs Department.

He joins Financière BFCE in 1990 as Deputy Director with responsibility for investment operations, mergers and acquisitions.

In 1993, Rémy Weber joined the CIC Crédit Mutuel group. After holding various management positions, he became Chairman and CEO of CIC Lyonnaise de Banque, a position he held from 2002 to 2013. During this period, he was also a member of the CIC group’s Executive Board and then of its Executive Committee.

In 2013, Rémy Weber became Chairman of the Executive Board of La Banque Postale, and Deputy CEO and Head of Financial Services at La Poste.

CEO of Suka Conseil since 2020, Rémy Weber joined the Board of Directors of Vicat in 2021. He chairs the Audit Committee and sits on the Remuneration Committee. He is also Chairman of the Supervisory Board of Kereis group (a European leader in omnichannel insurance brokerage) since November 2021 and Chairman of the Supervisory Board of Empruntis group since May 2022.

As a member of the Supervisory Board of CDC Habitat, he also sits on the Strategy Committee and the Audit Committee.

Finally, Rémy Weber has joined the Supervisory Committee of Primonial group since December 2022.

Rémy Weber is a graduate of Sciences Po Aix and the HEC business school.

The proposed appointment of Rémy Weber addresses the need for Sopra Steria Group’s Board of Directors to have members with a thorough understanding of the banking sector and its needs. Sopra Steria Group generates a significant proportion of its revenue – across all business lines and locations – in the financial sector, notably through its subsidiary Sopra Banking Software, a strategic technology partner to financial institutions. Furthermore, his executive management experience will be useful to the Board in its discussions. The Board of Directors considers Rémy Weber independent under the independence criteria set out in the AFEP-MEDEF Code.

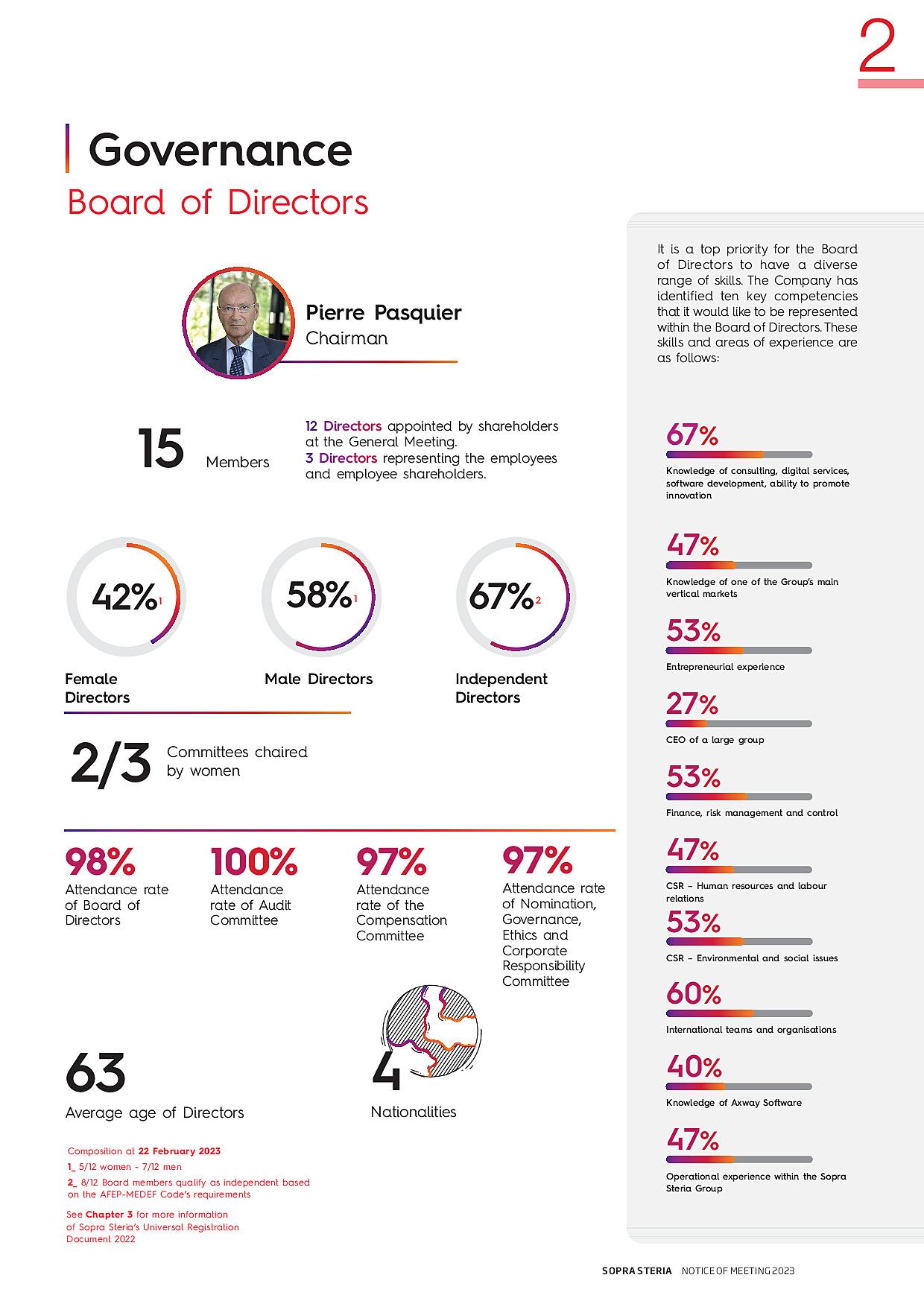

Subject to shareholder approval at the General Meeting of the resolutions concerning the appointments of Sonia Criseo, Pascal Daloz and Rémy Weber, the composition of the Company’s Board of Directors will change as follows:

Number of members

Female Directors*

Independent Directors*

Nationalities

Average age

As of 31 December 2022

15

5, i.e. 42%

8, i.e. 67%

4

63

After the General Meeting of 24 May 2023

18

6, i.e. 40%

10, i.e. 67%

5

62

* Out of 12 and subsequently 15 members, excluding Directors representing the employees and employee shareholders.

The following table summarises the key areas of expertise and experience that the proposed appointees would add to the Board of Directors:

Expertise

Knowledge of consulting, digital services, software development, ability to promote innovation

Knowledge of one of the Group’s main vertical markets

Entrepreneurial experience

CEO of large group

Finance, risk management and control

CSR – Human resources and labour relations

CSR – Environmental and social issues

International teams and organisations

Knowledge of Axway Software

Operational experience within the Sopra Steria Group

Sonia Criseo

✔

✔

✔*

Pascal Daloz

✔

✔

✔

✔

Rémy Weber

✔

✔

✔

✔

* Knowledge of CS Group, in the process of being merged into Sopra Steria Group.

Buyback by sopra steria group of its own shares (resolution 18)

You are asked to renew the authorisation granted to the Board of Directors at the General Meeting of 1 June 2022 permitting the Company to buy back its own shares, in accordance with applicable laws and regulations (Articles L. 22-10-62 et seq. of the French Commercial Code).

Under this authorisation, the number of shares bought back shall not exceed 10% of the share capital; as an indication, this would equate 2,054,770 shares on the basis of the current share capital. The maximum price per share that can be paid for the shares bought back is set at €275; this price may be adjusted as a result of an increase or decrease in the number of shares representing the share capital, in particular due to capitalisation of reserves, free share awards or reverse stock splits.

- ■to obtain market-making services from an investment services provider acting independently under the terms of a liquidity agreement entered into in compliance with the AMF’s accepted market practice;

- ■to award, sell or transfer shares in the Company to employees and/or company officers of the Group, in order to cover share purchase option plans and/or free share plans (or similar plan) as well as any allotments of shares under a company or Group savings plan (or similar plan) in connection with a profit-sharing mechanism, and/or any other forms of share allotment to the Group’s employees and/or company officers;

- ■to retain the shares bought back in order to exchange them or tender them as consideration at a later date for a merger, spin-off or contribution of assets and, more generally, for external growth transactions. Shares bought back for such purposes are not to exceed, in any event, 5% of the number of shares making up the Company’s share capital;

- ■to deliver the shares bought back, upon the exercise of rights attaching to securities giving access to the Company’s share capital through redemption, conversion, exchange, tender of warrants or any other means, as well as to execute any transaction covering the Company’s obligations relating to those securities;

- ■to retire shares bought back by reducing the share capital, pursuant to Resolution 18 approved at the General Meeting of 1 June 2022;

- ■to implement any market practice that would come to be accepted by the AMF, and in general, to perform any operation that complies with regulations in force.

The Board of Directors would have full powers, with the option to subdelegate these powers, to implement this authorisation and decide on the arrangements, under the conditions and within the limits set by law.

-

Text of the resolutions

Requiring the approval of the Ordinary General Meeting

Resolution 1

Approval of the parent company financial statements for financial year 2022

The shareholders at the General Meeting, having fulfilled the quorum and majority requirements for Ordinary General Meetings, and having reviewed the Board of Directors’ reports and the Statutory Auditors’ report, approve the parent company financial statements for the year ended 31 December 2022 as they were presented, which show a net profit of €167,666,165.65.

The shareholders at the General Meeting also approve the transactions reflected in these financial statements and/or summarised in the aforementioned reports. The shareholders at the General Meeting also approve the amount of expenses not deductible for income tax purposes, as defined in Article 39, item 4 of the French General Tax Code, which amounted to €756,421, and the corresponding tax expense of €189,105.

Resolution 2

Approval of the consolidated financial statements for financial year 2022

The shareholders at the General Meeting, having fulfilled the quorum and majority requirements for Ordinary General Meetings, and having reviewed the Board of Directors’ reports and the Statutory Auditors’ report, approve the consolidated financial statements for the year ended 31 December 2022, which show a consolidated net profit (attributable to the Group) of €247,823,146, as well as the transactions reflected in these consolidated financial statements and/or summarised in the reports.

Resolution 3

Appropriation of earnings for financial year 2022 and setting of the dividend

The shareholders at the General Meeting, having fulfilled the quorum and majority requirements for Ordinary General Meetings, and having reviewed the Board of Directors’ reports and the Statutory Auditors’ report, note that the net profit available for distribution, determined as follows, stands at:

and resolve, after acknowledging the consolidated net profit attributable to the Group amounting to €247,823,146, to appropriate this profit as follows:

Since the legal reserve already stands at 10% of the share capital, no allocation to it is proposed.

In the event of a change in the number of shares with dividend rights, the total amount of the dividend will be adjusted and the amount allocated to discretionary reserves will be determined on the basis of the total dividend amount actually distributed.

2019

2020

2021

Dividend per share

-

€2.00

€3.20

Number of dividend-bearing shares

-

20,539,743

20,527,488

Dividends paid *

-

€41,079,486.00

€65,687,961.60

* It should be noted that the dividend is eligible for the 40% deduction mentioned in Article 158 3 2° of the French General Tax Code if the taxpayer opts to have the dividend taxed at the progressive income tax rate.

Resolution 4

Approval of disclosures relating to the compensation of company officers mentioned in Article L. 22-10-9 I of the French Commercial Code, in accordance with Article L. 22-10-34 I of the French Commercial Code

In accordance with Article L. 22-10-34 I of the French Commercial Code, the shareholders at the General Meeting, having fulfilled the quorum and majority requirements for Ordinary General Meetings, and after having reviewed the report on corporate governance prepared by the Board of Directors, approve the disclosures stated in Article L. 22-10-9 I of the French Commercial Code and as presented in the report.

Resolution 5

Approval of the fixed, variable and exceptional items of compensation making up the total compensation and benefits of any kind paid during financial year 2022 or allotted in respect of that period to Pierre Pasquier, Chairman of the Board of Directors

In accordance with Article L. 22-10-34 II of the French Commercial Code, the shareholders at the General Meeting, having fulfilled the quorum and majority requirements for Ordinary General Meetings, approve, after having reviewed the report on corporate governance prepared by the Board of Directors, the fixed, variable and exceptional items of compensation making up the total compensation and benefits of any kind paid during the financial year ended 31 December 2022 or allotted in respect of that period to Pierre Pasquier, Chairman of the Board of Directors, and as presented in the report.

Resolution 6

Approval of the fixed, variable and exceptional items of compensation making up the total compensation and benefits of any kind paid during financial year 2022 or allotted in respect of that period to Vincent Paris, Chief Executive Officer (from 1 January to 28 February 2022)

In accordance with Article L. 22-10-34 II of the French Commercial Code, the shareholders at the General Meeting, having fulfilled the quorum and majority requirements for Ordinary General Meetings, approve, after having reviewed the report on corporate governance prepared by the Board of Directors, the fixed, variable and exceptional items of compensation making up the total compensation and benefits of any kind paid during the financial year ended 31 December 2022 or allotted in respect of that period to Vincent Paris, Chief Executive Officer for the period from 1 January to 28 February 2022, and as presented in the report.

Resolution 7

Approval of the fixed, variable and exceptional items of compensation making up the total compensation and benefits of any kind paid during financial year 2022 or allotted in respect of that period to Cyril Malargé, Chief Executive Officer (from 1 March to 31 December 2022)

In accordance with Article L. 22-10-34 II of the French Commercial Code, the shareholders at the General Meeting, having fulfilled the quorum and majority requirements for Ordinary General Meetings, approve, after having reviewed the report on corporate governance prepared by the Board of Directors, the fixed, variable and exceptional items of compensation making up the total compensation and benefits of any kind paid during the financial year ended 31 December 2022 or allotted in respect of that period to Cyril Malargé, Chief Executive Officer for the period from 1 March to 31 December 2022, and as presented in the report.

Resolution 8

Approval of the compensation policy for the Chairman of the Board of Directors

In accordance with Article L. 22-10-8 II of the French Commercial Code, the shareholders at the General Meeting, having fulfilled the quorum and majority requirements for Ordinary General Meetings, and after having reviewed the report on corporate governance prepared by the Board of Directors, approve the compensation policy for the Chairman of the Board of Directors, for his term of office and as presented in the report.

Resolution 9

Approval of the compensation policy for the Chief Executive Officer

In accordance with Article L. 22-10-8 II of the French Commercial Code, the shareholders at the General Meeting, having fulfilled the quorum and majority requirements for Ordinary General Meetings, and after having reviewed the report on corporate governance prepared by the Board of Directors, approve the compensation policy for the Chief Executive Officer, for his term of office and as presented in the report.

Resolution 10

Approval of the compensation policy for Directors for their service

In accordance with Article L. 22-10-8 II of the French Commercial Code, the shareholders at the General Meeting, having fulfilled the quorum and majority requirements for Ordinary General Meetings, and after having reviewed the report on corporate governance prepared by the Board of Directors, approve the compensation policy for Directors for their service and as presented in the report.

Resolution 11

Decision setting the total annual amount of compensation awarded to Directors for their service at €700,000